An Agnostic Moat; Zumiez’s Most Recent Quarterly Results

Zumiez had a great quarter ended August 3 (remember I don’t write until I have received and digested the 10-Q). They did it with sales that rose just 4.3% from $219.0 in last year’s quarter to $228.4 million in this year’s. But they also increased their gross margin from 33.1% in the same quarter last year to 33.8% in this year’s quarter. And their selling, general and administrative expenses as a percent of revenue declined from 30% to 28.7%.

The bottom line was a net income that more than doubled from $4.38 to $9.03 million. They’ve got an imminently solid balance sheet. Combined with improved margins and reduced expenses over a modest revenue increase and you end up with a great bottom line.

More on that later. You’re probably wondering what I mean by an agnostic moat. If not, I wasted a lot of time coming up with that title.

Zumiez is agnostic in that within their target customer group, they don’t care what they sell to whom. That isn’t completely true- they set some broad limits. For example, remember when they declined to get into the athletic shoe market even though it was hot among their customers?

Their moat- a moat being defined as an advantage that’s hard for a competitor to copy- is their culture established and reinforced over decades.

I’m not saying that in 1978, when Zumiez was founded, Tom Campion and Gary Haakenson sat around and said, “You know, I think there’s going to be ecommerce and a revolution in the ability to collect and utilize customer data, and we better build an organization to accommodate that.” But somehow, Zumiez evolved to be prepared to manage those trends.

CEO Rick Brooks brings agnostic and moat together when he says, in the conference call, “Our teams across the organization put a significant amount of effort in understanding our customers, not only today but how they will continue to evolve and what will be important to future generations. This thinking is embedded in our culture and is reflected in who we higher and how we operate. These teams are in tune with the local and national trends that are important to our customers and can speak authentically to them across all of our channels. This approach allows us to serve the customer in authentic bringing all the touch points together through the customer journey.”

Brands continue to come and go at Zumiez; because the customers buy the brands, or don’t. Will there be organizational enthusiasm for a new brand and disappointment when the data shows the brand isn’t working out? Sure. But increasingly, decisions on which brands to carry and where they are sold will be data driven. Agnostically determined if you will.

“It starts,” Rick says, “with having the right products and brands that our customers are looking for, made up of a distinct mix of leading and emerging brands that are not broadly distributed.”

The subtlety of how they do that is growing with the quality of their data. Talking about what they call trade areas (that include ecommerce as well as brick and mortar sales), Rick notes, “There are many brands important to our customers that may serve only a handful of our trader areas. Our customers want to express their individuality through many different avenues, which can drive unique assortments even in trader areas only miles away from each other. Over the years, we spent significant time and resources improving our localized merchandise assortments to investments in our people and technology that enhance the customer experience at each touch point.”

So, an agnostic moat with increasingly sophisticated brand selection and distribution. Sounds great. But next time I get the chance I’m going to ask Zumiez management how they reconcile an increasingly data driven organization with a culture that was created to recognize brands and trends.

Rick addresses this when he notes, “…we continue to work hard on the concepts of what trade area means for us, how we define it, what the roles of stores are within a trade area. And the roles of key people even within the trade areas for serving customers. [italics added] We have — we’re now moving beyond the discussion and definitions of how we execute against this at a higher level. We have new measures around how much of product is available every day to meet consumer demand, total consumer demand in a trade area, and our buyers are, as you would guess, with our competitive teams are responding really well to that, and we’re getting better at it.

I wonder if Zumiez will have to change the kinds of employees it values. I hope not. I don’t quite know how it will work, but I sense (and wish I had a better word than that) serious value in data and customer cultural awareness jointly driving the business if the two can be reconciled.

Okay, back to the financial stuff. Zumiez ended the quarter with 710 stores; 607 in the U.S., 51 in Canada, 42 in Europe and 10 in Australia. That’s net growth of just seven stores, three of which were in North America. Seven stores were closed in North America.

As CFO Chris Work puts it, in the U.S. and Canada, “…we’re fairly built out from a store network perspective.” But growth, they believe, can still come from well, sure, ecommerce. But more importantly, it can come from the “trade area” integration of brick and mortar and ecommerce even as store count stabilizes.

Store growth will mostly come from Europe and Australia. Zumiez is emphasizing the anticipated benefits of transplanting their systems and procedures to these markets as well as the opportunity to cross pollinate with brands and trends. Rick commented that “…we have the evidence that’s true that emerging brands can quickly become global buys, go from local to global and of course, be localized in every market around the world for us.” I wonder if we’ll see them do anything in Latin America.

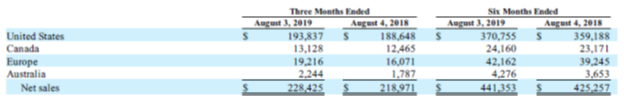

The chart below, from their 10-Q, shows sales growth in their four markets.

In percentage terms, Australia leads the way with 25.6% quarter over quarter revenue growth. Europe comes in at 10.6%. Canada’s growth was 5.3% and the U.S., just 2.75%. It wasn’t all that long ago there would have been great wailing and gnashing of teeth at a big retailer that was growing its revenue and store count this slowly in its dominant market.

Comparative store sales rose $7.9 million (3.6%). The increase in gross margin “…was primarily driven by 40 basis points of leverage in our store occupancy costs and a 20-basis point decrease in distribution and shipping costs.” In that improvement, I see the increasing effectiveness of their data systems and the impact of putting their stores in charge of ecommerce fulfillment. The year over year increase in inventory of just 1% also reflects those factors.

However, they expect that for the whole year, their product margin will decline from 0.1% to 0.2% due to a decline in private label and an increase in hardgoods and footwear revenues, where the margins are lower.

The 1.3% decline in SG&A expense as a percentage of revenue “…was primarily driven by 100 basis points of leverage in our store costs, including 30 basis points of depreciation, and a 20-basis point decrease related to accrual of annual incentive compensation.”

It’s not so much that Tom and Gary envisioned the future. What they did was create a flexible culture that was capable of responding as the future came at it. As determining what to sell where becomes more and more a matter of data, rather than gut feel of people who are paid to be close to the market, it will be interesting to see how the organization steps up to the challenge- a challenge every retailer is going to face.

Leave a Reply

Want to join the discussion?Feel free to contribute!