SurfStitch Annual Results- Wow! And Not in a Good Way.

I’ve been encouraged by a couple of readers to pay attention to SurfStitch, which I haven’t typically covered. But now I am. Turns out, it’s way too interesting not to.

SurfStitch (SS for short) is an ecommerce retailer through the three sites SurfStitch.com, Surfdome.com, and Swell.com. It also has three sites it calls media platforms; Magicseaweed.com, Stabmag.com and Garageentertainment.com. If you’re not familiar with them, it might be worth a couple of minutes to look at their sites before you continue reading.

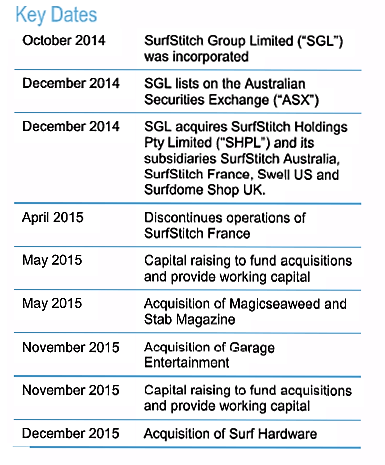

Okay, I guess the place to start is with a chronology of events from their financial review. You can see they were really busy between October, 2014 and December, 2015. And not so much on running their existing business I guess.

SurfStitch was founded in 2007 by Justin Cameron, Lex Pedersen and Haydn Smith. Justin is the former CEO who joined the board of directors on October13, 2014 and left the board on March 9, 2016. Lex Pedersen continues with the company as a board member and Director of Business Development. Haydn Smith, as far as I can tell, is not on the board or in an executive position.

The current CEO, Michael Sonand, joined the board this past July. In the conference call following the earnings release, he indicated he’d been CEO four months. The first thing I did was listen to his presentation. He came across as focused, in touch with reality, and has his priorities right with an initial emphasis on stabilizing the business and its cash flow. That doesn’t make this an easy turnaround.

It’s time for a few numbers (all in Australian dollars). Let’s focus on the reported numbers from the statutory financial statements.

Revenues for the year ended June 30, 2016 were up 143% from $97.9 to $238.8 million. Gross profit was up from $37.3 to $84.1 million, or by 125%. That’s kind of the end of the good news. The gross profit margin fell from 38.1% to 35.3%.

Selling and distribution expenses rose 127% from $44.7 to $101.3 million. Administrative expense was up from $7.4 to $49.2 million. And the cherry on top is $99.3 million of (noncash) impairment charges.

As a result, operating income declined from a loss of $21.3 million to a loss of $156.3 million. The after tax loss from continuing operations was $154.7 million, up from a loss of $17.6 million in the year ended June 30, 2015 (the prior calendar period- pcp). Including discontinued operations, the net loss was $155.4 million, up from a loss of $50.6 million.

Obviously, much of the change was driven by the acquisitions. I could spend a whole bunch of time on pro forma statements and adjustments, but the bottom line sort of speaks for itself and that’s where the company is.

Over on the balance sheet, we see some not unexpected deterioration. The current ratio fell from 2.12 to 1.63. Total liabilities to equity rose from 0.36 to 0.99. Total equity fell from $133.4 to $48.8 million. They ended the year with $21.3 million in cash, down from $39.7 million at the end of last year. There’s also a 14.6% decline in ending inventory to $40.0 million that’s good to see.

What went wrong? Here’s what they list.

- Increasingly challenging trading conditions, particularly in North America;

- A focus on increasing market share through sales at lower margins- resulting in a 644bps [on a proforma basis] year on year decline in gross margin;

- An increase in expenses driven by a fast tracked global branding and eCommerce platform;

- A rapid period of expansion which involved significant management time in effecting the relevant acquisitions…and three major capital raisings;

- As yet unrealized synergies from new acquisitions.

Let’s see. What else should you know? In December 2014 they did an internal restructure “…in preparation for the listing of the Company on the Australian Securities Exchange.”

Then, during the most recent year, the company “…commissioned an independent valuation of the identifiable assets acquired and liabilities assumed in relation to business combinations that occurred shortly prior to the internal restructure…as a result, the goodwill acquired as part of the internal restructure has subsequently decreased.” The result was an incremental loss of $2.225 million.

So income was overstated right before the public offering? Oops. On page 97 of the report, we are told, “A firm of solicitors issued a media release on 11 June 2016 indicating it was engaged in a preliminary investigation of the Group, and invited shareholders to register their interest in participating in a possible class action.” I’m stunned. I’m also guessing that the $99.3 million of impairment charges in the most recent fiscal year associated with the acquisitions made not all that long ago (see the schedule above) hasn’t made shareholders feel any more charitable.

What has a very busy Mike Sonand been doing over the last four months? Here’s how the report describes the situation as of June 30. SS has three ecommerce and three media “platforms” as I’ve listed above.

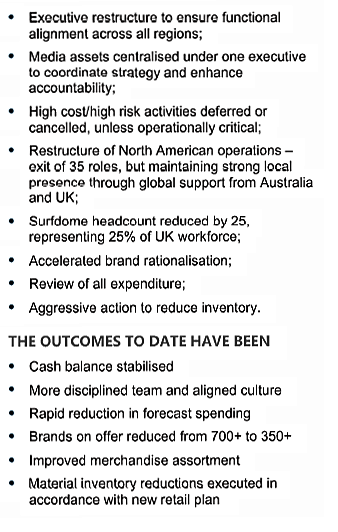

Here’s what the report says SS is doing or has done so far.

The work force reductions are pretty significant. As to the brand reduction, I’m not sure I knew there were 700 brands much less that one company could carry them all. They’ve also decided to divest Surf Hardware (acquired December, 2015) because it doesn’t fit their strategic model. During the year, Surf Hardware generated $22.8 million in revenue and $8.1 million in gross profit.

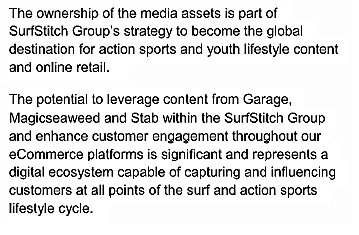

I support the tactics Mike and his team are pursuing. But now I’d like to ask a global strategic kind of question. Let’s take a brief look at their three media properties.

“Magicseaweed is the world’s largest user generated surf content network, providing forecasting and live reporting…”

“Stab is the world’s leading online surf publishing network.”

“Garage Entertainment and Production…produces and digitally distributes premium action and extreme sports long form files and TV content.”

Their plan for integrating these? They tell us:

Perhaps a few regular readers are thinking what I thought when I read that; “Kinda sounds like GoPro.”

Like GoPro, SS has no proprietary technology. Its products can be duplicated and sold by others. Also like GoPro, SS is trying to succeed by building a customer community and differentiating itself utilizing its media websites and properties. GoPro has the advantage of having its own editing software. SS is also introducing SS branded product and expects it will “…eventually represent up to 20% of the Group’s product line.”

SS defines its target market as action sports and people interested in the related lifestyle. GoPro is focused on what I’d call the active outdoors market. As they currently define it, then, I’d say that SS’s potential market is smaller than GoPro’s.

But what I said about GoPro is also true for SS. They might be able to build a defendable market niche based on creating a tight knit community utilizing their media assets to create that community. Maybe. But even if they do, I think it’s a niche that probably doesn’t support public company required growth and they’d be better off as a private business that could focus on the bottom line instead of the top.

It’s always nice to have a new CEO with nothing to hide or defend. You get the straight story. There is a lot more nuts and bolts analysis I could do here, but I don’t think it would be very productive in helping you understand the fundamental situation. Let me conclude with three summary thoughts.

First, the rate at which SS went from a public offering in December of 2014 to its current condition in a year and a half is, at least in my experience, unprecedented. I’ve never seen anything like it. Would somebody who knows the whole story please call me up and tell me how it happened so quickly?

Second, this is an early stage turnaround where they seem to be doing all the right things and are making them happen quickly. They didn’t have much choice.

Finally, I understand their strategy but have the doubts I expressed above about how it can work out. SS would be better off as a private company. It’s hard to be successful if you’re just an online retailer selling the same brands everybody else has.

Oh look, Globe has filed its report. It’s turning into an Australian kind of two weeks what with Billabong being the last company I looked at.

Deja vu all over again. Content & Commerce. Heavy hitters. Big money, Surf’s sexy allure. Toast….

http://www.surfline.com/company/press/cortes_bank.cfm

Hi Silly,

Damn, that article takes me back. It was before Palladini went to VF and Vans. I don’t quite see this as Deja vu. I know what you mean, but the safety net of a strong economy and the ability of a brand to manage itself and how it is perceived is not here the way it was 15 years ago. But that doesn’t completely explain what happened to Surfstitch. Just feels like management had an unjustified sense of optimism. There, didn’t I put that tactfully?

Thanks for the comment,

J.

Hi Jeff,

Thanks for your analysis and thoughts. Slow moving train wreck it isn’t. Maybe as a private company it might work but there are a lot of pissed off investors that will want a lot more than 15 cents plus a couple of likely court cases to navigate before that will ever happen.

Since Justin Cameron ran off they have been trying to calm the market with commentary and rhetoric around “fundamentally it’s a great business”. Sorry but it’s bullshit. There’s nothing great about it. It’s turnover for turnovers sake. The core business, ie Surfstitch, has never made a cent.

What’s sad about it all is the number of independent retailers that have closed or had their businesses compromised from SS unrelenting promotional activity. There’s damage being done and the brands are oblivious or just don’t care. Next stop rrp = gouging, then all stations to commoditisation.

Here’s a pretty good article. Note the commentary around pay increases. I wouldn’t mind making that sort of money without a care, or a $150m loss, in the world!

http://www.abc.net.au/news/2016-08-30/surfstitch-coming-apart-at-the-seams/7799500?pfmredir=sm

Cheers,

Anthony Wilson

Hi Anthony,

Yeah, saw that article. Too many undifferentiated brands, too many retailers online and otherwise. Everybody does what they think they have to do to survive. Meanwhile, it’s hard on everybody waiting for the losers, whoever they turn out to be, go out of business. In the meantime, we lose some we’d rather not lose.

I’ve got to go back and take a look at the original filing for the IPO and see what Surfstitch told investors then.

Thanks,

J.

Jeff great analysis. I will say the same thing I’ve said a zillion times, two things that do not go together:; Australians and adequate accounting. In the US a restatement of financials just prior to an offering would result in the SEC’s pulling folks licenses, huge fines and perhaps some jail time threats. No one would ever risk it.

Hi Chuck,

Yeah, I don’t much believe in Australian accounting either. Billabong’s “equivalent wholesale revenues” and what appears to be SurfStitch’s creative accounting to make it’s public offering numbers look better are great reason’s not to invest in Australian companies in any industry. You already know how I feel about the apparent poetic license they give them to include/exclude the so called significant items.

J.

not sure your comment of trusting Ausy accounting holds any truth in reality. Their listed company regulations and GAAP equivalent accounting system exceed international guidelines. Certainly the in-vogue “pro-forma” “disclosures” of US listed companies – particularly in silicon valley – is far worse, epitomized by Jack Dorsey, saying on the Twitter conference call that he did not have the GAAP numbers in front of him.

Hi Mark,

I don’t think much of the pro forma numbers U.S. companies put out either. I especially hate it when the talking heads on TV provide those numbers rather than the GAAP numbers. Hadn’t heard about the Dorsey thing. That’s stunning. At least one of the analysts asked!

With the Australian numbers, I’ve had a particularly difficult time with their apparent ability to decide at will what a “significant item” is and to remove it. I have the impressions there’s even more poetic license there than in the U.S. I’ve also found the presentations sometimes seem more convoluted than they need to be and, from time to time, see undefined terms I am not familiar with. That may just be a cultural difference, and I recently screwed up due to such a term in the Globe financials. Should have known better.

What it sounds like you’re telling me is that if I was Australian, I wouldn’t be concerned. Or at least less concerned. Probably some truth in that. But I’ve asked a couple of Australian analysts and they’ve agreed that the Australian numbers can be a bit harder to figure out than the U.S.

Thanks for the comment. I always appreciate it when somebody tells me why they think I’m wrong (and you might be right). It’s the only way I can hope to learn anything, so please keep it up.

J.

I was mostly commenting on the blanket statement of not trusting Aus accounting – again it is at least as “good” as US and EU standards. So that is at the baseline of information that needs to be included in reporting to be accurate. Are there differences in allowances/expenses such as you mention with “significant items” of course – but that is not a weakness in standards, just a issue to be reconciled when you are comparing to say a US company like Nike-VF-Columbia. And besides general interest and entertainment, I am trying to see where companies I am interested in perform against others to create/update performance benchmarks that I use. This is not a general defense – I will just mention a few aspects I like about the Aus listed/public company reporting. One- they are required to lead with real or what they call Statutory net number – in the case of SurfStitch – ($154m aud) loss, when they present. This is equivalent to a GAAP net in the US, (for sake of this conversation-I am aware there are differences that would need to be reconciled) So that becomes to headline in financial press – which is fair as that represents the real growth or in this case destruction of capital. Not sure some companies in the US, certainly not my favorite whipping boy’s Twitter/Square would be trading at such high multiples if the headline was their GAAP results quarter after quarter. Two – reporting docs are very detailed in a plain spoken way, albeit very long. Which makes it the source of information, not just a starting point to try to infer what is going on.

Hi Mark,

Point taken. I suppose I can’t reasonably reach my conclusion or even dispute you unless I undertake a systemic study of the differences between the two accounting systems. It sounds a little like you may have done just that, or at least have access to information that describes the differences. You know, if you can point me to a discussion or article that makes that comparison, I’d love to share it with people. I’m still not sure I agree with you but I certainly can’t prove you wrong.

Thanks,

J.