Intrawest’s Quarter; Business as Usual. Mostly In a Good Way

You may recall that Intrawest got in an avalanche of unmanageable debt when the Great Recession took down the resort real estate market. They solved the problems of an unpayable interest bill by getting their primary debt holder to convert a big chunk of its debt to equity and taking Intrawest public. I wrote about their predicament before they went public.

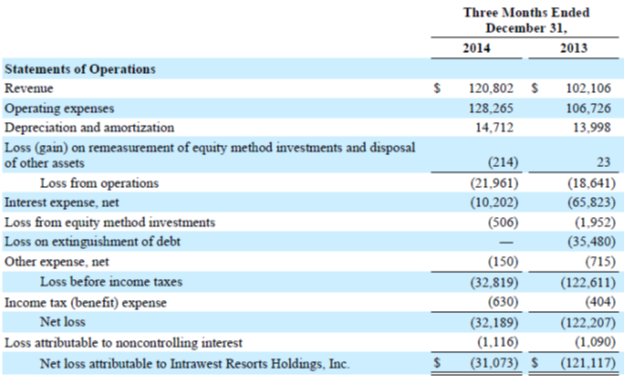

Intrawest, to refresh your memories, owns and operates Steamboat, Winter Park, Mont Tremblant, Stratton Mountain, Snowshoe and Blue Mountain. Let’s start with their income statement for the quarter ended December 31. This is prepared according to generally accepted accounting principles- just the way I like it. You can review the entire 10Q here if you want. Unless otherwise noted, all the numbers in this article are in thousands of U. S. dollars.

If you focus on the improvement in net income compared to last year’s quarter, it looks pretty good. The loss fell from $122 to $32 million. Let’s dig in a bit. The first thing you might notice is the $55 million decline in interest expense, an expected result of the conversion of debt to equity. That is definitely pretty good (unless you’re the people who had to convert debt to equity and didn’t get all that interest) and is a permanent improvement.

Next, just a bit below interest expense, you’ll see “Loss on extinguishment of debt.” It was $35.5 million in last year’s quarter and nothing in this year’s. So the net loss improved by $90 million. And the total of the interest expense reduction and $35 million loss on debt is about the same $90 million.

Moving a bit further up the income statement, we see that operating income got worse during the quarter compared to last year’s quarter, rising 17.8% from a loss of $18.6 million to a loss of $22 million.

Revenue rose 18.3% from $102 to $121 million. But the increase was “…primarily due to inclusion of revenue from owning 100% of Blue Mountain since September 19, 2014.”

Prior to that date, Intrawest owned 50% of Blue Mountain. The way the accounting works, Intrawest reported 50% of Blue Mountain’s net income, but none of its revenue. Now, as of the acquisition, they report 100% of its revenue- not just their share of income.

You’ll also note a 20%, or $21.5 million, increase in operating expenses. $17 million of that increase was from including Blue Mountain operating expenses.

The quarterly improvement is almost completely due to reduced interest expense, which will continue to be a positive each quarter, and the elimination of the one-time loss on debt extinguishment from last year’s quarter just because the size of the numbers involved.

However, those numbers are huge, and shouldn’t be allowed to overwhelm other positive trends. Here’s how CFO Travis Mayer describes it in the conference call.

“Excluding Blue Mountain, lift revenue, which is the largest component of mountain revenue, increased by $1.8 million or 5.6%. Same store revenue from lodging, ski school, retail and rental, and food and beverage increased by $2.6 million or 7.3%. Our mountain revenue growth was primarily due to increased season pass and frequency product sales, increased prices and a 2.2% increase in skier visits. Revenue from season pass and frequency products for the quarter increased by 10.7% and comprised 45.6% of total lift revenue versus 42.7% in the prior year period…”

Effective ticket price (again, excluding Blue Mountain) was also up 4%, though I always wonder how exactly resorts manage season passes in calculating that. I doubt they all do it the same.

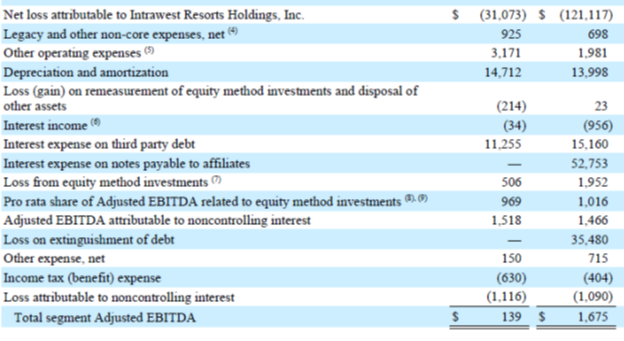

Intrawest also presents us with the ever popular adjusted EBITDA calculation, where they show that before, oh, all kinds of charges, they had a profit of $139,000 compared to a profit of $1.675 million in last year’s quarter. The decline was due to higher helicopter maintenance costs and corporate expenses associated with being a public company.

Not because I expect you to study it in detail, but just so you can see it, here’s how they get from their GAAP result to the adjusted EBITDA. The first column is for the December 31, 2014 quarter and the second for the same quarter last year.

Especially with winter resorts I’ve always been cautious with these EBITDA presentations. And of course, this isn’t just EBITDA. At their discretion, management has removed all kinds of other stuff. I’ve never thought poetic license was appropriate in a financial presentation.

I’ve got a couple of comments. First, they note that they use adjusted EBITDA as “…a key compensation measure…” and in making capital allocation decision. That makes sense. These items are mostly out of the control of operating managers.

But second, if I was an investor, I might be confused by a measure that removed interest expense when the company has just gotten it’s ass in a sling exactly because of too much interest expense. Third and finally, Intrawest states in its 10Q, “…The reportable segment measure of Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income (loss) or other measures of financial performance or liquidity derived in accordance with GAAP. “

It seems that Intrawest management and I are in agreement on that point.

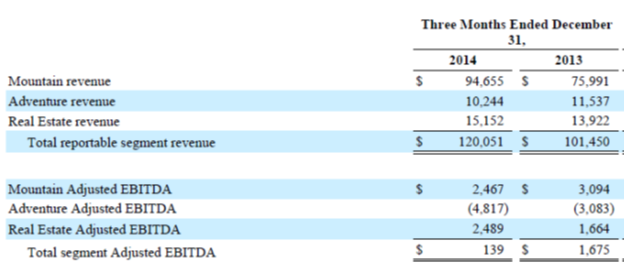

Intrawest describes itself as “…a North American mountain resort and adventure company, delivering distinctive vacation and travel experiences to our customers for over three decades. We own interests in seven four-season mountain resorts with more than 11,000 skiable acres and over 1,140 acres of land available for real estate development.” Here’s how they break down their business and the result by segment (using adjusted EBITDA, I’m afraid).

While I’m thinking about it, I’ll tell you that 62.4% of the quarter’s revenue was from the United States and the rest came from Canada. This is an issue because of the strengthening U.S. dollar. Translation cost Intrawest $3.8 million during the quarter.

Mountain revenue was 79% of total revenue for the quarter. It “…includes the Company’s mountain resorts and lodging operations…” from its six resorts. Adventure revenue (8.5%) is from Canadian Mountain Holidays, “…which provides heli-skiing, mountaineering and hiking at eleven lodges in British Columbia, Canada.” They also lease out their fleet of helicopters for firefighting.

Real estate (the remaining 12.5%) “…is comprised of and derives revenue from Intrawest Resort Club Group (“IRCG”), a vacation club business, Intrawest Hospitality Management, Inc., which principally manages condominium hotel properties in Maui, Hawaii and in Mammoth Lakes, California, and Playground, a residential real estate sales and marketing business, as well as the Company’s 50.0% interest in Mammoth Hospitality Management L.L.C. and 57.1% interest in Chateau M.T. Inc. The Real Estate segment is also comprised of ongoing real estate development activities and includes costs associated with these activities, such as planning activities and land carrying costs.”

Mountain revenue doesn’t get broken down between summer and winter. But it’s interesting (and appropriate) that Intrawest thinks of itself as a four season business. Geographic and seasonal diversification is going to be important to the industry. I also have to believe that when mountain real estate development picks back up again, having more year round activities will help be attractive to potential buyers.

New CEO Tom Marano seems very aware of this, noting in the conference call, “…many guests are not aware of our entire portfolio of assets and seemingly are quite open to exploring our other destinations. This is a huge opportunity for us and plays into our strategy to better cross-market our resorts in part through multi-resort season passes.” He also says, “…I see an industry ripe for further consolidation and I believe that with discipline we can grow by acquiring complementary resorts through transactions that have an attractive IRR or are strategic to our business.” I think he’s got something there.

Intrawest, with its debt problem managed, its geographically diverse resorts, its strategic focus on year around business and its expertise and opportunity in real estate if/when the mountain real estate market recovers, should do fine. Climate change is going to matter, but they seem to be as well positioned as anybody to roll with it. I wish we had some idea just how much revenue and earnings they were getting from non-winter business. Off season cash flow is a wonderful thing that makes financing easier and provides some flexibility when surprises happen.

Leave a Reply

Want to join the discussion?Feel free to contribute!