Deckers’ Annual Report: Can Niche Brands Become Global Lifestyle Brands?

Deckers (owner of Sanuk) has gone and changed their year end from December 31st to March 31st. So the recently released 10K reports on the year that ended March 31st, 2015 compares it to the year ended December 31st, 2013 as well as reporting on the quarter that ended March 31st 2015. I’ll compare the two annual results, each of which covers 12 months.

As usual, we’ll focus mostly on what’s going on with Sanuk. Here’s the link to the 10-K if you want to peruse it yourself.

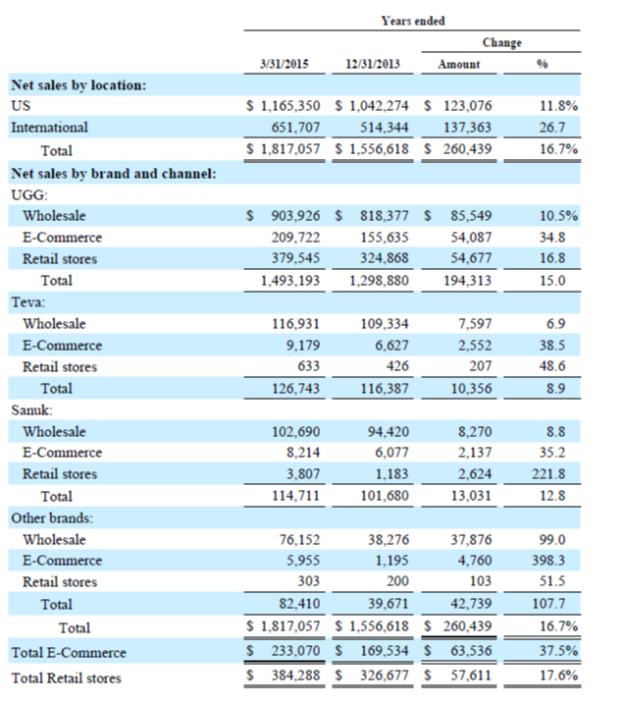

Deckers’ revenues rose 16.7% from $1.557 billion in the year ended December 31st 2013 to $1.817 billion in the year ended March 31, 2015. Their five largest customers were 22.2% of worldwide sales and none were 10%. They ended the year with 142 stores (mostly in the U.S. and China) up from 113 in the previously reported year.

The table below provides details on their revenue by brand and channel. You’ll note that the UGG brand accounts for 82% of Deckers’ total revenue. Sanuk generates 6.3% of the total. Its revenue grew from $101.7 to $114.7 million (12.8%) from one year to the next.

They note that, “Our weighted-average wholesale selling price per pair decreased to $46.53 for the year ended March 31, 2015 from $46.87 for the year ended December 31, 2013. The decreased average selling price was primarily due to our Teva and Sanuk wholesale segments, partially offset by an

increase in the average selling price in our other brands wholesale segment.”

That’s an overall decline of only 0.73%. But given that UGG represents 82% of total revenue and that the average wholesale selling price of UGG apparently increased, it implies some pretty dramatic reductions in Teva, Sanuk, or both.

Here’s what they tell us about Sanuk’s results.

“Wholesale net sales of our Sanuk brand increased primarily due to an increase in the volume of pairs sold, partially offset by a decrease in the weighted-average wholesale selling price per pair. The decrease in average selling price was primarily due to a shift in product mix. For Sanuk wholesale net sales, the increase in volume had an impact of approximately $14,000 and the decrease in average selling price had an impact of approximately $5,000.”

And here’s how they describe Sanuk’s distribution.

“We sell our Sanuk footwear primarily through independent action sports retailers, outdoor retailers, specialty footwear retailers and larger national retail chains including Nordstrom, Dillard’s, Journeys, DSW, Urban Outfitters and Tilly’s. We believe all these retailers showcase the brand’s creativity, fun, and comfort and allow us to effectively reach our target consumers for the brand.”

That doesn’t look like a bad list of accounts, but of course it’s not complete. We see increased sales offset by a lower selling point. One possible interpretation is that Sanuk is finding its way into some lower priced distribution as it looks for growth. Deckers would hardly be the only company managing brands for growth that has to make some tough distribution decisions. But what we’ve seen with various brands is how hard it is to keep brands tied to a “core” market credible as they expand distribution. The new customers may know the brand, but not the story that gives the brand its competitive advantage.

Speaking of that, here’s how Deckers describes how it competes.

“We believe that our footwear lines and other product lines compete primarily on the basis of brand recognition and authenticity, product quality and design, functionality, performance, comfort, fashion appeal, and price. Our ability to successfully compete depends on our ability to:”

“• shape and stimulate consumer tastes and preferences by offering innovative, attractive, and exciting products;

- anticipate and respond to changing consumer demands in a timely manner;

- maintain brand authenticity;

- develop high quality products that appeal to consumers;

- price our products suitably;

- provide strong and effective marketing support; and

- ensure product availability.”

So, that’s all correct. All those things are good things to do. But they are the same thing everybody else is trying to do. None of them offer the potential to provide a sustainable competitive advantage unless Deckers can do them, and continue to do them, better than all the other companies trying to do the same things with their brands.

That’s not a criticism of Deckers. It just seems to be the reality of our market.

Deckers overall gross profit margin was up from 47.3% to 48.3%. Of the 1% increase, 0.7% came from doing higher margin retail and ecommerce business and 0.2% from acquiring their UGG distributor in Germans. Which I guess is a way of saying that none of it came from making product less expensively or raising prices.

Selling, general and administrative expenses rose 23.7% from $528.6 to $653.7 million. As a percent of revenues, those expenses rose from 33.9% to 36%.

Net income was up $146 to $162 million, or by 11%. As a percentage of revenue, net income fell from 9.4% to 8.9%.

Sanuk’s operating income from wholesale increased 6.4% from $20.6 to $21.9 million. “The increase in income from operations of Sanuk brand wholesale was primarily the result of the increase in net sales as well as a decrease in operating expenses of approximately $2,000, partially offset by a 4.8 percentage point decrease in gross margin. The decrease in gross margin was primarily due to a shift in sales mix as well as an increased impact from closeout sales.”

I’d love to know specifically what “shift in sales mix” means. But we’ve got higher closeouts causing a big reduction in the gross margin. I wonder if that was what drove the expense reduction.

2015 is the last year that Deckers has to pay the former owners of Sanuk their earn out. It’s 40%, without limit, of the brand’s gross profit for calendar 2015. Right now, Deckers is estimating that amount at $24 million.

Deckers had a pretty good year given the general economy and competitive circumstances. With regards to Sanuk, they paid a lot of money for it, and so far haven’t seen the return.

Chairman, President and CEO of Deckers Angel Martinez described the Sanuk strategy this way in the conference call:

“Our strategy is to evolve the Sanuk brand from primarily a man’s surf brand into a global lifestyle brand continues to unfold. This has been fueled by a heightened focus on women through innovative new products such as the brand’s Yoga series of sandal and shoes which has opened up distribution with leading department stores and specialty retailers.”

What many companies and brands seem to be running into all over the industry is that taking a surf (or skate, or snow, or whatever) brand that’s closely identified with one activity and making it a “global lifestyle brand” is way harder than it sounds. In fact, I have general concerns that it may only rarely be possible (in a reasonable time frame) because the required growth craters the brand’s competitive positioning.

I’m beginning to think it makes a lot more sense to create a new brand rather than pay a high price for an existing one if you’re going to lose or fire all the people who made the brand you acquired successful in the first place. Too bad Deckers did that with Sanuk.

When you sell $6 to $8 million dollars in close-outs in one year, start selling large national discount shoe chains at deep discounts and are declining in sales with-in your core market it’s going to effect your bottom line and erode your brand image and consumer value. Sales to the specialty shops is down double digits in shoes. The Women’s Yoga and Yoga Sling series (which if you remember) where both launched before Decker’s acquisition now represent over 40% of their business. So any talk about the need to strengthen their women’s collection is already well in play. The question is …. what happens to the brand and it’s current sales when those two styles run their course and die off. What do they have coming up to replace them. From what I am hearing and seeing, not much. Congratulations to Jeff Kelley and the rest of the now banished executive team for extracting as much money from Decker’s as they did when the brand was sole. It has become the model on how this is done right and to the greatest effect. So in closing, my questions is … is Sanuk the next Simple? Just might be. Only time will tell.

Hi YKW,

Thought I might hear from you pretty quickly. Sucks to be a great brand owned by a public company that requires more growth than the brand can provide at the rate the public company needs it without damaging the brand. Oh well.

Thanks,

J.

Yep. But corporate ego and a fundamental lack of understanding of what it is that you just bought is also the root cause of many acquisition disasters. It is all to common and not just something that Decker’s is guilty of. I would just have hoped that by now most large or public companies would have learned from others hard learned mistakes.

YKW-

I actually think they may have figured that out, but are constrained by the purchase price they paid from doing anything except pushing growth faster than they should. I am kind of expecting a write down of the $113 million of intangibles Deckers is carrying on its balance sheet for Sanuk.

Thanks,

J.