Well, I guess we might as well get right to it. The date change for the SIA show to three week days in early December starting in 2017 was a major topic of conversation at the show. I got a point of view. Several, actually.

The New Dates

First, I’ve been through this twice before. Or is three, including the move from Las Vegas to Denver? Now, as then, a bunch of people hated it, a bunch of people liked it, and some shrugged their shoulders. I suppose there were people it benefited and those it didn’t. But a year after the change, nobody was even talking about it. Well, maybe except me. I love Denver, but miss playing blackjack. No idea why I’d miss something that usually cost me money.

I guess what I’m trying to say is I’m pretty sure it’s a done deal for better or worse. So let’s get over it and focus on running our businesses better in what are surely challenging times for pretty much everybody.

What did I hear from people? The specialty retailers hate the idea of being out of their shops for three or four days in early December when they are busy selling and don’t know what their inventory position will be like. The large apparel brands are thrilled and I guess pushed for the change. The hard good snowboard brands mostly said, “If the retailers come, we’ll be here. If not, we won’t be or if we are, it will be with a booth one third our current size.”

Now, if it wasn’t a done deal, what I’d like to see is a merger of Outdoor Retailer and SIA into one show. No, it’s not impossible. Yes, it would be difficult, maybe expensive, highly charged, and have lots of obstacles. But not impossible and, I think, responsive to the realities of our market. It might even be easier to accomplish than it would have been a year or two ago.

My next point of view- how did Nick Sargent find himself taking over just as this was happening? The timing seems, I don’t know, not well coordinated maybe? Or- maybe it’s perfect. Anyway, it’s a lot of change at one time. What doesn’t kill you makes you stronger, Nick. There must be a story I’ll never hear. Damn.

That’s enough on the change of dates. Let’s move on.

Outstanding Industry Data

Wednesday I went to the SIA intelligence day and heard Goddess of Research (not her actual title) Kelly Davis lay out all kinds of interesting market data for hard goods and apparel. You all need to be aware that the quality of the research SIA is doing and making available has gotten really good and way more valuable, hence I’ve bestowed the title “Goddess.”

Both presentations are available as PDFs to members. They are full of good information and I suggest you get them. The single stat that hit me hardest was the weather slide in the hard goods presentation. What it said on the slide was, “Weather explains ¾ of the variance on snow sports participation and sales.”

Interestingly, I didn’t hear audience members wailing and keeling over when that slide came up. Maybe we’re all just too used to that idea. I have to have a long talk with Kelly about just what that means, and I’ll report back. Notice she said 75% of the variance- not 75% of sales. Still, it implies a certain lack of control over your results in this most seasonal of businesses even when you do things right. And it seems to validate the approach I’ve been pushing for years- only buy (or produce) what you reasonably believe you can sell at good margin in an average year and carry over as little inventory as possible. It’s never worth more the following season.

I’d always rather you were bemoaning the sales you missed rather than the inventory you can’t sell.

The second research related item I want to tell you about is the Downhill Consumer Intelligence Project (DCIP). This coordinated effort collected way better data from way more consumers than SIA has ever collected before. It tries to tell you not just how consumers have acted, but why.

You can see some of the data in Kelly’s presentations. But, perhaps more importantly, you also have access to and have the ability manipulate this data in something called the DCIP dashboard. I’m not sure who gets what access and who has to pay and who doesn’t (I only get access to the top line data) but go check it out.

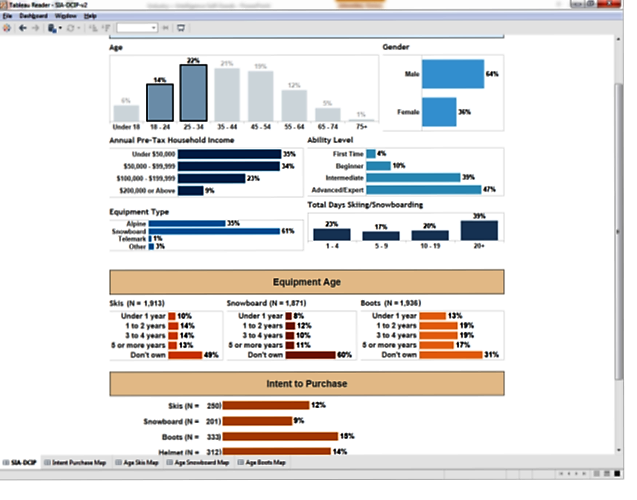

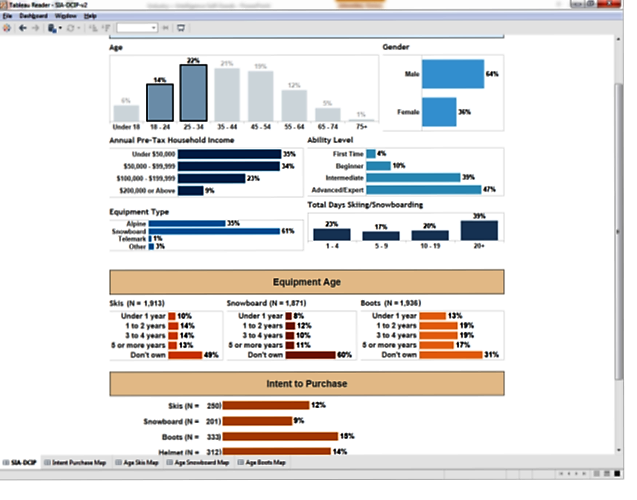

Below is a sample page from that program which, I think, shows some of the variables you can manipulate. Anybody who doesn’t focus like a laser when they see that 49% of skiers and 60% of snowboarders don’t own their equipment is not in touch with reality. That’s either a problem or an opportunity. I imagine it’s both.

You know what I found out at the show? Among all the hundreds of people who have free access to this program and data, literally nobody has used it to write a report that slices and dices their market. That makes me want to tell you a story about a sister industry.

Skateboarding: A Cautionary Tale for Snow

Even before 2003, skateboarding had been through its cycles. But it was around then that its popularity really took off and the Chinese decided it might be worth making some skateboards because the market had gotten big enough to be interesting.

There were maybe half a dozen “core” skateboard companies at the time mostly founded by former pro skaters. They enjoyed a great business model where they sold their product mostly to “core” skate shops. That provided retailers and brands with enough margin to fund traditional marketing programs focused on their team riders. There hadn’t been much (any?) product change in a long time. The industry had convinced skaters that a skate board was made from seven or eight laminated plies of Canadian hardwood maple and not any other way.

After some fits and starts, the Chinese (and now others) learned to make a skateboard that was the same as that made by the core brands. But they made and sold it at a much lower price and skaters (and skaters’ parents who were footing the bill) realized that there was nothing wrong with paying less for a product that tended to wear out anyway (When wood contacts concrete or asphalt, wood loses).

I’d characterize the core brands as having resisted this major change in their business model, though eventually they started to adjust.

Meanwhile, the former riders who’s started these brands got a little older (it happens). Pretty soon they were in their 40s or more. Somehow, though they still thought they could be the arbiters of the skate industry. So when longboards, and plastic boards, and scooters came along (not necessarily in that order) they said, “Nah, that’s not skateboarding and it’s not cool.” But of course, the 14 year olds didn’t much care what these older gentlemen thought and went by on their longboards, plastic boards, and scooters and said, “Yeah, well, whatever.” With one or maybe two exceptions, the “core” brands have lost most of their relevance to the market. They didn’t change when the market changed.

And We Snow Sliders Care Why?

In skateboarding, there are always new brands popping up. Getting 100 good decks made is easy, and the kids (amazing how many people I call kids these days) are having so much fun having their own brand they don’t care that they aren’t paying themselves.

It’s not that easy in snowboarding, and I noted I didn’t see the usual 6 to 10 new brands I’ve become used to seeing there. Yes, there were a couple, but not many. That kind of bothered me.

It bothered me because even though there isn’t the kind of disruption China and longboards brought to the skate industry, there is certainly the issue of the management of leading companies (ski and snowboard, resorts, brands, retailers) getting older and, whether they admit it or not, inevitably less in touch with their core customer who, Kelly Davis tells us, is young. Only 6% are baby boomers (though they spend a lot of money).

Last year I made a presentation at the show and said, “Hire some 14 year olds.” I wasn’t kidding. We’re faced with a slow economy that’s been, and continues to be, particularly hard on our primary customers. It’s also changing faster than the people in senior industry management positions have ever seen. It’s making traditional organizational structures and management processes less relevant. I’m not quite ready to say “obsolete” but maybe I should be.

You have to follow your customers not lead them. Your business will be more reactionary than you are comfortable with (or at least more than I’m comfortable with- that’s why I want the 14 year olds). I expect successful companies will be taking little risks every day in their advertising and promotion, and long term print campaigns will become a thing of the past. The way younger employees work is going to befuddle and annoy you, but you’re the one who will have to adjust.

A senior manager (or owner’s) job has always been to hire the right people and let them do their job. What I’m concerned about is senior managers (or owners) not being clear on just what that job is and how they will know if the employee is or is not doing it. The skate brands got stuck in the past. My perception is that the past is receding way more quickly in snow in 2016 than it did in skate starting in 2003.

I continued to hear too many anecdotal stories at the show about brands, retailers, resorts that won’t make even small, but fundamental changes to the way they run their businesses. We’ve all watched as brands, retailers, resorts have gone out of business.

Somebody once wrote, “The biggest risk is taking no risk at all.” Still makes sense to me. What you perceive as risky, or just as too much trouble, isn’t, but only the 14 year old can see that.

The Burton Conundrum

It isn’t any secret that Burton hasn’t been doing as well as it used to. Whether due to issues with distribution or lack of focus, it’s been through a period where it’s not as dominant as it once was. That was widely acknowledged at the show, though by all accounts they still make outstanding product.

I feel strongly both ways about this. On the one hand, there’s no doubt that some other brands have found opportunities as a result, and I like healthy competition+. But at the same time, Burton is closely identified with snowboarding, and with many non-riders, it may be the only pure snowboarding brand name they know. In addition, a number of Burton programs (Learn to Ride comes to mind) have been important in supporting and building snowboarding. As an industry we rely, and I imagine will continue to rely, on their efforts in these areas. A focused and successful Burton is important to the industry.

Burton also enjoys the benefit of not being a public company. As a result the company’s goals can be (and I perceive have been) not entirely focused on growing revenue every quarter.

So what do I want? My cake and to eat it too of course. I want Burton strong and prosperous. Just not too strong and prosperous.

A Brand Model I Liked

Karakoram has been around six years, but this is the first time I’d had a chance to talk with them. They make high end, split board bindings for use in the backcountry. What do I like about them?

They told me their product improves the way split boards function and the explanation made sense. They sell an expensive, high end product that meets a clear need. They know their target customer group. That group will not be turned off by the price. In fact, I’d guess they associate it with the quality and reliability they require.

Their product development is clearly focused; they only make changes that improve performance. Feels like that might take some costs out of the annual product cycle. Split boards and backcountry seem to be growth markets. Finally, they’ve got a bunch (six?) of patents on their product.

There’s nothing better than a high end product with some barriers to entry in a clearly defined and growing market. How many of those factors does your business have going for it?

Get over the show date change. Use SIA’s data. Don’t follow in the skate industry’s footsteps. Follow your customer. Embrace change since you have no choice. Identify your business’ strengths. Yeah, I know. Easier to say than to do.