Recession as Part of Your Strategy: Zumiez’s Results for the Year Ended February 2nd

Let’s go right to something Zumiez CEO Rick Brooks says at the end of the conference call on their results.

“…our goals [is to] continue to grow the profitability of the business from [an] operating profit perspective. Now of course if we have recession we’ll go backwards and we’ll see competitors go away across the globe and we expect coming out of the recession we’re going to emerge even stronger with a stronger share position in the marketplace which will allow us to drive operating margin higher again in that case.”

Rick is careful not to predict a recession, though I’ll bet he believes we will have one eventually. That’s what I believe. I’m pretty sure that’s what other executives at various companies believe. Executives who share that belief are building their balance sheets, strengthening their brands, controlling distribution, and positioning themselves to manage expenses. Like Rick, they expect a recession will hurt, but they expect it to hurt other more- to their benefit.

It’s hardly unexpected that companies would plan for an anticipated economic event. What might be unusual (I hesitate to use the word unprecedented) is having to plan for a recession when this ten year recovery has been so weak, debt continues to be high and growing, fiscal policy, judging by the size of the deficits, is still so stimulative, and monetary policy has little to offer us because interest rates are still low or negative around the world.

Meanwhile, the retail revolution continues on pace and perhaps the best way to come out of a recession stronger is to be making the changes that revolution requires.

As I’ve chronicled over some years now, Zumiez seems to be ahead of the curve on this. From the 10K:

“We employ a sales strategy that integrates our stores with our ecommerce platform to serve our customers. There is significant interaction between our store sales and our ecommerce sales channels and we believe that they are utilized in tandem by our customers. Our selling platforms bring the look and feel of an independent specialty shop through a distinctive store environment and high-energy sales personnel. We seek to staff our stores with store associates who are knowledgeable users of our products, which we believe provides our customers with enhanced customer service and supplements our ability to identify and react quickly to emerging trends and fashions.”

CEO Brooks in his conference call comments reminds us more specifically how they’re doing this. First, they have a “…distinct mix of leading and emerging brands that are not broadly distributed.” Note that private label was 13.5% of total revenues in fiscal 2018, down from over 20% a few years ago. I suspect the non-owned brands Zumiez is introducing each year are replacing some of this private label business.

Second, “Over the years, we spent significant time and resources improving our localized merchandise assortments to investment in our people and technology that enhances the customer experience of each touch point.” This relates to number three.

“The next factor critical to our success is speed. We’re already faster than most of our competitors due to our decision three years ago to shut down our e-commerce fulfillment centers and deliver all digital orders out of our stores. Not only did this concept of localized fulfillment mean we now have one cost structure to leverage, which we believe is making easier to expand operating margins and our current results and over the long-term, we can now get product into the customer’s hands faster by reducing the click-to-order processing time, cutting down the shipping business to the customer and also offering in-store pickup.”

“Finally, we’ve taken our operating model and expanded it internationally in order to identify consumer trends that emerge locally and grow globally around the world and achieve the scale necessary to work together with our brand partners in serving our customers globally…We are applying learnings and best practice from each of our markets to ensure that we are on top of the latest fashion trends and brand cycles. We can now launch anywhere in the world and quickly spread globally due to the proliferation of smart devices and social media.”

Connectivity has certainly changed things over a couple of decades making Zumiez’s strategy of discovering local trends and taking them global plausible. But I remember my surprise, many year ago, when I found out, at least in snowboards, that “red” in the United States was not the same color as “red” in Japan. I wonder to what extent culture is less distinctive across nations than it used to be. Given the rise of nationalism we’re seeing, perhaps not as much as Zumiez hopes. All trends won’t be global. All won’t transcend boarders. The secret sauce will be in figuring out which ones will.

If you look at Zumiez’s list of its competitive strength in the 10K, you will find they expect to compete by doing what other companies also need to do but doing it better (and having started doing it sooner). That’s very close to how VF sees itself as competing. With the exception of the corporate culture Zumiez has built over decades, none of it’s competitive strengths are unique or maintainable, which isn’t to say they can’t keep doing them better than others for some period of time.

But if they can maintain those strengths until a recession comes along and makes “…competitors go away across the globe…” Well, that might work out. Let’s talk about why.

Zumiez ended its fiscal year with 707 stores- 608 in the U.S., 50 in Canada, 41 in Europe and 8 in Australia. They added 5 stores in North America, down from 12 the previous fiscal year. In talking about the current fiscal year, they state, “As we reach our targeted number of stores in North America, we expect that total store count growth in fiscal 2019 in the region will continue to moderate. In Europe and Australia, however, we continue to believe we have growth opportunities and we are planning 8 new stores in fiscal 2019, consistent with fiscal 2018.”

In a risk factor they also state, “We plan to continue to open new stores in the Canadian, European and Australian markets. We may continue to expand internationally into other markets, either organically or through additional acquisitions.” The comment about acquisitions is interesting. Rick says in the conference call, “…we’re going to look outside of the business for growth vehicles that we think are the right cultural fit and yet have a good run rate for growth and are accretive for our shareholders.”

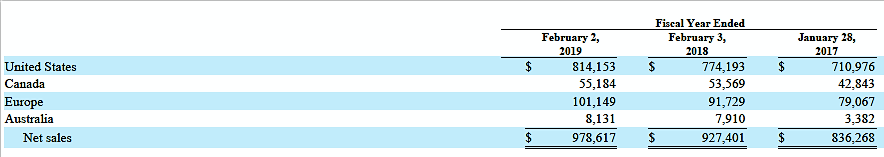

As you see in the chart below, the U.S accounted for 83.2% of revenue in 2018. Add Canada and it’s 88.8%. Revenue growth for Zumiez presently requires growth in North America, but growth of store numbers will be constrained for now.

Would a recession and trouble for competitors mean more store opening opportunities for Zumiez? Who knows? More interesting is how their trade area concept might permit revenue and profit growth in North America.

A trade area, you may recall, is a geographic region where the goal is to maximize total revenue (or maybe total operating profit) with the minimum number of stores. It goes far beyond localization of product but isn’t expected to have a meaningful impact in 2019.

CFO Chris Work puts it this way:

“…we’re at the early innings of this thing [trade areas] for sure. We are dealing more and more with it as we kind of get our hand around it and I think this is another area that could really help us over the long term…as we think out beyond 2019 this is an area where we can really look at trade area by trade area with how are we performing in this trade area, how many stores we have in this trade area and what is our opportunity if we were to remove say these lowest performing store in a trade area to still reach that consumer and provide them value and like I said we’re in the early innings today. We’ve been doing this a little bit with some of the stores that we’ve closed to-date and we’re seen a good impact of what it means to the surround stores.”

I am intrigued to see how integration of brick and mortar, ecommerce, and online under the trade areas concept integrates with their new systems and the data those systems generate to improve performance over the next couple of years. I suspect that this, plus any “benefits” from a recession, will be the sources of revenue and profit growth for Zumiez in North America.

In Europe, Zumiez is continuing to lose money. Chris tells us, “…this is not something that’s losing tens of millions of dollars. This is a business that’s losing millions of dollars and I think that it’s a business that’s continued to grow and as I said has needed some, needed investment to do that.”

Rick says about Europe, “…we are really building and replicating the omni channel platform that we built here in the U.S. So, to do that takes the investment of building out the physical presence in the market. And I will tell you that from a consumer behavior perspective, we are not seeing any significant differences between what happens when we build out this marketplace.”

I am curious if they need a bigger presence in Europe to begin to recognize some of the efficiencies they get with 608 stores in the U.S. They paid a lot of money for Blue Tomato.

This article has run long, but a short review of the financials is still in order. In the fourth quarter, sales fell 3.7% to $304.6 million, but the quarter was a week shorter than last year. The comparable sales increase (remember that includes ecommerce as well as brick and mortar) rose 3.9%. Gross margin rose from 37.2% to 37.4%. They got a 0.6% improvement in product margin and a 0.4% improvement in inventory shrinkage, where they are recovering from a problem. Net income rose from $19.9 to $29.6 million, but that includes a $4.3 million benefit from the change in U.S. tax law.

I thought combining brick and mortar and ecommerce sales was a good idea for organizational and cultural reasons. Still do. Sends the right message to the company. But as an analyst, I’d really like to see them broken down again. Or at least I need some metric or metrics to judge how ecommerce and brick and mortar are supporting each other. That will be increasingly important under the trade area concept.

The balance sheet is rock solid, with $165 million in cash, a more than three to one current ratio, no long-term debt and only $40 million in any kind of long term liabilities, and equity that’s risen over the year from $356 to $400 million. Inventory rose 2.78% to $129.3 million.

That’s a lot of cash to go with no debt. Certainly makes an acquisition possible. Chris notes that their first priority is investing in the business and the second is to “…look for the right investments outside the core business…And lastly, we are focused on returning value to our shareholders through share repurchases and/or dividends.” I don’t recall previous mentions of dividends, but I could be wrong.

For the year, “Net sales were $978 .6 million for fiscal 2018 compared to $927.4 million for fiscal 2017, an increase of $51.2 million or 5.5%. The increase reflected a $50.4 million increase due to comparable sales and a $12.3 million increase due to the net addition of 9 stores (made up of 5 new stores in North America, 7 new stores in Europe, and 1 new store in Australia offset by 4 store closures), partially offset by a decrease of $9.1 million related to the additional week in the 53-week period and calendar shift in fiscal 2017. By region, North America sales increased $41.6 million or 5.0% and other international sales increased $9.6 million or 9.7% during fiscal 2018 compared to fiscal 2017.”

“As a percentage of net sales, gross profit increased 90 basis points in fiscal 2018 to 34.3%. The increase was primarily driven by 50 basis points of leverage in our store occupancy costs, 40 basis points due to lower inventory shrinkage, and 20 basis points due to higher product margin, partially offset by 20 basis points in higher shipping costs.”

Remember the advantage in terms of leverage they get from fulfilling ecommerce orders in stores. The higher shipping costs is something everybody is dealing with.

SG&A expense as a percent of sales fell 0.1% to 28.1%. Advertising expense, included in SG&A, rose from $10.8 to $12.2 million. Total SG&A for the year was $274.9 million.

Pretax income rose 28.8% from $48.4 to $62.3 million. Net income was up 68.7% from $26.8 to $45.2 million. However, due to the new tax law, their effective tax rate declined from 44.6% to 27.5%. It saved them $8.7 million in income taxes.

The strategic issues are more interesting than the solid financials this time. They’ve got a challenge in Europe where they have a smaller base and an economy that, for the moment, is softer than in the U.S. In North America, Zumiez is reaching it’s store limit. A recession may, they believe and I agree, improve their competitive position over the longer term. Sales growth may depend partly on the presently somewhat nebulous trade areas concept (at least it’s nebulous to me, though I really like it) being rolled out. I do expect them to be able to further leverage their cost base as more of their initiatives bear fruit.

It’s a challenging time. Looking long term, Chris puts it this way. “While we grow sales and grow margins, so it’s a different path there and as we look long term, this was a business six to seven years ago we were talking about getting operating profit as a percent of sales in the low teens. I think that’s changed and I think that’s changed across pretty much the entire retail footprint but it is a business that we think consolidated we can push to the high single digits.”

A revised operating profit goal that’s at least four percentage points lower than what they expected a few years ago tells you how challenging things are for most retailers. But it seems like Zumiez should do better than most in weathering the bumps in the road.

Leave a Reply

Want to join the discussion?Feel free to contribute!