Hibbett Sports: Annual Results and Omni-Channel Progress After a Remarkably Late Start.

“At the end of the second quarter of Fiscal 2018, we successfully launched our e-commerce website,” Hibbett Sports (HS) tells us in their 10-K for the year ended February 2nd. This isn’t news. I wrote about it last October when I discussed their quarterly results.

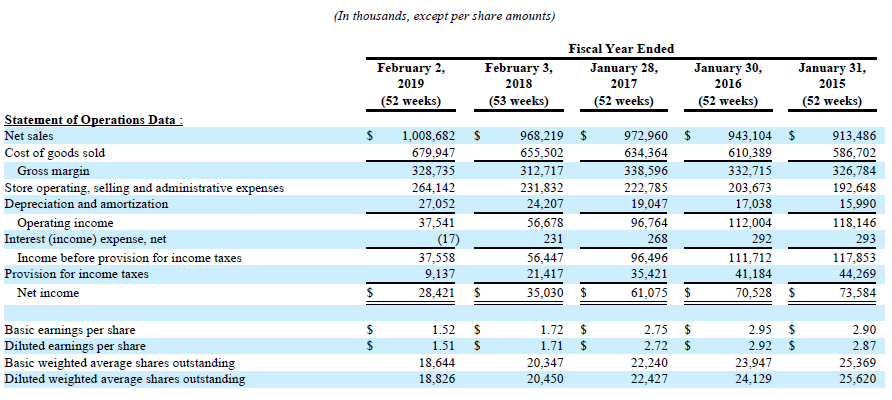

If you’re not already familiar with HS, you might review that article before continuing. My goal is to bring you up to date based on their full year results and new information in the 10-K. Let’s start with this chart. It shows HS’s annual results for the last five year.

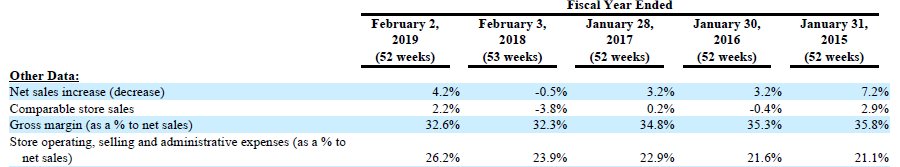

Over this period, sales have risen a total of 10.4%. Net income has fallen each year by 61.3% over the whole period from $73.6 to $28.4 million. Here are some more numbers over the same period.

Note the trends in the gross margin and store operating, selling and administrative expenses as a percentage of net sales. These movements in the wrong direction occurred while the number of stores open at the end of each fiscal year rose from 988 to 1,163. That growth of 175 stores includes the purchase of City Gear and its 136 stores in November 2018 for $88 million. $86.8 million was paid in cash.

HS borrowed part of the purchase price and we see the impact on their balance sheet, where short term borrowing has risen from zero a year ago to $35 million.

Between the November 4 acquisition date and the fiscal year end on February 2, City Gear generated $49.1 million in revenue and a loss of $0.4 million. The acquisition was responsible for just over half of the five-year revenue increase.

Meanwhile, HS spent $16.5 million over the fiscal year to purchase 776,000 of its own shares on the open market. They are authorized to purchase an additional $188 million in shares should they choose to.

Excuse the following short digression. Like many companies these days, HS couldn’t figure out a productive way to invest in its existing business, so it made an acquisition and bought back stock. This behavior continues to be facilitated by capital misallocating low interest rates. If you’re an individual saver, a pension fund, an insurance company, or a company buying back it’s stock and doing acquisitions, you’ve been impacted by low rates.

Yes, if you need a mortgage you’ve probably been helped (at least in the short run), but overall money is going to the wrong places for the wrong reasons and it’s going to bite us in the keister. Already is. Hey, here’s a fun exercise- go check out the overall number of shares bought back in recent years and imagine what level the stock market might be at if those buy backs hadn’t been there to support prices.

Digression complete. Back to Hibbett Sports. Here’s an interesting quote from their 10K.

“Our business is dependent to a significant degree upon close relationships with our vendors. Our largest vendor, Nike, represented 65.4%, 57.9% and 57.0% of our purchases for Fiscal 2019, Fiscal 2018 and Fiscal 2017, respectively. Our second largest vendor, adidas, represented 10.0%, 11.0% and 5.5% of our purchases for Fiscal 2019, Fiscal 2018 and Fiscal 2017, respectively. Our third largest vendor, Under Armour, represented 5.7%, 10.8% and 16.4% of our purchases for Fiscal 2019, Fiscal 2018 and Fiscal 2017, respectively.”

That’s about 81% of revenues from three brands. If Nike should ever hit a bump in the road (that could NEVER happen, right?) HS kind of has a problem.

“Our primary merchandising strategy,” they note in the 10K, “is to provide a broad assortment of quality brand name footwear, apparel, accessories and athletic equipment at competitive prices in a conveniently located full-service environment…We believe that the breadth and depth of our brand name merchandise consistently exceeds the product selection carried by most of our competitors, particularly in our smaller markets.”

Can you do that with three brands? Especially with three brands that are distributed literally everywhere online and off.

The argument that the strategy is viable centers around their smaller markets and store locations. They’ve got 123 in Texas, 122 in Georgia, 105 in Alabama, 78 in Tennessee, and 74 in Mississippi. Only 12 in California.

They continue in the 10K: “We identify markets for our stores under a clustered expansion program. This approach primarily focuses on opening new stores within a two‑hour driving distance of existing locations, allowing us to take advantage of efficiencies in logistics, marketing and regional management. It also aids us in building a better understanding of appropriate merchandise selection for the local market.”

There’s nothing I don’t like in that, but the five-year results make it clear it’s not enough. It also seems inconsistent with having, for example, a single store in Minnesota and just a few stores in other states. Perhaps some of these were acquired in the acquisition.

Over many years, I’ve advocated for the idea that the retailer has to bring credibility to the brands it carries- not the other way around. HS seems to be trying to make it work “the other way around.” I mean, if 65% of their revenues are Nike, what choice do they have?

None, I guess. One of their risk factors is, “Our success depends substantially on the value and perception of the brand name merchandise we sell.”

They continue, “Although we face competition from a variety of competitors, we believe that our stores are able to compete effectively by providing a premium assortment of footwear, apparel, accessories and team sports equipment. Additionally, we differentiate our store experience through extensive product knowledge, customer service and convenient locations. We believe we compete favorably with respect to these factors in the smaller markets predominantly in the South, Southwest, Mid-Atlantic and Midwest regions of the United States.”

I have never thought of three brands as permitting a retailer to offer a premium assortment, but I do take their point about where their market is.

Anyway, apparently recognizing some potential shortcomings in their strategy, HS says in their risk factors, “We plan to initiate a strategic realignment, which includes an accelerated store closure plan, that may not yield the economic results expected.”

“As the retail environment continues to evolve, the Company is focused on improving the productivity of the store base while continuing to grow its omnichannel business to serve customers where and when they want to shop. In an effort to adapt to changing shopping patterns, the Company has decided to initiate a strategic realignment that will include the closure of approximately 95 underperforming Hibbett stores in Fiscal 2020, while opening approximately 10 to 15 new Hibbett Sports and City Gear stores. We cannot guarantee that this strategic realignment will result in an economic benefit for the company. Our results of operations could be adversely affected by the underperforming stores’ liquidation process through reduced gross margin rates and increased operating costs.”

I was surprised to see that as a risk factor. I’ll be curious where the closed stores are located. Reading HS’s risk factors is interesting. They talk specifically about pressure from competitors, the impact of social media, and the importance of omni-channel.

Their omni-channel efforts seem to be getting some traction. In the last quarter of their fiscal year, “E-commerce sales increased 60% and represented 10.6% of total sales…” They tell us that traffic, conversion and average orders all increased. During the year they launched a mobile app and implemented buy online, pick up in store and reserve in store programs.

But did they come at the expense of brick and mortar sales. I’d love to see some more detailed discussion of how brick and mortar and online support each other.

Hibbett Sports seems to be doing the right things but damn, they were late doing them. Retiring CEO Jeff Rosenthal (he’ll still be on the board of directors) acknowledges in the conference call how far behind they’d been and how far he thought they’d come. “We have really transitioned this company from being way behind to be now a leader, and I have felt the last three or four years, I’ve been playing defense. I got this team and this team got me to be able to play offense, and we should be very proud of what we’ve been able to do.”

As he says, “We’ve built over $100 million e-commerce business. And I know, even from the investment community and others, they’ve had – they had doubts that we were 17 years late to this. And to build up over $100 million business in 18 months, should give this team some credit.”

He’s right- about what they’ve accomplished and about being 17 years late. I’ll be curious to see how the small market, southern focused strategy mixes with a three brand dependence and their omni-channel efforts.

Leave a Reply

Want to join the discussion?Feel free to contribute!