Hints of a New Business Model; Skullcandy’s Quarter

I love it when a plan starts to come together. Especially when it’s a plan I’ve endorsed and follows an approach I’ve been recommending for many companies since about 2008. As you know, I’ve been concerned that public companies have pressures on them to grow that make it hard to be brand builders because getting that growth can require you to distribute your product in ways that are bad for the brand. But often, the brand is all you’ve got, and you damage it at your peril.

The larger a public company is the more of an issue it becomes. Skull has the advantage of not being that large. It further benefitted, if you want to call it that, from being an acknowledged turnaround from which nobody had much in the way of immediate expectations. This left new CEO Hoby Darling, when he joined the company in March of 2013, free to clean up the distribution, reduce off price channel sales and focus on building the brand even though the immediate result was a big reduction in revenues.

I’m not claiming “Problem solved!”, but the results for the September 30 quarter are very positive.

Sales grew 16% from $50 million in last year’s quarter to $58.1 million. The gross margin rose from 44.9% to 45.3%. SG&A expenses were up about 3.7%, but operating income still rose from $514,000 to $3.58 million. Pretax income was up from $236,000 to $2.66 million in spite of $780,000 in additional other expenses that were foreign currency related.

Net income doubled from $1.08 to $2.15 million in spite of a tax bill that went from a benefit of $842,000 to an expense of $507,000 representing a total increase of $1.35 million.

So what’s the secret sauce? There isn’t one! I will remind you, as Hoby does every chance he gets, what Skullcandy’s five pillar strategy consists of. “…the pillars are: One, marketplace transform; two, create the innovation future; three, grow international to 50% of the business; four, expand and amplify known-for categories and partnerships; and five, team and operational excellence. “

Make good product, compete where you can identify an advantage, support your retailers, get the right people in the right jobs, run the business well, cherish the brand. Gee, it sounds way cooler when you call it five pillars and use lofty phrases like “marketplace transform.”

I’ll bet you that it isn’t just the analysts that hear this. Every employee probably hears it all the time and has been hearing it since he rolled it out shortly after taking the job. It’s Skullcandy’s mantra. It brings focus, direction, and efficiency to the company. Once you internalize it, you know what’s important and what’s not, and what to do and not do. Okay, I admit it’s not that simple, but I hope you see the advantage to any company.

I’m having a lot of fun talking about issues of strategy, but I need to give you a few more pieces of financial information. I’ll get back to strategy.

Skull’s domestic sales (just the U.S.) were $38.5 million, up 18.9% from $32.4 million in last year’s quarter. International sales rose 11.1% from $17.6 to $$19.5 million. International, then, represented 33.6% of total revenue for the quarter.

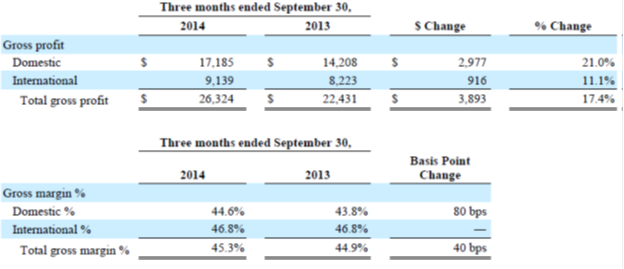

The table below from the 10Q shows gross profit and gross profit margin broken down by domestic and international and the change in each.

“Domestic net sales increased primarily due to sales of earbuds, wireless speakers and opening a new account.” I assume that new account in Walmart, which I’ll discuss below. “International net sales increased primarily due to increased sales in Canada, and to a lesser extent Mexico and China.” Europe is conspicuous by the absence of its mention.

Domestic operating profit improved from a loss of $2.47 million to a profit of $397,000. In international, it grew from $2.98 to $3.19 million. That’s about a 1% return domestically and 16.3% internationally. No wonder they want to increase international sales to 50% of the total. I should note, however, that I expect some further improvement in domestic operating profit as/if they make progress on their strategy. Hoby Darling notes in the conference call that they continue to “…edit accounts that don’t support Skullcandy’s premium yet accessible brand position.”

In addition, note that “The Domestic segment also includes the majority of general corporate overhead and related costs which are not allocated to the International segment. “ As a result, it’s not quite fair to compare domestic and international operating income percentages straight up.

The gross margin increased partly because of a shift to sales of higher margin products and also because of “…decreases in warranty expenses as a result of enhanced product quality.” The second is particularly good to see. It’s no secret that Skull had quality issues.

SG&A expense fell as a percentage of net sales from 43.8% to 39.2%, though in total dollars they increased by $824,000 with the first reason for the increase given as “…increase in marketing and demand creation efforts…” and the other being higher research and development expense. Both are consistent with the strategy.

Two other things for you to note:

“In the third quarter of 2014, the Company sold products to certain customers through consignment arrangements. The Company had approximately $1.0 million of inventory consigned to others included in inventories at September 30, 2014.” I generally hate consignment, because it implies some brand weakness if that’s the only way a company can get a retailer to take its product. But perhaps in the day of selling to huge retailers, it’s inevitable when you start up with one of those retailers, and I’m wondering if this isn’t part of the deal with Walmart.

There’s one customer that accounted for 17.4% of revenue and 17% of Skull’s receivables during and at the end of the quarter. I’m guessing Best Buy.

Okay, Walmart. I’ve been arguing that the days of easy distribution decisions were long over, and that each new retail channel had to be evaluated individually. I’ve also suggested that in the day of the omnichannel and mobile devices, where you sell may not matter as much; how you merchandise in the channels you choose and how you connect with your consumers is what counts. That seems to be how Skullcandy is thinking about Walmart. In the conference call, CEO Darling lists five questions they asked as they considered a relationship with Walmart. The questions are:

- “…does our consumer shop there?”

- “…does out competition sell there?”

- “…can we segment our product line so that by adding Walmart, we aren’t cannibalizing sales of our existing retail partners?”

- ”…can we reach a new consumer in a geography that has been underserved by Skullcandy?”

- “…can we deliver good in-store experience and tell our brand story?”

They believe the answers to one, two, and four are yes. Three is so far so good. Five is something they are working on into next year.

My suggestion is that every company shamelessly steal these questions and use them in evaluating your own distribution decisions. One catch- you have to figure out with some rigor who your consumers are first.

Obviously, I’m pretty impressed with what Skullcandy is doing. But hey, it’s me and I have some longer term strategic issues which I’ve raised before.

First, consumer technology products have always, eventually, become a commodity. Skull thinks they can prevent that for their brand at least. They have to.

Second, the competitors are many and larger and better resourced than Skullcandy. Part of Skull’s plan is to compete with new and improved products and technology. We’ll see. Maybe it’s becoming about the smarts of the people you have and the connections with consumers as a source of new ideas rather than just the size of your budget.

Finally, if Skullcandy continues to improve, they may find themselves in the position where they have that age old conflict between curating the brand and growing revenues to the satisfaction of Wall Street. I suppose that’s a problem they’d like to have.

As you know, there’s a lot we don’t get told in 10Qs and conference calls. But I’m intrigued by Skullcandy because what I’m hearing, or think I’m hearing at least, is that they have wiped the slate clean and are building a brand for the online/internet/mobile/omnichannel/empowered consumer era. I don’t yet know the extent to which all these changes obviates some of the common business knowledge around distribution, marketing , merchandising, niche building and product development. I don’t think extrapolating the past into the future works as a predictive mechanism. What I think is that the reason Skullcandy may succeed is because they are embracing some of these changes. It can change the competitive equation.

Congrats to Hoby and his success! Given what he was handed and how he’s managed it, I’m impressed.

With regard to consignment, I agree that its not the preferred method of doing business, however if SkullCandy is doing business with Apple they (along with all other suppliers) have to participate in this unique consignment situation to take advantage of being in the apple stores. If they’re consigning goods elsewhere, not so good…

Regarding Walmart and Question #5, I’d be asking what the Walmart shoppers expectation is regarding brand or customer experience, I suspect its much different than what a Nordstrom shopper would be expecting. I think that they are definitely reaching a new consumer, selling in new geographical areas, and although segmentation is always important (its become a buzz word) given Skull’s price points, I’m not sure their consumer is running back and forth comparing the prices at Best Buy and Walmart, chances are the kid tells mom he wants Skullcandy head phones and she buys them while shopping at Walmart and when he tells dad the same thing, he buys them at Best Buy.

There are 300 million people in the US, so lots of consumers to reach as long as you are willing to meet them where they shop!

Hi Double M,

Yeah, I’m cautious/nervous about consignment myself but, as I said in the article, can see where it might be part of the deal with some large retailers.

With regards to Skull’s approach to Walmart, I suspect they are asking pretty much what you’re asking as part of question five. They just didn’t go into detail in the conference call, which is not a surprise. “Meeting them where they shop,” be it online, mobile, or brick and mortar is what it’s all about these days, and is throwing some conventional business wisdom out the window.

Thanks for the comment,

J.

Hey Jeff, it will be interesting to see if they can pull it off. We are a “core” retailer in Australia, here Skullcandy have opened up distribution to every man and his dog and our sales in turn nosedived and we no longer stock Skullcandy.

Hi Croc,

Thanks for info from another part of the world. Gve me more! Any indication they are pulling back some of the distribution like they say they are doing other places? Are they trying to better merchandise the product in the places they are in?

J.