Quik’s July 31 Quarter: Restructuring Results Slow to Appear.

You know, maybe it’s a delusion, but an awful lot of corporate reports for the companies I follow are starting to sound the same. I need to read something else. Most of them say some variation of we’re trying to figure out how to integrate brick and mortar with online, sales growth is hard to come by, we’re rationalizing expenses and improving efficiencies, we’re reducing SKUs, we’re improving systems to get the right inventory to the right place at the right time, we have some constraints caused by our balance sheet, the U.S. market is especially tough, we’re pinning our hopes on Asia/Pacific, we’re trying to improve product, we’re focused on building our brands and managing our distribution, and the market is very promotional.

I think that covers it, and now I have to somehow relate that introduction back to Quiksilver. I guess I can do that by saying they are dealing with most of these issues.

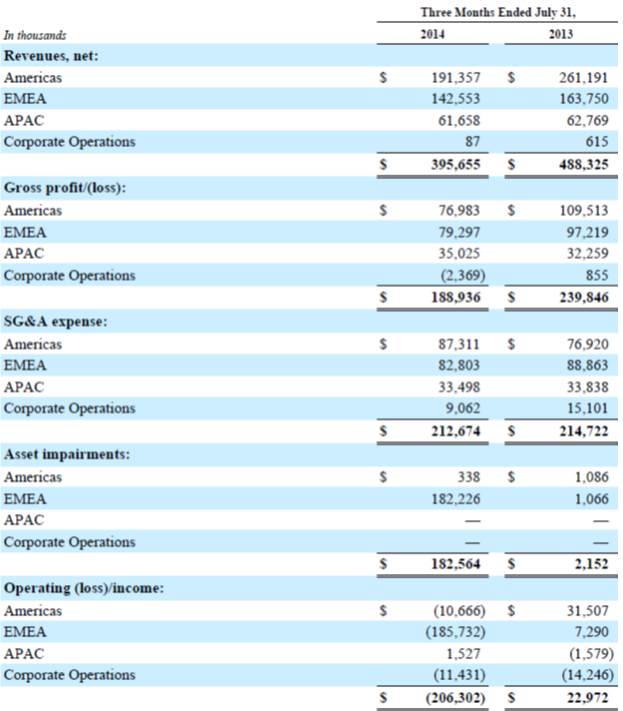

Sales for the quarter ended July 31, 2014 fell 18.9% from $488 million in last year’s quarter to $396 million. Sales declines in the Americas, EMEA and APAC respectively were 26.8%, 12.8% and 1.8%.

The gross profit margin was down from 49.1% to 47.8%. The Americas gross margin fell from 41.9% to 40.2%. In EMEA it went down from 58.4% to 55.6%. In APAC it rose from 51.4% to 56.8%. The decline in gross margin “…was primarily due to increased discounting in the wholesale channels of North America and Europe (320 basis points), partially offset by net revenue growth from our higher margin direct-to-consumer channels (160 basis points).”

SG&A expenses were down just 1% from $215 to $213 million, but as a percentage of sales they were up mightily, from 44% to 53.8%. They reduced athlete and event spending by $5 million, but had a gain on the sale of a building of $5 million. Employee compensation fell $4 million because they didn’t have the severance costs they had last year. They spent an additional $5 million on marketing other than athletes and events, had $3 million more in bad debt expense and $2 million in higher depreciation.

Operating profit went from a positive $23 million to a loss of $206 million. However, that includes noncash goodwill impairment related to European assets of $182 million. Remember, however, that even though it’s noncash, it’s indicative of lower expected future cash flows from the assets being written down.

Ignoring all the noncash charges in this year and last year’s quarter, operating income fell from a positive $25 million to a negative $24 million, so it’s hardly good news. Interest expense was about $19 million compared to $20 million last year. There was a bottom line net loss (including the write down) of $222 million compared to a profit of $1.8 million last year.

Here’s the chart from the 10-Q that lays it all out for you by segment. You can see the 10-Q here if you want, though I doubt anybody ever goes to look. The Americas segment is just what you’d think it is and most of its revenue comes from the U.S., Canada, Brazil and Mexica. EMEA is Europe, the Middle East and Africa, but mostly the revenue is from Great Britain, continental Europe, Russia and South Africa. APAC (Asia and the Pacific Rim) is mostly Australia, Japan, New Zealand, South Korea Taiwan and Indonesia. Notice how China does not make the top six yet.

Quiksilver, by the way, ended the quarter with 658 company owned stores. They are on pace to open a net of 60 new stores by the end of this fiscal year.

Please note that APAC’s operating income rose $3 million on a small decline in sales. Ain’t nothing like raising that gross margin.

In the Americas, “This net revenue decrease was primarily due to lower net revenues from our DC brand in the wholesale channel of $47 million driven by reduced clearance sales, narrowed product distribution to mid-tier wholesale customers, and the licensing of DC children’s apparel. In addition, net revenues decreased in the Quiksilver and Roxy brands by $14 million and $7 million, respectively, in the wholesale channel due to licensing of Quiksilver children’s apparel, lower customer demand, and less effective order fulfillment compared to the prior year. Americas segment net revenues decreased 28% in the developed markets of North America, but increased 9% on a combined basis in the emerging markets of Brazil and Mexico.”

The licensed kids business was responsible for $11 million, or 16% of the decline in the North America wholesale business.

I want you to specifically note that they are pulling back DC’s distribution with the goal of strengthening the brand. It’s about time. In this case at least, they are giving up some sales in a good cause.

There isn’t much good news about revenues in AMEA. The decline is “…due to lower revenues in the wholesale channel across all three brands driven by lower customer demand as a result of poor prior season’s sell through, and less effective order fulfillment compared to the prior year. These decreases were partially offset by double-digit percentage growth in the e-commerce channel … ”

Lower demand, poor sell through, and troubles with order fulfillment is quite a triple whammy.

In APAC, wholesale revenues were down but that was offset by growth in retail and e-commerce.

Here’s revenue for the quarter by brand.

The decline in the Quiksilver brand “…was primarily due to reduced net revenues in the Americas and EMEA wholesale channels of approximately $14 million and $15 million, respectively. A portion of the decrease in Quiksilver brand net revenues ($6 million) was due to the licensing of children’s apparel.

The Roxy decline “…was primarily due to lower net revenues in the Americas and EMEA wholesale channels of approximately $7 million each, partially offset by increased revenues in the e-commerce and retail channels.” Roxy was not licensed for children’s apparel.

DC’s decrease in revenue “…was primarily driven by lower net revenues in the Americas and EMEA wholesale channels of $48 million and $10 million, respectively. The Americas net revenue decrease was driven by reduced clearance sales, narrowed product distribution to mid-tier wholesale customers, and the licensing of DC children’s apparel.” They also reported successfully launching DC’s offering in “accessibly priced canvas footwear market,” and expect a positive impact going forward.

So it seems we can conclude that wholesale in the Americas and EMEA kind of sucks. You can see the problem in this chart showing sales by channel.

I’d like to point out the relative contribution to revenue of wholesale compared to retail and e-commerce. There were gains totaling $7 million in retail and e-commerce and a decline of $100 million in wholesale. E-commerce revenues were down 9% in the Americas by the way. Global comparative store sales were up 1% during the quarter. So when Quik talks about retail and e-commerce offsetting wholesale, it’s not much of an offset overall.

Looking at the balance sheet, you’ve got a current ratio that improved from 1.73 a year ago to 2.46 as of July 31. Long term debt is up slightly from $808 to $812 million. Total liabilities to equity have vaulted from 2.97 to 10.6 times. Liabilities fell significantly from $1.64 to $1.2 billion, but equity was down from $553 to $114 million.

Quiksilver notes that they are updating their profit improvement plan “…based upon recent difficulties within the wholesale channels of our Americas and EMEA segments. As part of updating our PIP, we will establish additional SG&A reduction objectives and allocate capital to our emerging markets, e-commerce and retail channel growth plans.” So more expense cuts to come.

In a short section on page 29 of the 10-Q called “Known or Anticipated Trends,” Quik gives us a look at what the future looks like. Over the next few quarters they expect net revenue comparisons will be “unfavorable.” That means they will be lower when compared against the previous year’s quarter. For the year they expect them to be “unfavorable” in North America and Europe wholesale but favorable in emerging markets and e-commerce. Didn’t say anything about retail.

“Unfavorable” is such a benign sounding word for such an unfortunate result, speaking of benign words.

They also tell us that the adjusted EBITDA for the year that ends October 31 will be lower than for the previous year. I tend to believe that if the adjusted figure is worse, the as reported will be even worse. Maybe I should have said “unfavorable.”

There’s a lot going on. Some of the things I think Quik is doing right have caused what I hope are short term difficulties. Reducing DC’s distribution is absolutely critical to the brand’s success, but in the short term costs revenue. They’ve stopped or at least reduced discounting on their web sites. Again, a possible short term revenue hit, but good for the brands. Just as a guess, I expect core shops to like that.

In the conference call, CEO Andy Mooney announced, as part of their positive accomplishments, that “…we moved a large number of small independent accounts to a B@B service model.” I understand the financial rationale for doing that, but I have reason to believe you shouldn’t expect those accounts to see it as positive.

And literally as I write this, I got an email telling me that Quik is reorganizing its marketing function to help give it a better connection to the core.

They also decided not to order any products in quantities below production minimums because of the additional cost. That eliminated some orders, but helps gross margin. Some late deliveries were the result of changing from regional to global demand planning, but it’s a good thing to do anyway.

There was also some discussion about the previously announced program to selectively reduce prices. They don’t expect it to reduce margins given the other efforts they’ve taken to reduce SKUs and rationalize production.

Quik is making changes in every facet of their operations. That some of them didn’t quite go according to schedule isn’t a surprise. I just heard from a client that they’ve got a container held up in customs because of an “invasive moth.” God, you just can’t make this stuff up and to some extent it happens to every company every year.

But Quiksilver doesn’t have the luxury of time. Its brand building (rebuilding?) has to be successful sooner rather than later. Its balance sheet can’t continue to deteriorate, but it sounds like we can expect further losses in the next few quarters. For all the things I think they are doing right, there’s a time limit here that’s gotten shorter as a result of a couple of tough quarters.

Jeff,

Another great analysis! Thank you. Funny how the wording in these companies official reports are as carefully “massaged” (as in rubbing and kneading something into submission) as a political speech. “less effective order fulfillment” sounds like some internal speed bump, but I know reps who quit Quiksilver because of the very low “shipping percentage”, as we reps like to call it. We call it that because we make our sales commissions based on how much pre-ordered product gets shipped, plus any reorders we can get in season. If a company is shipping 90% on their prebook, that is good. If it gets down anywhere in the high 80’s, still good. Lower 80’s we start thinking about how much less we are going to make because of the shortfall in shipping. 70’s is very mediocre shipping to poor, depending on where it lands in the 70’s. Shipping percentage anywhere in the 60’s will piss off retail accounts, who are depending on that product to say that they are selling from a full basket, and it will make reps look for another job. This has happened at Quik, and most likely because of all the tweaking they have tried to do with their supply chain. Not a good thing, but also an indication that they really are dropping styles that don’t get sufficient prebook numbers. Retailers don’t give a crap about what the reasons are, they just hate that low of a number, and will look to other, more reliable suppliers after that. So, what looks like a speed bump when worded that way, is actually a disastrous situation that has to be turned around, as you so eloquently put it, “sooner rather than later.” Good luck to Quiksilver. They obviously have several fronts where improvement has to happen, just as you said, within a time frame, and the clock is ticking. Because of staff turnover, the difficulty factor of pulling all this off increases, and I hope they consider this. Shifting most of their design hub to France is also a questionable move, in more ways than one, but let’s see how this rides out. I don’t see this move as greatly enhancing their sales prospects in the US, but if it does, Mooney will certainly tout it as a huge victory, and perhaps he would deserve it. Once again, good luck. I will hold to my prediction of Mooney being replaced by the board sometime in the next few months.

Cheers,

Big Guy

Howdy Big Guy,

Thanks for the good info as usual. You should know that I have received a couple of off line comments consistent with your concern about moving design to France. I remember, about a hundred years ago, when Nidecker designed snowboard ads in France for the U.S. They were so bad they were almost exactly right. But not quite and the rest, as they say, is history.

I have said before, and will say again, that I think at least part of what Quik is doing is driven by their balance sheet constraints. It may not be a good move in the longer term, but right now they don’t have a choice. I like to think I made that point in the article. It also depends, to some extent on what market they are now aiming for. While they say they are focused on the core, that’s not where they get most of their revenue. If the majority of their revenue is coming from an older demographic and from broader distribution, is it possible the design issue isn’t as critical. Not sure- just asking.

Thanks,

J.

Okay, let’s take that point “the majority of their revenue is coming from an older demographic and broader dist.” I’ll accept that, but it doesn’t bode well that they have treated Waterman Collection like it didn’t matter in their big picture. Waterman certainly was aimed at the “older demographic” and was the fastest growing division at the company for 4 or 5 very recent years. Retailers are now left with half the sku’s they used to choose from, and the whole sales, marketing, and design team (of Waterman Collection) are now all replaced. There was even talk of closing the division when Mooney first took over. Does that show any sign of valuing the “older demographic”? Recently some retailers told me that they are looking at other mens lines because Waterman no longer has the breadth of product. Point being, if it ain’t broke, don’t fix it, but Waterman was gutted, not fixed. Thanks Jeff!

Big Guy,

More good info. Thanks. So I’d like to know two things about the Waterman Collection. The first is what its revenue volume was like. The second is where it was distributed. Actually, I think I know that the distribution was cautiously managed. It wasn’t in as broad a distribution as Quik. But I’m not sure. Anyway, the answers to those two questions would influence how I feel about Waterman.

With regards to retailers complaining that Waterman no longer has product breadth because of cutting SKUS, I guess that’s what I’d expect them to say. Retailers, I think, would rather have lots to choose from rather than little and in as many colors as possible. That doesn’t mean they will buy them all, but they’d like to be able to pick and choose. Their perception is that it doesn’t cost them anything to have Quik make all that stuff. Quik, of course, correctly feels differently. I don’t remember the precise numbers Mooney used in a conference call when he first got to the company, but the number of SKUs they were making and the average number of each garment they were producing was ridiculous. If those numbers were even close to accurate, there’s no doubt that Quik had to massively consolidate manufacturing and cut SKUs. Now, how much exactly? Ah, well figuring that out is why management is supposed to get the big bucks. There’s too many SKUs, and then there’s too few. It’s your analysis of the market that determines where between the two extremes you want to be. Honestly, if there weren’t some retailers complaining that they cut too much, I’d be concerned that they hadn’t cut enough.

Keep ’em coming!

J.

Jeff,

Thanks again for your reply. Quik Waterman was only a 30 million dollar division, but that had grown from about 5 or 6 million in about as many years, with most of those being recession years. The demand was there, and I think it could have easily become a 50 million dollar division within a couple more years. Perhaps not a game changer, but definitely could have provided a positive in the midst of many negatives, which they badly need right now. Cheers!

Big Guy,

Remember Mervin was bigger than that and solidly profitable and they sold that.

J.

Hi Jeff,

I always enjoy reading your posts and equally the comments from other readers. It is pretty clear that Mr. Mooney has very little understanding about the core business and how things trickle up from your small accounts on an intangible level. There are a lot of core shops that don’t necessarily do very much business, but they are the brand drivers for local groms/ families for future generations. Sending these accounts to a b2b direct model essentially is a slap in the face and they will eliminate Quik and substitute in another brand very easily. Interesting how Mooney sees this as a positive. The space is very saturated and they are the easiest brand to cut. Once the small core shops drop them completely it will trickle up. Enthusiasm at the grass roots level with the firing of local reps/ elimination of rep servicing and the loss of Slater is a huge negative when it comes to brand demand at the whole-sale and retail level (along with other issues). Cutting the feet off the people who built your brand over the years will not end well for them. Also interesting how Mooney thinks by eliminating larger non core distributors, it will suddenly spark more demand at the core level. Shoes and apparel are so heavily saturated with new brands that are younger and cooler. Mooney is out of touch and is driving the company into the ground, just look at their share price now from where it was when he took over as CEO. I just wander how long until the board replaces him.

Hi Little Guy,

Clever name. You are not the first to express this point of view both in these comments and in the private emails I get. I don’t think you’re wrong, but I don’t think you’re as right as you used to be. Partly, that’s because there are so many fewer core retailers. If you wanted to argue that makes the ones still standing even more important, you might be right. Remember the market we’re in now. Rather than brands telling consumers what they should want to buy and why, brands are asking consumers what they want and how they’d like to engage with the brand. Does that make the core stores more or less important? Not sure.

You make, I think, an intriguing point about Quik cutting DC’s distribution to improving its brand equity when you suggest, basically, that it may be too late. We’ll see. I think there’s room for DC as a brand, but if you mean they can never regain the momentum they had before, I tend to agree.

Finally, remember all this is being done at least partly in response to the pressures of the public market and a weak balance sheet. Short term considerations may be winning over long term. I wonder if Andy Mooney wouldn’t have been better off to just say that when he announced some of the stuff, but of course he couldn’t do that.

Thanks for the comment.

J.

Big Guy agrees with Little Guy. That’s the long and the short of it. Speaking of which, I would short ZQK for the long haul. All in fun, of course. I don’t give stock advice either. 🙂

Do Big and Little know who each other is? I don’t know if I’d short it or buy some with the idea that it may be taken private at a premium.

J.

Not sure if I know Little Guy. Send me a private msg. and let me know who we are talking about. If LG has been around a while, I probably know him. Sounds like he is pretty familiar with Quik’s situation.

I don’t know who he is either!

J.

Jeff,

One more thing on Quiksilver. I believe there is a parallel between what happened here and the scenario that played out when Ron Johnson went from overseeing Apple retail to being CEO of JC Penney. In both cases (the other being Andy Mooney coming from Disney retail), you have new CEO’s that came from retail operations where a captive market was in play. Apple and Disney retail operations had the benefit of owning iconic brands that could only be purchased either at their own stores, or in Disney’s case, their own stores plus whatever tightly controlled retail they wished to accomplish through other retail chains. Point being, these two iconic brands wielded such horsepower that one can surmise that only an executive that was literally trying to sabotage the company could really screw it up. Okay, so, Johnson and Mooney may both have done a great job in their respective previous positions, I won’t try to take that away from them. The place where I see they both carried some blinders with them into their new positions is that, coming off these captive markets, they both entered markets where competition is fierce, and they may have both been basking in the afterglow of companies where they controlled their own destiny, with no competitor to be able to chip away at their customers allegiance to the product. In the new environment, they seem to both have assumed that they could run things as they wished, as though the audience for their new brand was captive. They both made sweeping changes, and look! Surprise, surprise, the market reacted in most cataclysmic ways. The real trick to this is that their “new” market, at the new company, is not a captive audience. As so many have pointed out, the surf shop customer has many lines to choose from, not just Quiksilver. The JCP customer has many retailers to choose from, that carry the same brands, by the way. My theory is that both of these CEO’s took the “magic” they had worked at their previous gigs, and assumed that their touch was going to work Merlin-like wonders in their new environment. Problem: no captive market any more. Make sense?

Cheers,

Big Guy

Big Guy,

Yes it makes way too much sense. Johnson lost so much credibility he got replaced. I really don’t want that to happen with Mooney. You and I aren’t the only ones raising these issues, and I hope he’s hearing some of it so he can think about some of those decisions. I’m not going to sit here and say “Yes! He has to do it differently.” Don’t feel like I have enough information, though I do tend to agree that he needs to embrace the core shops even if they are hard to work with, order smaller quantities, and have trouble displaying the brand well. The trouble is, I don’t know if they feel like they need Quik any more. Also, in the case of both JC Penney and Quik, they had to do something dramatic. Their balance sheets and cash flows required it. I thought Johnson did some of the right things at Penney- but he tried to do them way too quickly and too many at the same time. It may be that Mooney at Quik had less time than Johnson had.

Thanks for the comment,

J.

I’m kinda fascinated by all the attention Quik still get’s. My position on this hasn’t changed and I will reiterate it again. Public companies will not succeed in a niche industry like surf,. that as a brand Quik is “Dead-man walking” and that Andy is a really smart guy but the wrong guy for this particular brand and job. The question is, is all of this too late to save the brand. My guess is that it’s to late. But what do I know? Next stop? TARGET!

Good afternoon YKW,

All three brands will be “saved” if by saved you mean they will survive and continue to sell some product somewhere. If you mean be leaders in the very small surf industry, probably not so much. I still think Quik needs to be a private company.

J.

Jeff,

I can’t help myself. It’s an addiction. I have to respond. You Know Who echoes things I am hearing elsewhere. With Quik stock dipping to $1.60, even insiders are starting to talk about Mooney’s replacement. The problem now is, that still leaves all his cronies. So, a new guy comes in. Does he now have to replace all upper management for a third wave? I think YKW nailed it. Dead man walking. He also mentioned Target. Spot on. You too, Jeff, have also said many times that Quik may have to go the way of the mass market, which to me, takes them out of “surf” altogether. Then they are just another Maui & Sons, Mossimo, OP that sits in the mass mkt. doors and is gobbled up at significantly cheaper prices by grannies, mullet-wearing crossbow experts, and middle aged potbellied drinkers in Kearney, Nebraska. Not that there is anything wrong with Kearney. But it will no longer be a company worthy of anybody’s attention at the small door level, which takes it out of the realm we all care about. Sad, and only a real miracle could pull them out of the quagmire they find themselves in. Mooney didn’t have the Merlin touch, so who is out there that does?

Big Guy

HI Big Guy,

So basically we agree. A week or two ago, I was in a Fred Meyers which is groceries and also kind of a department store in case you don’t know them. And low and behold, in their weekly add was “Quiksilver- 40% off.” So I went to the clothing section and there was Quiksilver kids stuff. I actually took a picture I may get around to publishing. Well, we knew they licensed the kids stuff, so that it showed up there is not a surprise. But even though it’s just kids, it says Quiksilver on it and anybody who thinks that doesn’t influence brand perception is out of their mind.

Thanks for the comment,

J.

Thanks, Jeff! Yes, I’m familiar with Fred Meyer. They used to approach me at trade shows, and I would give them a polite but firm “NO.” Doesn’t surprise me that the kids line is in there now. Next step, young mens.

B

Big Guy,

I’m now at the point that whenever I walk into a department store of any kind, I look to see what brands are there and how they are being merchandised. I am no longer surprised by much.

J.

Jeff, I may be spending too much time on the internet, but in your archives is an article entitled “Market Evolution; Things to Think About from Quik CEO Mooney and My Spin on Them.” It was written exactly a year ago today, and I was amazed at how well you did at asking all the right questions as well as having a healthy skepticism about Mooney’s moves, and whether they were really going to work or not. Also, You Know Who had some input, right on the money. You two probably could have laid out what was going to happen a year ago, and it would be today’s headlines. Thanks for giving us your analysis. It’s actually fun to go back and read things where someone knew, a year ago, that dangerous waters were being stepped into. Cheers, Big Guy

Big Guy,

I think its true- you are spending too much time on the internet. But as long as it’s on my site, I’m inclined to be okay with it. Don’t know if you saw the article today, but a significant shareholders who’s a respected retailer is stating that the strategy has failed and that they need to look for a buyer. Apparently, the stock was up on the news (3.85%) even with the market crashing. You’ll also be interested to know that I talked to a finance guy in Europe yesterday who told me that Quik’s debt there is trading for $0.60 on the dollar. So this one guy isn’t the only one with doubts.

I think YKH and I have been thinking the same thing about Quiksilver for quite a while now. This would be another case where I’d rather I was wrong, but it’s looking like maybe I wasn’t.

Thanks for the comment,

J.