Abercrombie & Fitch’s Quarter: Now You See Him, Now You Don’t

When CEO Michael Jeffries is on the conference call on December 3rd, then “retires” on December 8th, you kind of figure out there are issues. The 10-Q can be viewed here. On page 24 you can read some of the details of his retirement, though not the reason for it. The recent financial performance of the company probably has something to do with that.

As always, I’ll get to the financial details. But let’s start at the 10,000 foot level and hear how Abercrombie & Fitch (A&F from now on) describes their market positioning on page 24 of the 10-Q. The quote is a bit long, but I’d like you to read it carefully and see how it feels given what you think about our market.

“The modern Abercrombie & Fitch is the next generation of effortless All-American style. The essence of laidback sophistication with an element of simplicity, A&F sets the standard for great taste. From classic campus experiences to collecting moments while traveling, A&F brings stories of adventure and discovery to life. Confident and engaging, the Abercrombie & Fitch legacy is rooted in a heritage of quality craftsmanship and focused on a future of creative ambition. abercrombie kids is the next generation of All-American cool. The essence of fun and friendship, a&f kids celebrates each moment by sharing its effortless great taste with the world. From documenting school spirit days and team sports to

traveling abroad and experiencing new cultures, a&f kids tells stories filled with youthful excitement and a touch of mischief. Confident and independent, abercrombie kids stands for quality, on-trend style, and creative imagination. Each day brings a new discovery, a chance for adventure, and the opportunity to make history. Hollister is the fantasy of Southern California. Inspired by beautiful beaches, open blue skies, and sunshine, Hollister lives the dream of an endless summer. Spontaneous, with a bit of edge and a sense of humor, it never takes itself too seriously. Hollister’s laidback lifestyle is naturally infused with authentic surf and skate culture, making every design effortlessly cool and totally accessible. Hollister brings Southern California to the world.”

I am not saying that’s not a valid market position and maybe that’s truly what they are aiming for. But it doesn’t feel like the customer group I associate with our target market in action sports, youth culture, outdoor or whatever we’ve become. There certainly ain’t no “authentic surf and skate culture” there.

I hate to say this, but there are a few things in that positioning statement that appeal to me and my generation (boomer). You probably already know how incredibly uncool I am. I only buy new clothes when my wife starts to hem and haw when she sees what I’m wearing. Sometimes, in desperation, she throws out pieces I’ve got and hopes I won’t notice. I think the lapel width on the emergency suit I own is back in style again, but I’m not sure.

Fundamentally, then, this is their strategic problem. For lack of a better word, A&F is preppie. That’s where their roots are. But that’s a shrinking market if only because those customers are aging. Growth, then, requires some new customers. How do you change your positioning to attract those new customers without alienating the old ones?

It’s not a new or unique problem, but it’s a hard thing to do. They seem to recognize this. I think it’s related when they note as a risk factor that,”Our inability to transition to a brand-based organizational model in a timely fashion could have a negative impact on our business.” I’d add that transitioning could have at least a temporary negative impact.

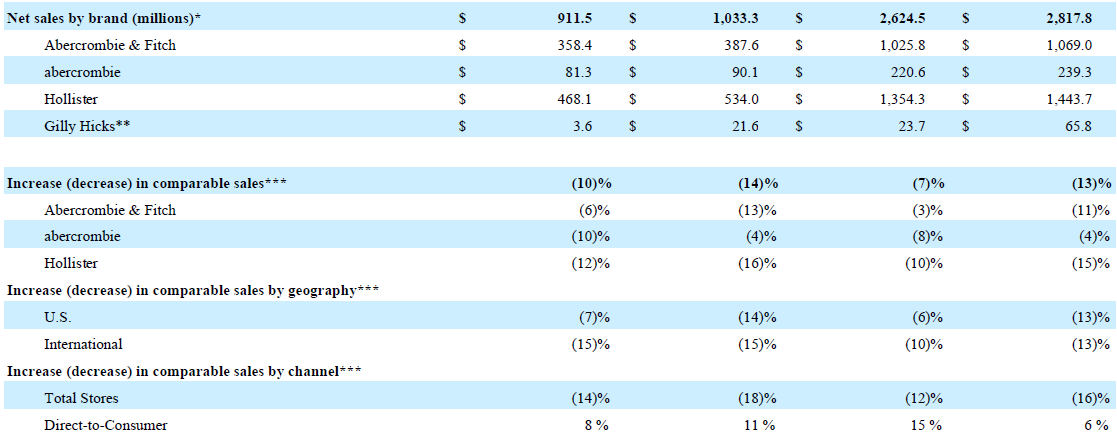

Sales for the quarter ended November 1st fell 11.8% compared to last year’s quarter from $1.033 billion to $911.5 million.

Sales in the United States fell 11.9% to $595 million. Europe was down 18.2% to $223 million. Other rose 9.2%, but only to $94.1 million, representing 10% of the quarter’s total revenue. Direct to consumer rose 7.4% from $174.6 to $187.5 million.

This is probably a good time to remind everybody that the strengthening dollar, a trend I see continuing, is going to cause revenues translated from other currencies to decline. It reduced A&F’s sales for the quarter by $8 million. I hope that’s the worst it causes.

Below I’ve pulled out of A&F’s 10-Q the changes by brand and for comparable sales during both the quarter and the first nine months of the fiscal year. I think the numbers speak for themselves from a revenue perspective. They expect fourth quarter revenues to be down “…by a mid-to-high single-digit percentage.”

The company ended the quarter with 1,000 stores, down from 1,049 a year ago. They expect to close a total of 60 this year, and a similar number in each of the next several years.

The gross profit margin fell from 63.0% to 62.2%. They describe the decline as “…primarily driven by increased promotional activity.” Store and distribution expense fell 13.9% from $481 to $414 million. It fell as a percentage of sales from 46.4% to 45.4% even with the decline in sales. That’s good work.

There’s also a 17.2% decline in marketing, general and administrative expenses from $126.7 to $105 million. It also fell as a percentage of sales from 12.3% to 11.5%. Again, good work. They characterize the decline as the result of decreased compensation expense offset by an increase in marketing expense.

Okay, now we have to get to the part where in last year’s quarter, they had restructuring and asset impairment charges totaling $88.3 million. In this year’s quarter, they “only” reported charges of $16.7 million. That’s a $71.6 million difference. In addition, they had other operating income in last year’s quarter of $9.9 million. In this year’s quarter, it was $1.5 million.

As you can imagine, this resulted in quite a change in operating income. In last year’s quarter it was a loss of $35.4 million. This year, it was a gain of $33.4 million. That is quarter over quarter improvement, but with huge impact from the various charges. If you eliminate all those charges and the other income in both quarters, you find their operating income rose from $43.1 to $48.5 million.

As you know, I don’t take at face value any management’s cry that “It’s a one-time charge” or “It’s noncash!” and the implicit suggestion that I just ignore them. The need to take those charges tell you something about the future of the business and its cash flow. That doesn’t mean you shouldn’t be aware of the difficulties those charges cause in interpreting the financial statements.

Interest expense rose from $1.7 to $5.6 million. Net income for the quarter improved from a loss of $15.6 million to a profit of $18.2 million. However in last year’s quarter they had a tax benefit of $21.4 million compared to a tax expense of $9.6 million this year.

On the balance sheet, the current ratio is mostly unchanged, hovering around 2.2. Long term debt to equity has risen from 0.34 to 0.48. Inventory has fallen consistent with the sales decline (down 20%), but cash is up. However, long term debt has risen from $123.7 to $292 million, explaining the increase in interest expense. Total equity has fallen from $1.68 to $1.4 billion. If you want to argue the balance sheet is a bit weaker than a year ago, I guess you can, but there is no fundamental problem here. In last year’s nine months, cash used in operations was $230 million. This year, it’s been a positive $29 million.

Last thing on the financials; the 10-Q included a review by PricewaterhouseCoopers, their independent public accountant. You don’t normally see that in a 10-Q. I think it’s due to the fact that the company had some accounting issues that, while not significant in their overall scheme of things, requires the restatement of prior year financials. Not a good thing to have happen when the company is having issues as it calls your other numbers into question at the worst possible time.

CEO Jeffries summarizes the changes they are making this way in the conference call.

“These changes include; first, shifting to a branded organization; second, making major changes in our assortments including faster speed-to-market and lower AUC; third, engaging how we — changing how we engage with our customer; fourth, introducing new store designs; fifth, aggressively investing in DTC and omni-channel; sixth, closing domestic stores; and seventh, taking well in excess of $200 million of expense out of our model.”

Shades of PacSun. Closing bunches of stores over a period of years and changing their market positioning. The difference is that PacSun had lost their market position and needed to get one back. A&F has one, but needs to change it. Their balance sheet better positions them to accomplish the task and the reduction in expenses over the last year is good progress.

But damn, it’s a hell of a challenge when the evolution of your target customer is involved.

Leave a Reply

Want to join the discussion?Feel free to contribute!