On the Surface, It’s All About the COVID. But Not Really: VF’s Quarter

I’m sure you’ll all be stunned to learn that VF’s financial results for its December quarter were impacted by the pandemic. We’ll take a brief look at the numbers, but I won’t review VF’s virus related adjustments. They are broadly the same as what other companies did.

There are also two strategic events I see as interrelated. On December 28, the purchase of Supreme for $2.1 billion (subject to the usual adjustments) closed.

Back on January 20, 2020 “…VF announced its decision to explore the divestiture of its Occupational Workwear business. The Occupational Workwear business is comprised primarily of the following brands and businesses: Red Kap , VF Solutions , Bulwark , Workrite , Walls , Terra , Kodiak , Work Authority and Horace Small. The business also includes certain Dickies occupational workwear products that have historically been sold through the business-to-business channel.”

Those businesses are still for sale. Hardly a surprise that 2020 was a tough time to find a buyer at a fair value. I also wonder if VF is trying to sell them as a group and finding buyers who’s prefer to choose among them.

Perhaps most interesting are comments made in the conference call. We’ll spend some time on those.

By the Numbers

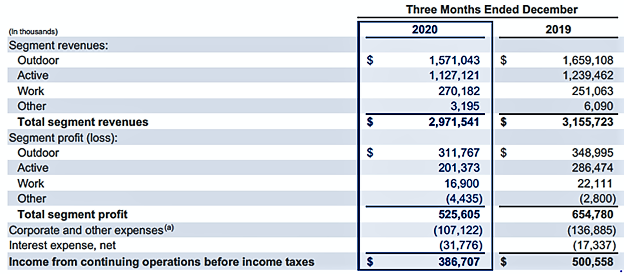

Revenue fell 5.84% from $3.156 in the prior year’s quarter (PYQ) to $2.972 billion in this year’s. Operating income was down 23.7%, falling from $540 to $412 million. Net income declined 25.4% from $465 to $347 million. Below are the revenue and operating profit by segment for the two quarters.

Outdoor and active, the segments which include most of VF and all the brands we care about, both declined in revenue and profit. Work represents small numbers (9.1% of revenue in the most recent quarter) and is losing money. Vans revenue fell 6% from the PYQ. The North Face was flat and Timberland fell 16%.

Direct to consumer revenues fell 2% while ecommerce rose 53%. International revenues were flat including a favorable 4% currency impact. Gross margin was down 2.5% to 54.7% “…primarily driven by elevated promotional activity and the timing of net foreign currency transaction activity.”

During the quarter, VF received $8.3 million from the government through the CARES act. Kind of wish that money went to smaller businesses that can’t get along without it.

The balance sheet showed a 31.3% decline in stockholders’ equity from $4.568 to $3.138 billion. That is largely the result of additional borrowing VF did to improve its liquidity during the pandemic. Cash and short term investments total $3.853 billion, up from $0.540 billion a year ago. Interest expense rose from $22 to $34 million. Let’s hear it for artificially low and capital allocation distorting interest rates! I assume the balance sheet will improve with the sale of the work brands and as noted, that was hard to accomplish in 2020.

It’s not that the balance sheet is weak- it’s just not as strong as it was a year ago. But it’s strong enough to allow VF to continue to pursue its strategic initiatives and buy Supreme, which is why I love strong balance sheets so much.

Strategic Events

This takes us to a convenient time to discuss buying Supreme and selling the work brands. Supreme, they tell us, is expected to add something like half a billion in income and $0.20 in earnings per share in VF’s next full fiscal year. As you can see from the numbers above the work business probably won’t do quite that well.

Work is nine brands plus some of Dickies that are cumulatively losing money. Supreme is one brand already firing on all cylinders. Managing one rock solid brand is way easier than managing nine small, unprofitable, brands. Supreme is also in the part of the market VF wants to be in, and the work brands are mostly not. Supreme can move the needle for VF. The work brands, even collectively, cannot.

VF makes it clear that they will figure out how to support Supreme but won’t mess with it. I expect Supreme may mess with VF a little. We’ll see some VF brands further adopting Supreme’s product introduction through scarcity model. It’s a really good time to do that.

Conference Call Comments

I’ll use some quotes from VF management to make some points. Let’s start with one from Chairman, President, and CEO Steve Rendle.

“Our teams continue to activate capabilities to better understand and build more intimate relationships with our consumers, digitize the go-to-market process and enhance and integrate the online and off-line consumer experience.”

Well, that mouthful in one sentence encapsulates an awful lot of strategic thinking. It should not surprise or perplex anybody who’s going to emerge from the pandemic in solid shape. Consistent with that statement, Steve reminds us that they’d implemented “ship from store” before the holiday season at most Vans and North Face full price stores. They are working on related “…save the sale functionality, which will allow our brands to leverage retail inventory when an item is out of stock online.”

Ship from store and save the sale are critical to the integration of online and brick and mortar. They also are financially attractive as they leverage some existing store costs.

In response to an analyst’s question, Steve confirms the focus on integration when he says, “So I think what’s important for us is, isn’t really the penetration percent, but more about building these seamless connections between the virtual and the physical and building those optimized consumer journeys that allow us to really meet our consumer where they are.”

CFO Scott Roe says it even more clearly. “We’re kind of agnostic between growth in our end stores and the digital.” I’d say there’s no “kind of” about it. That’s the way you have to think.

Management was also asked how they were going about planning inventory, and they gave two answers: conservatively and cooperatively. Says Scott, “…we’re super pleased with the way that our key retailers and partners have worked with us. Again, they’re not canceling orders. Orders are sticky. They may be conservative, but they’re doing what they say.”

I talked to a non VF brand where revenue was up 60% in 2020. Now, they are pretty sure 60% annual growth isn’t the new normal for them. But is that growth new participants, extra product use during the pandemic, customers from their competitors, sales that would otherwise happened in 2021, or what? Meanwhile, costs, especially for shipping are rising, and timelines are sometimes uncertain.

Be cautious about the number of SKUs you have. Perhaps lean towards some product that will still be saleable at full price six months or a year after you first receive it. Maybe you decide you’re okay with missing a few sales, a modest amount of scarcity being a good thing for brand building. Maybe it even lets you raise your prices. And, as VF is doing, you work with your retailers and partners.

It’s harder than ever to make a reasonable estimate of future sales. There is value in maintaining flexibility. That’s not new but perhaps it’s more urgent.

Here’s something that CEO Rendle says that’s related to, and made possible by, flexibility.

“…you will also see…a higher degree of frequency of news stories across all of our brands, but more frequent drops with more compelling stories, not depending so much on that early drop with a reorder sequence behind it. Clearly, that’s important on your core styles, but you’ll see us continue to advance this idea of more frequent deliveries of new innovations, new color stories, collabs, married with the appropriate amount of marketing to drive that demand.”

VF has recognized that it’s business model can be described as a group of co-dependent variables. That was always true, but the speed of the interaction and number of variables that can be usefully measured has jumped dramatically pushed along first by the leaps and bounds in data collection and analysis with increased urgency caused by our friend the virus.

VF is doing fine. Like everybody, they were caught off guard and rocked by the virus. But they have the size and resources, like most of the larger companies, to take advantage of the circumstances.

Leave a Reply

Want to join the discussion?Feel free to contribute!