Defying Gravity: VF’s Quarter and Van’s Results

I’ve been opinionating for some time now that careful control of distribution was a requirement of brand building in a world of products very similar to competitors. I’ve further said that it might be a good idea to give up some sales and build the bottom line at some expense to the top line.

I’m squirming around here trying to discern some platitude that explains Van’s results and gets me off the hook. “The exception that proves the rule” is all I can come up with, though I’ve never entirely known what that meant.

In the quarter ended March 31st, Van’s revenues grew “…39% with strength across all regions, channels and franchises.” The reported increase was 45%, but that included 6% from favorable foreign exchange rates. They continue in the conference call, “Revenue in the Americas increased 44%. Europe increased 36%. And Asia Pacific increased 24%. Our wholesale business increased more than 30% and our direct-to-consumer businesses increased nearly 50%, including more than 75% growth in digital, and over 40% total comp growth supported by our customs platform, which tripled in the quarter.”

The brand’s expected growth for fiscal year 2019 that will go through the end of March 2019 (they’ve changed their fiscal year and the quarter we’re talking about now is the transition quarter) is 12% to 13% with 20% growth in the first half.

I can understand that kind of growth for the year, though I continue to wonder how long they can keep it up without a hiccup. President and CEO Steve Rendle pointed to their product development and launches, specifically noting that 75% of revenue was from other than Old Skool. He also noted that Van’s “Retail inventory levels are in great shape and we remain disciplined with respect to inventory management, merchandising and assortment planning.” I like that, but note he specifically said retail inventory levels rather than just inventory levels.

North Face revenues rose 11% and Timberland 5% during the quarter compared to the numbers in last year’s quarter. The numbers without the foreign exchange impact were 7% and (1%) respectively for the two brands. The Outdoor and Action Sports segment grew 19% overall for the quarter so the influence of Vans is obvious.

CEO Rendle made a comment about VF becoming a “…a purpose-driven company” and noted it was the title of this year’s annual report. “It will help us attract and retain the industry’s best talent, it will provide clarity to our decisions and actions, and it will galvanize our associates around a shared purpose and enable us to serve as a powerful force for good in the world. It’s no longer enough to just focus on what we do. It’s equally important to consider both how and why we do it.”

When you are this big, this diverse, and trying to maintain your flexibility, there is a lot of organizational value in having a consensus among employees as to what the company is trying to do and why. This is an overused word, but it empowers people because when a phone call comes in or a piece of paper comes across their desk, they are more efficient in dealing with it. Just to use one example I’ve personally dealt with, and one VF is certainly interested in, if you have a potential acquisition come across your desk, there might be a lot of effort put into whether or not it’s of interest. But if there’s already clarity about what an attractive acquisition candidate looks like, there won’t be. No paralysis by analysis.

Meanwhile, and in a related vein, VF is changing. As you know, it’s increasingly dominated by its outdoor and action sports segment. But it’s brands are changing as well.

On October 2, 2107 VF purchased Williamson Dickie for $798.4 million. The workwear company contributed $233.1 million in revenue and $10.7 million in net income (net of restructuring charges) during the quarter.

On November 1, 2017, VF bought Icebreaker, an outdoor brand focused on “…high -performance apparel based on natural fibers, including Merino wool…” No income statement was disclosed. Probably too small to require it. They did note a $9.9 million gain on the derivatives used to hedge the purchase price.

As announced on March 10, 2018, VF is in the process of purchasing Altra, “…an athletic and performance-based lifestyle footwear brand…” The purchases price is $135 million.

VF has also, on March 17, 2018, signed an agreement to sell Nautica for $289.1 million. Earlier in 2017, VF sold Jansport and its licensing business.

With brands coming and going, and with the increasing dominance of Vans and the outdoor and action sport segment, being “purpose driven,” as Steve Rendle described it, becomes even more important. Not just because of acquisitions. VF has always been disciplined and focused in its approach to those. CEO Rendle goes on to say, “We’re making changes to reposition and strengthen our business, get us closer to our consumers, encourage greater collaboration, and position us to win…”

Yeah, this is all good, but kind of touchy feely. What might it mean?

Let’s return to Vans for a second. Obviously, Vans has moved way past being a skate/surf brand. That may be its roots, but you don’t do however many billions of dollars in revenue Vans is doing without transcending what, I’m kind of sorry to say, is a niche market. And they expect to keep growing the brand. What products are they going to sell to whom through which new distribution channel? How do they make the brand stand for something to people who don’t know or care much about skate/surf?

I think “purpose driven” though it may sound like a platitude, has something to do with figuring that out.

The other thing I won’t be surprised to see, based on some of the comments as well as the coming and goings of brands and the dominance of outdoor and action sports and especially Vans, is some kind of restructuring of which brands are in what segment and what the segments are called. Here’s what they said on page 18 of the 10-Q

“In light of completed and pending transactions resulting from our active portfolio management strategy, along with recently effected organizational realignments, we are evaluating whether changes need to be made to our internal reporting structure to better support and assess the operations of our business going forward. We expect to finalize our assessment early in Fiscal 2019. If changes are made to our reporting structure, we will assess the resulting effect, if any, on our reporting segments, operating segments and reporting units.”

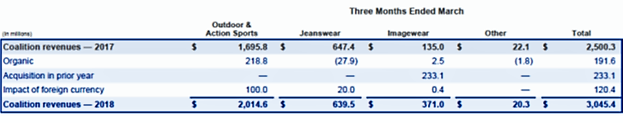

VF’s revenues for the quarter grew 21.8% from $2.5 to $3.05 billion. Of that growth, $233 million came from acquisitions, $120 million from foreign exchange and the remainder from their existing brands (organic growth). You can see this broken down by segment below.

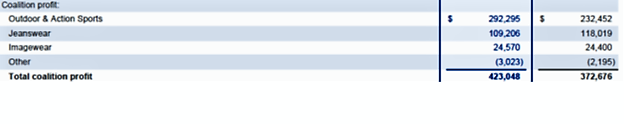

Without outdoor and action sports, there is no organic growth. Below, you see where the operating income came from and how it’s changed since 2017. 2018 in on the left, 2017 is on the right for the quarter ended in March of each year.

Wholesale revenue, excluding acquisitions and foreign exchange, rose only 1%. Looks like direct to consumer is where the growth is.

The gross margin rose from 50.3% to 50.5%. “Gross margin was favorably impacted by increases in pricing, a mix-shift to higher margin businesses in the Outdoor & Action Sports coalition and foreign currency changes, offset by lower margins attributable to the Williamson-Dickie acquisition and certain increases in product costs.”

Wish I could get my hands on some gross margin information by brand.

SG&A expenses rose from 38.5% of revenue to 40.3%. “The increase was due to expenses related to the acquisition and integration of businesses and higher investments in our key growth priorities, which include demand creation, customer fulfillment, direct-to-consumer and product innovation. Higher compensation costs also impacted the three months ended March 2018.”

Net income rose 21% from $209 to $253 million. Even with $10.7 million of income from the Williamson-Dickie acquisition during the quarter, the imagewear segment operating income (which includes Williamson-Dickie) didn’t budge. All the growth in operating income is from outdoor and action sports and I’d love to know, of that total, how much is from Vans.

The balance sheet, largely due to acquisitions, got weaker. Working capital fell from $2 billion to $1.23 billion. The current ratio fell from 2.1 to 1.4 a year ago and debt to total capital was up from 37.2% to 50.4%. Stockholders’ equity declined 15.7% from $4.37 to $3.69 billion. What I’d highlight is the increase in short term borrowings from $289 million to $1.53 billion. They expect to reduce that “in coming months.” Certain of the current asset accounts rose, but the increases were consistent with revenue growth and the Williamson-Dickie acquisition.

Cash used by operating activities was a negative $243 million. In last year’s quarter, it was negative $210 million.

I still worry about VF’s dependence on Vans and what happens when the inevitable soft spot comes along. But this is a company that “gets it.” They understand the pace of change and the need to be flexible in an unprecedented environment. They recognize (not everybody seems to yet) that no distinction can be made, for both financial and marketing reasons, between a sale made online and one sold in a store. They are not (far from it) paralyzed because the future is a bit more blurry than usual. They try new things. Some work, some don’t. They move on.

Not a bad approach.

Well well, when I see Vans in shops that sell Michael Kors hand bags and women’s shoes, I have to ask how relevant and how much longer, as the they just tossed the core market to the wind, and as you know, their customers know the brand, name, but not the story. I,d like to see what your coverge is in a couple of years from now.

Hi Bruce,

No brand grows forever, no matter who they are or how great at management. I think Van’s time is coming and actually suspect it’s already started to arrive. The right thing to do would have been to slow growth by managing distribution to keep the brand strong. But it’s hard to do that as a public company- especially when it’s the Van’s brand that’s driving VF.

Thanks for the comment.

J.