What Do You Do for An Encore? Globe’s Six Month Results

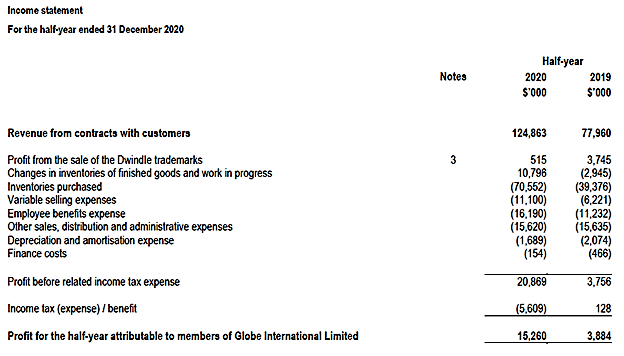

When revenues rise 60.3% (from $77.8 to $124.8 million- Australian dollars of course) and net profit is up 292.9% from $3.9 to $15.3 million for the six months ended December 2020 compared to the same period in the prior year, I’m not left with much to analyze.

That’s especially true with Globe. As a public but closely held company it has never been forthcoming with information on exactly how it has pulled off its results. This time is no different.

Perhaps the most intriguing question for Globe as well as other industry companies who have, perhaps unexpectedly, done really well is how you plan for next year. Globe won’t start with a baseline assumption of 60% growth for the six months ending this December 30.

Or will they? No, they won’t. Probably. Seriously- how do you plan? Was the ginormous increase caused by left over demand from a first six months when supply was constrained? Did your competitors screw up beyond belief and go out of business? Did the pandemic make all kinds of new customers suddenly lust for your product? Are you just marketing geniuses?

I can’t answer that for Globe or any other industry company without a lot more information than I’m likely to get. Let’s just be grateful that Globe gives us any information at all and see what we can learn.

Here’s the income statement as provided in the filing.

Australasia revenue rose 55.1% from $42.4 to $65.7 million. North America was up 82.4%, rising from $23.0 to $41.9 million. Europe was up a meager 36.9% from $12.6 to $17.3 million. Remember, all numbers are Australian dollars. The increases in selling and employee expense seem reasonable given the growth of revenue.

Globe has six brands it owns and eight third party brands it distributes. Go to Globe’s corporate web site if you want to see what they are. The press release tells us “The 60% growth in net sales was fueled by the group’s four key brand pillars- Impala, FXD, Globe and Salty Crew. Each of these brands had strong brand trajectory before the COVID- 19 pandemic set in and have continued to deliver impressive sales growth throughout the pandemic.” Note that those are all owned brands.

I want to emphasize that Globe didn’t have an outstanding six months because after the pandemic hit they said, “Holly shit, we better do something.” Okay, granted they didn’t plan to sell Dwindle in the last six months of 2019 to avoid having it during the pandemic. But they did make a good decision to sell it and the timing sure worked out. Here’s what CEO Matt Hill said.

“This time last year, just weeks prior to the onset off the pandemic, we advised the market that we had completed the restructure of our Globe brand and divested our stable of Dwindle brands. Moving forward, our focus was on our growth brands across the outdoor (Salty Crew)), workwear (FXD) and boardsports ((Impala and Globe) markets, all of which grew in the first half of FY20 and were poised for further growth.”

Over a couple of years prior to 2020, they’d bought and sold brands and restructured Globe to be in markets they wanted to be in with a business cadence they liked; more balanced year around sales, I think. It was a thought out process- not a pandemic panic. It addressed the already in progress retail market changes. As for all of us, the changes, accelerated by the pandemic, required a bit of fancy footwork in uncertain conditions. Certain aspects of Globe’s strategy and structure probably had to evolve faster, but they were still the right changes.

Their gross margin of 43.2% was up from 37.6% in last year’s second half. The increase was due to higher online sales, a weaker U.S. dollar, and a shift towards higher margin hard goods, offset by higher freight costs.

Globe received, in all three geographic segments, a total $898 thousand in pandemic related government support. Obviously, the number in last year’s six month period was zero. “While the total value of stimulus recognized was not significant to the result…the various stimulus programs were strategically significant to the Group, as they allowed a forward looking and confident stance in what was otherwise an environment of panic.”

Environment of panic? Okay, so maybe they did say, “Holy shit, we better do something,” but for tactical, not strategic reasons. I’m guessing neither the management of Globe or of other companies I’d describe as well prepared were completely calm and confident in the chaos of last spring.

Anyway, great result for what look to me like the right reasons.

Leave a Reply

Want to join the discussion?Feel free to contribute!