Deckers’ Solid Quarter: Your Retail Strategy Had to be Right Before There Was Ever a Pandemic

Deckers produced a strong result in their quarter ended December 31. I guess either because or in spite of covid. Probably both. Which is an interesting thing to say and I’ll have to explain it.

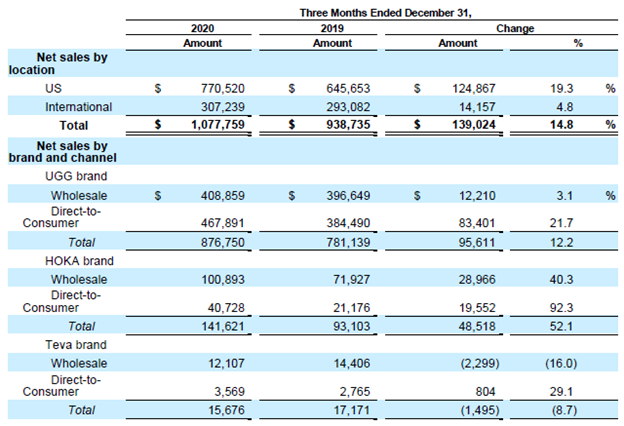

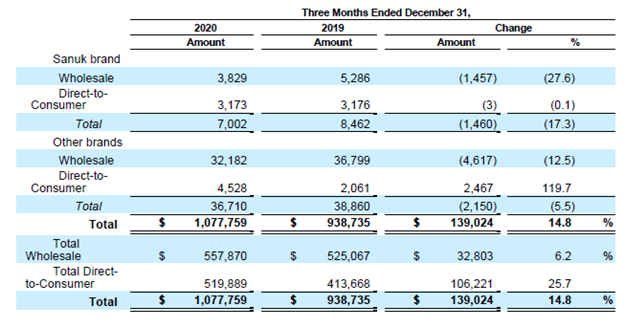

Revenue rose 14.8% from $938.7 million in last year’s quarter (LYQ) to $1.078 billion in this year’s. The gross margin rose from 54.1% to 57.0%, “…primarily due to higher full-priced selling and rate expansion, favorable channel mix resulting from increased penetration of DTC, and favorable changes in foreign currency exchange rates.”

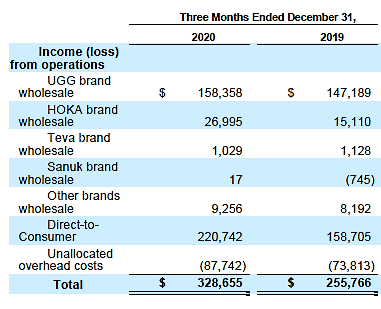

SG&A expense, as a percentage of sales declined from 26.9% to 26.5%. The result of these three factors was pretax income that rose 28% from $256.6 to $328.6 million.

The first two charts below show revenue by brand broken down by channel and the percentage change between the two quarters.

The chart below shows the change in operating income for the two quarters.

Not much analysis required here. Revenue and operating income growth are driven by UGG and HOKA. Other Brands are making a nice operating profit contribution and “…currently consist of the Koolaburra by UGG brand. The Koolaburra brand is a casual footwear fashion line using sheepskin and other plush materials and is intended to target the value-oriented consumer in order to complement the UGG brand offering.”

Teva and Sanuk are not particularly meaningful.

Now, on to the part where I explain what meant by their good results were “…because or in spite of covid. Probably both.” Here’s a rather lengthy quote from CFO Steve Fasching during his introductory remarks on the conference call.

“Back on our second quarter earnings call, we laid out a number of tailwinds experienced in the first half of our fiscal year. These tailwinds included compelling products that are resonating with consumers in the current environment, accelerated adoption of e-commerce, our brands benefiting from consumer trends shifting toward casualization as people continue to work from home and heightened awareness of HOKA. With the results we just delivered, we were able to capitalize on these variables in the third quarter as well.”

“We also discussed some potential headwinds that we anticipated could impact the third quarter as we stepped into our peak season. To quickly summarize, the assumed challenges were the potential for both owned and third-party shipping constraints. A second wave pandemic impact on operations. Limitations resulting from inventory purchase reductions at the onset of the pandemic. And finally, higher shipping and warehouse costs related to increased safety and hazard pay as well as increased marketing costs to capitalize on brand momentum.”

Problems and opportunities; two sides of the same coin. Like all successful industry companies during the pandemic and the retail changes/consolidation the pandemic accelerated, Deckers had a mindset- or was able to give itself permission- to make changes it might have been slower to make before covid. In some cases, it had no choice. In other cases, the pandemic worked for it- perhaps to Deckers’ surprise.

I’m not saying the pandemic hit and Deckers said, “Wow we need to change our strategy and do a whole lot of things different whether or not we want to.” Their current strategy started to take shape sometime ago after they got out from under the Sanuk debacle and made some management changes.

That’s true of most companies coping well with the pandemic. Here’s another lengthy quote from the 10-Q describing their omni-channel strategy.

- We have implemented a product segmentation strategy, as well as an allocation strategy for the UGG brand’s core Classics franchise, in the US wholesale marketplace. These strategies are designed to assist us in controlling product inventory, reducing the impact of discounts and closeouts on our sales and gross margins, and increasing full-priced selling across our product offerings. Similarly, we have implemented a multi-year marketplace reset strategy in Europe and Asia to drive UGG brand heat and build a foundation of diversified product acceptance, which is driving a healthier product mix and reducing the need for promotional activity.

- As a result of changes in consumer purchasing behavior, we continue to enhance our omni-channel strategy to bolster our e-commerce capabilities and enable us to better engage with consumers and expose them to our brands. Our strategy is transforming the way we approach marketing, including through a sustained focus on digital marketing efforts, as well as localized marketing activations, authentic collaborations, and product seeding to drive global brand heat, including the marketplace reset strategies in Europe and Asia as well as launching international loyalty programs in our DTC business. Further, we have enhanced our focus on adaptive digital marketing as we seek to target consumers within the work-from-home environment and promote products that are desirable based on current consumer preferences, working conditions, and lifestyle choices.

If you saw that explanation of their strategy and there was no pandemic, what would you think? I’d think, subject to verification of some details, that it makes a lot of sense.

And you know what? I think I’m going to leave things right there. I could inflict another thousand words on you giving conference call examples of where they say they did great, maybe made some mistakes, got lucky, or had to fly by the seat of their pants – like most of you when the virus came out of nowhere.

The point is that they’d implemented a strategy they thought would succeed as retail evolved. That strategy had to be tweaked but not fundamentally changed when the viral surprise accelerated that evolution.

Leave a Reply

Want to join the discussion?Feel free to contribute!