Deckers Turns in an Impressive Quarter (Except for Sanuk)

Deckers, the owner of Sanuk, not to mention UGG and Teva, had a great quarter. Revenue rose 24.2% to $480.3 million from $386.7 million in last year’s quarter. The gross margin was up from 43.2% to 46.6%. The acquisition of their brand distributor in Germany and a decline in the cost of sheep skin had a lot to do with the gross margin increase. SG&A expense was up 36.5% from $120.4 to $164.3 million. Net income was up 23% to $40.7 million from $33.1 million.

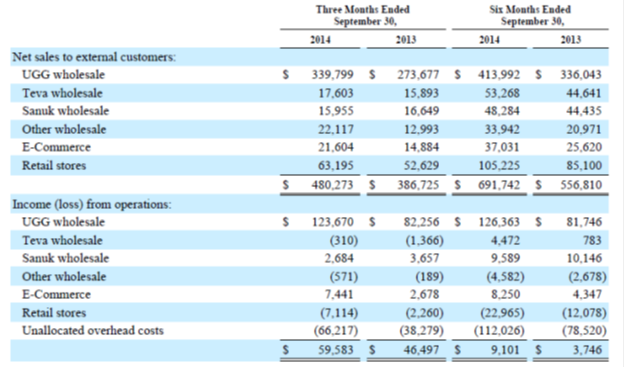

Here, from the 10Q is a breakdown of revenue and operating income.

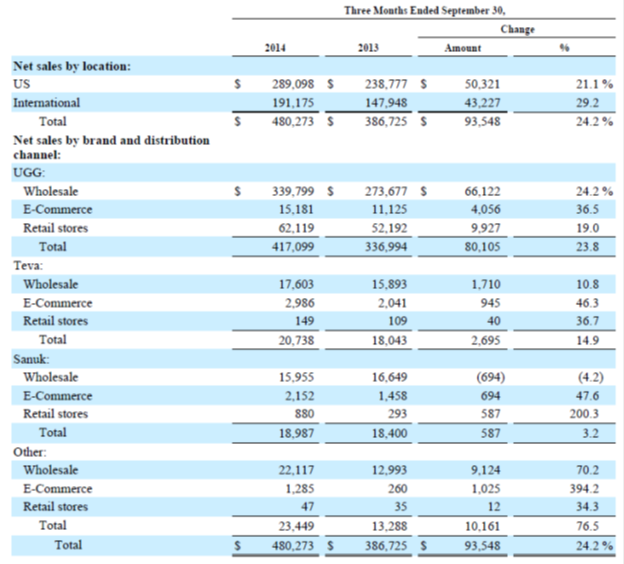

You’ll note right away that Sanuk’s wholesale business fell by 4.2% and that operating income for that wholesale business was down 16.8% from $3.66 to $2.68 million. But in the chart below, you’ll see that Sanuk’s total revenues were up 3.2% due to some growth in e-commerce and retail store sales. I’ve included Decker’s other brands and segments to give you a picture of the whole company, and so you see how dominant the UGG brand is.

You’ve probably noticed way before now- and it’s certainly not unique to Deckers- that international growth is higher than U.S. growth. I expect that to continue for many companies, though the increasing strength of the U.S. dollar may impact it. In case you haven’t noticed, we’re threatening to be in the middle of a currency war, though “a series of competitive devaluations” sounds much more benign.

What do you think your sales in Japan are going to look like when the Yen gets to 200 to the dollar?

Now, let’s focus on Sanuk’s wholesale decline for a minute. Inevitably, the decline in the number of specialty action sports retailers has impacted wholesale revenues of action sports based brands including, I suspect, Sanuk.

And I hypothesize that as you replace that revenue with revenue from larger retail chains, you’ll find your margin impacted. How do you manage that? By focusing on e-commerce and by becoming a retailer yourself. There’s plenty of both going on. Deckers opened one concept and one outlet Sanuk store in 2013.

Here’s what Deckers says about the decline in Sanuk’s wholesale revenues: “Wholesale net sales of our Sanuk brand decreased primarily due to a decrease in the weighted-average wholesale selling price per pair as well as a slight decrease in the volume of pairs sold. The decrease in average selling price was primarily due to a shift in product mix.”

They go on later: “The decrease in income from operations of Sanuk brand wholesale was primarily the result of a 7.1 percentage point decrease in gross margin as well as a decrease in net sales, partially offset by decreased operating expenses of approximately $500. The decrease in gross margin was primarily due to a decrease in margin on closeout sales as well as increased sales discounts.”

We also learn that Sanuk inventory was 39.2% higher than a year ago. Yikes! Remember, Sanuk’s revenues were only up 3.2%. Perhaps they shipped in some extra in case of a port strike, but that’s still a big increase.

Sanuk sold, then, fewer pairs at a lower price in its wholesale business, took a big margin hit due to discounts and closeouts, and appears to have a bit too much inventory; hence discounts and closeouts. That’s not good.

Deckers ended the quarter with 130 retail stores worldwide (45 are outlet stores) and expects to open an unspecified number of additional stores this year. As you may have noticed in the chart, they had an operating loss of $7.1 million on their retail stores, up from a loss of $2.3 million in last year’s quarter.

Deckers is one of the companies that is very actively engaged in figuring out the omnichannel. CEO Angel Martinez puts it this way:

“…the changes taking place in the retail environment are nothing short of dramatic. The consumer is now completely in charge and is dictating what distribution models will work and what models will fail at a rapid pace. The days of visiting the mall to peruse and shop have changed and are evolving. Now it’s all about building strong brands and creating access to product through integrated multi-channel distribution platforms that make it as convenient as possible for consumers to review and purchase the products they want. “

A great quarter for Deckers, but Sanuk still seems to be struggling, and is certainly not measuring up to the price Deckers paid, and is still paying, for the company. Nobody asked about that in the conference call. Probably because Sanuk was only 4% of Decker’s total revenues for the quarter.

Leave a Reply

Want to join the discussion?Feel free to contribute!