Zumiez’s Quarter: It’s Not the Numbers, It’s the Strategy

Well sure, we’ll spend some time on the numbers. You can see the impact of the pandemic for both better and worse. More importantly, their data systems, the trade areas, the way they treat brick and mortar and online as one sales channel and their culture are coming together in unprecedented economic and competitive conditions we are all facing, allowing Zumiez to accelerate a strategy that was already in place.

Rahm Emanuel is credited with being the first to say, “Never let a good crisis go to waste.” It’s not just politicians who do that. Bluntly, when times are tough and there’s “no choice” resistance to change declines.

Numbers

We can spend not much time on the balance sheet. More cash than a year ago, slightly improved current ratio (2.35), no long term debt, inventory down a bit from $183 to $161 million. We’ll get back to the inventory. Also remember that government payments, renegotiations with landlords, store closures and other pandemic related changes in cash flow also impact the balance sheet, making the year over year comparison harder than it might usually be. What you always want to be able to take away from the balance is that the company has the financial to continue to pursue its strategy. Zumiez does.

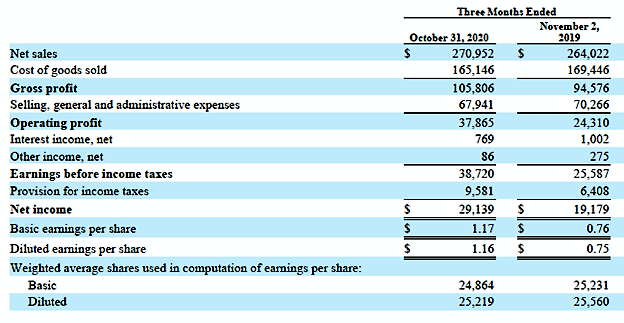

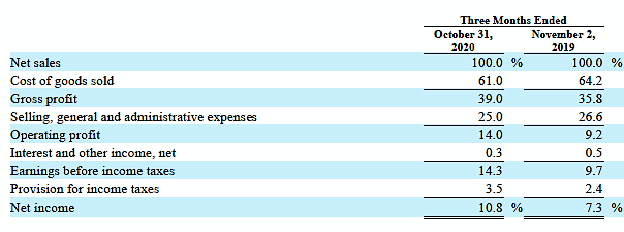

On to the income statement. Numbers in millions of U.S. dollars.

You see in the first chart a sales increase of just 2.65%. In the second, the gross profit margin is seen to have risen from 35.8% in last year’s quarter to 39.0% in this year’s. Regular readers know that’s a trade off I’d take any day. Though maybe not as a public company.

You can see that they reduced SG&A expenses in both dollar and percentage terms. The overall result was a 51.3% increase in earnings before taxes. Now let’s dig a little deeper.

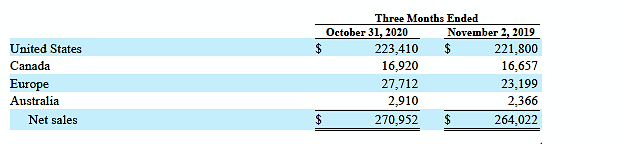

Below is the revenue by geographic area. Up in all cases. During the quarter stores were open 94.7% of total possible days globally.

Comparable brick and mortar sales were up 2.2%. Ecommerce sales rose 39.6%. “The increase in sales was primarily driven by the continued strength of our ecommerce demand, partially offset by continued stores closures and restrictions due to the COVID-19 pandemic.”

“The increase [in gross profit margin] was primarily driven by a 170 basis point increase in product margin, a 150 basis point decrease in inventory shrinkage, and a 30 basis point decrease in store occupancy costs. This was partially offset by a 40 basis point increase in web shipping costs due to increased web activity, however leveraged to the prior year when compared to total shipped sales.”

Zumiez has been working for a couple of years now to reduce inventory shrinkage with, apparently, some success. Of course, shrinkage is minimized when stores are closed as they note in the conference call. I’m thinking the increase in produce margin has to do with product scarcity.

On a side note, you might read this short piece on the shortage of shipping containers. I imagine this is impacting quite a few brands/retailers.

The decline in SG&A expense “…was primarily driven by a 90 basis point decrease in our store wages, 40 basis point leverage in other store costs, a 40 basis point decrease in corporate costs, a 30 basis point decrease due to governmental payroll credits, and a 30 basis point decrease in national training and recognition events costs. This was partially offset by a 40 basis point increase in annual discretionary incentive compensation and a 30 basis point increase in impairment on fixed assets.”

As you can see, it’s not easy to make a comparison to last year’s quarter before the virus. Too many expenses have increased or declined and are (Probably? Maybe?) one time events. In “The Weirdest Economy Ever” (wish I’d made that up) it’s going to be interesting to see how this all nets out. Some of these expenses will come back. Others won’t. Some will be for different things. I want to emphasize again that management teams all over are taking advantage of the chaos to make changes- as they should be.

CEO Rick Brooks notes in the conference call, “…we expect many of these costs will come back into the income statement along with lost revenue as we return to a more normal operating environment likely sometime next year.” He goes on to note, “The combinations of all these factors contributed to earnings per share increasing 54% in the third quarter…”

Fun Strategy Stuff

Like I sometimes do, I’m going to let Rick do the talking. “Our recent performance has been years in the making. We have spoken before about the significance of our culture and brand and how they serve as critical competitive advantages that helped us win throughout our 40-plus year history… Periods of significant change create opportunities. Companies that that have the right people, strategies and resources in place can take advantage of times like this to advance their brand and business. While Zumiez isn’t immune to the disruption created by the pandemic, we do believe the current environment will accelerate further consolidation globally and that our focus on our customer will lead to further wallet and mindshare gains as we emerge from the crisis.”

“We must be smart in how we navigate the business challenges, while also looking for long term strategic investments that will set us up for the future. These include great real estate opportunities, new tools within our one channel strategy and other strategic investments to support the next era of intimacy and now with our customers. The strength in our financial position can be a significant advantage in these times.”

That gets us to Zumiez Delivery. Think of it as a microcosm of other things they and other forward thinking retailers will invent.

Zumiez is delivering purchased product directly to customers’ homes. Not everywhere yet. They tell us the cost is competitive with traditional shipping. They have been in a “test phase” over the last couple of years. Currently, it’s in 24 of their trade areas accounting for 150 stores and “…as much as 5% to 10% of our daily deliveries right now.” They are up to 25% to 30% in some trade areas.

A trade area, says Rick, is “…a group of stores that work together in a geographic region to meet all the needs of the customers in that region.” I’ve never understood what the criteria for establishing a trade area are or how malleable they might be. I need to figure that out.

Anyway, using vans or employee cars along with employees to deliver some product doesn’t sound like that big a deal, does it? It is once you start to put it in the broader context of the trade area and the changes Zumiez has been making for years now.

First, let’s look at the delivery interaction with the customer. Think about that in terms of Zumiez long established culture and employee hiring and training practices. And recall that online orders are fulfilled in the stores.

A customer orders product they will receive via Zumiez Delivery. What, the box will just get dropped off at the customer’s front porch? I don’t know exactly how this is going to evolve, but I expect there to be a lot more to it than that.

Any chance that the person doing the delivery already has a relationship with the customer from store visits or previous online orders? Will they make an appointment for delivery? No reason they shouldn’t carry other sizes and colors as well as additional merchandise with the goal of selling more and reducing returns. As these vans/cars will potentially making more than one stop, they can carry product based on the customer’s previous purchases or even a conversation with the customer before the delivery. Talk about giving the customer an experience.

Meanwhile as these vehicles are part of the trade area and not attached to just one store, why wouldn’t they be involved in moving merchandise around among stores in the trade area, furthering leveraging the cost of Zumiez Delivery.

I imagine there are some opportunities I haven’t thought of, but let’s step back for a minute and consider how this tactic is supported by Zumiez’s broader strategies.

Corporate culture, trade areas, in store fulfillment of online orders, micro-sorting, new and evolving systems with algorithms providing insights into customer behavior and inventory (among other things), seeing brick and mortar and ecommerce as one revenue stream and the introduction of new, small brands are all strategies that enable Zumiez Delivery.

What other tactics do they enable? Management tells us that there are more to come without being specific yet.

Rick tells us a trade area is a group of stores. Okay, but it’s more than that. It’s a mental construct. It’s amorphous. Damn, it’s the Matrix! “Some rules can be bent. Others can be broken.” (Really looking forward to the new movie but I can’t figure out how Trinity comes back to life.)

Rick notes in the conference call that they have a list of centers they’d be interested in opening stores in. That’s a bit different from a few years ago when he said that they were about built out in the U.S. To quote him one more time, “The real estate potential for opportunities, back in the context of the concept of trade areas and thinking about how do we optimize to serve customers in these trade areas.”

What will be “…the evolution of our store portfolio over a period of time…” if delivery vans carry inventory themselves and are interconnected with the online orders and all the stores in a trade area. How big a van would you have to have (maybe including a pop up tent?) to have a mobile store. I wonder if one store in a trade area will be a 3D printing center, or maybe where they screen t-shirts.

Rick says, “And I think eventually we are going to find our teams can really tune this, we are going to know what’s a profitable order for us to deliver and what’s not. And our algorithms will take care of funneling those orders if it’s right into our own delivery capabilities, into our own system for delivery capabilities.”

I wonder how mobile, flexible interconnectedness among ecommerce, brick and mortar and mobile stores (if I can leap ahead and call them that) will impact inventory requirements and management. What will matrix like trade areas will do to Zumiez’s recruiting, training and compensation? I’m not even sure what revenue a store manager would get credit for under these circumstances.

So good financial results impacted both positively and negatively by the pandemic. More importantly, Zumiez’s strategy doesn’t have to change. They already had the pieces in place to accelerate what they were going to do anyway. And they are.

Leave a Reply

Want to join the discussion?Feel free to contribute!