The Challenge Hasn’t Changed: GoPro’s September 30 Quarter

On the face of it, GoPro had a pretty good quarter and, as usual, we’ll take a look at the numbers. The stock closed at $30.21 on October 28th. They released their earnings after the market closed. The next day, the stock closed at $25.62, down 15.2% on by far the biggest trading volume since July of 2014. What’s everybody worried about?

CEO Nick Woodman notes in the conference call that, “…this quarter marks the first time as a publically traded company that we delivered results below the expectations that we outlined in our guidance.”

That never makes Wall Street happy, but I hate knee jerk reactions to quarterly results. Still, the stock’s been in a downtrend since October 2014. What are people seeing from a longer term, strategic perspective?

Before I get into that, go to this link on the GoPro web site. Watch some of the videos on the products they are working on. Damn, some of this is cool.

In the 10Q, GoPro describes itself this way: “GoPro, Inc. (GoPro or the Company) makes mountable and wearable cameras and accessories, which the Company refers to as capture devices. GoPro also develops and provides free software solutions, the GoPro App (mobile) and GoPro Studio (desktop), that help consumers create, manage, and share GoPro content.”

We knew that.

Next quote from the 10Q: “We sell capture devices and also mountable and wearable accessories that enable professional quality capture at affordable prices, and to date these products have generated substantially all of our revenue.”

I added the italics.

Basically, all their revenue comes from consumer electronic products. Anybody reading this ever seen a consumer electronics product that hasn’t come down in price and become a commodity over time? One of the analysts in the conference call noted that Amazon had reduced GoPro’s Session price to $275 and that Best Buy had a price match guarantee.

In a section of the 10Q on page 21 (see the 10Q here) called “Factors affecting performance,” GoPro lists five items. These include, “Investing in research and development,” “Investing in sales and marketing,” “Leveraging software, services, and entertainment content,” and “Expanding into new vertical markets and growing internationally.”

Those are fine things and I’m for them. Which can they do better than their competitors? How will what they do be competitively distinctive?

You already know my concern around R&D and new products. I’ve raised it before and not just with regards to GoPro. Can GoPro spend enough to keep up with or ahead of the curve on product development in competition with its larger competitors? Well, maybe. Perhaps this time is different.

As far as sales and marketing, I think they can distinguish the brand there, but I’m wondering if they can do it in a broad enough market to continue to grow at a rate acceptable for a public company. Look, GoPro is cool. I’m not sure how that translates into market size, but if they focus on the part of the market where cool’s important, they will do fine. But is that the basis for distinguishing their products in the broader market if they don’t have products and features that are actually differentiable from the competition?

I will say for the 42nd time that being a public company in our industry is hard since brand building seems to require some caution in distribution and, hence, in sales growth. How have I put it? As you expand distribution, they may know your brand, but they don’t know (or care about) your story.

I can see that GoPro’s content and editing software may help overcome this by connecting the users of its products to the brand. Their hope, I think, is that this is a community they can build on. They are working hard to continually improve that software.

We are told that 55% of their receivables were from 5 customers at September 30. That’s up from 42% at December 31, 2014. Two customers accounted for 25% of revenue during the quarter (14% and 11% respectively). In last year’s quarter, there was just one customer that accounted for over 10% of revenue and it accounted for 27% of the total during the quarter.

With regards to “Leveraging software services, and entertainment content,” they go on to say, “We believe we have significant opportunities to establish new revenue streams from these software, services and entertainment investments. However, we do not have significant experience deriving revenue from the distribution of GoPro content, and we cannot be assured that these ongoing investments, which will occur before any material revenue contribution is received, will result in increased revenue or profitability.”

This is what they should be doing, though I wonder who they will find themselves competing with if they move towards being some kind of media company. As I said above, they can continue to tie a group of their users to their software platforms and shared experiences. But again, I’m unclear how big that market can be. The public company conundrum continues to rear its ugly head.

Expanding into vertical markets, I guess, refers to the 2016 release of their quadcopter with other products to follow. They describe some of those opportunities in the conference call. As they put it in the 10Q, “We intend to expand into new vertical markets and to increase our presence globally through the active promotion of our brand, the formation of strategic partnerships, the introduction of new products and the growth of our international sales channel.”

CEO Woodman tells us, in the conference call, “In 2016, we plan to announce several new GoPro entertainment initiatives, new products and services for our customers and new revenue streams for GoPro.” Announcements, of course, don’t generate much revenue by themselves.

I expect that some of their new products and capabilities will come from acquisitions. In the 9 month ended September 30, GoPro made a number of small ones for a total of $70.2 million. They don’t give us any details because the acquisitions “…were not material…”

Hey, here’s an idea. There’s a whole new capture business evolving selling to police, paramedics, security services, etc. Wonder if GoPro has thought about attacking that market. They are probably all over it.

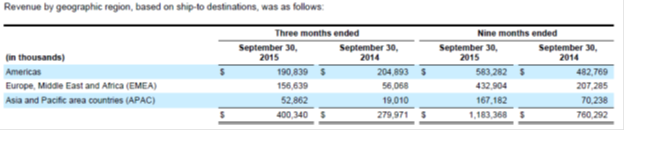

Speaking of growing their international sales channel, below is a breakdown of their sales by regions.

GoPro mostly sells in U.S. dollars, so the currency issue impacts them because of the higher price of their products in local currency, rather than the rate they use to translate foreign sales back into U.S. dollars. That is, it may reduce demand due to higher local currency prices.

They note that, “The year-over-year growth was primarily driven by increased demand for our HERO4 line of capture devices, particularly in the EMEA and APAC regions as a result of the continued expansion of our business and distribution network in international markets. The third quarter year-over-year decrease in the Americas region resulted primarily from the launch of new products in 2014 which were initially shipped to this region. Revenue in the third quarter of 2015 reflects approximately $19 million of price protection and marketing development funds issued in connection with the reduction of the HERO4 Session selling price.”

What I think I hear them saying is that their network is built out in the Americas, but not in the rest of the world, so they are growing faster there. That makes sense, but of course you have to ask what happens once the network is built out worldwide.

Their comment about the decline in the Americas is also intriguing. We learn more in the conference call, where CEO Nick Woodman tells us, “…, initial sale-through of HERO4 Session was weak. In retrospect, we believe we priced the products too high at $399, which caused consumer confusion where they were asked to decide between the HERO4 session and one of our best selling products HERO4 Silver also priced at $399.”

Nick is a little more direct later on his comments. “…revenue was less than anticipated in our guidance, particularly in the direct channel, primarily due to lighter than anticipated Session demand and unfavorable sell-trends in the United States.”

Ultimately, they had to lower the HERO4 price to $299 in September and pay $19 million in “price protection.” That feels a lot like customers continually expecting more for less from their consumer electronics.

The Numbers

Revenues for the quarter rose 42.9% from $280 to $400 million. Jeez, you would think that would be enough to keep people happy. Especially since the gross profit margin rose from 44.3% to 46.6%. “The increase [in gross margin]… was primarily due to a favorable mix shift to the higher margin HERO4 Black and Silver capture devices and continued improvements in supply chain costs.”

R&D rose 59% from $42.4 to $67.4 million. As a percentage of revenue, it was up 2% to 17%. Sales and marketing was constant at 17% of revenue, but rose from $48.1 to $66.4 million. In explaining the performance in the quarter, CEO Woodman tells us that one factor was that, “…we now believe we underfunded marketing in the second and third quarters of this year, which impacted demand.” G&A rose from $20.1 to $25.2 million, falling 1% to 6% as a percent of revenues.

Net income for the quarter was up 28.6% from $14.6 million in last year’s quarter to $18.8 million. That increase happened in spite of a tax increase from a credit of $2.9 million in last year’s quarter compared to a tax expense of $8.5 million in this most recent quarter. As a percent of revenue, net income fell from 5.2% of sales to 4.7%.

The balance sheet is strong and I don’t feel a need to discuss it. Much. I will point to a big increase in inventory that was partly the result of lower sales during the quarter. They acknowledge that in the conference call.

However, they can certainly afford to pursue their strategy. Cash generated by operations was $137 million for nine months, up from $54 million in the same period the prior year.

You know, GoPro reminds me a bit of Burton. They own a big chunk of the market they created, but it has been hard for Burton to break into other markets. Burton, of course, had the advantage that the best anybody else could do was make product as good as they made it (at least in hard goods), but probably not better.

One analyst asked the following pretty direct question: “So we can’t attribute the slowdown just to the session right? It does sound like sell-through has slowed across other product categories relative to product expectations.”

CFO Jack Lazar, in his answer, referenced some unfavorable trends during the quarter, but to my mind didn’t give the kind of longer term strategic answer that I think has the analyst (and me) concerned. I don’t have any criticisms of what GoPro is doing, but I do know that first mover advantage can be ephemeral.

To my mind this is all about their ability to execute a strategy that doesn’t offer them an obvious competitive advantage except in their core market. We’ll see if they can do it.

Read this one on my iPad tonight, long one! love it.

I did notice a video posted from GoPro last week or so, shot with their new prototype drone. It had some image stabilization it seemed, was very smooth, so they could one up the drone offerings on the market-but, if you are hedging your bets on a product with upcoming regulations, might be risky? but, they are way smarter than my dumb ass, so, more power to them.

Hi Stikman,

Yes, that’s the issue. Are they smarter and able to do things better than the other companies doing similar things? Don’t know. My concern is that I’d like a more solid basis for a competitive advantage than “being able to do stuff better than the other guys.”

Thanks,

J.

….and there are a number of tech development companies outside the US that are gaining momentum in markets outside the US. Some of them are Techgiants from other industries (cell phone) with seemingly huge development budgets.

I didn’t notice any mention of competition.

G

Hi Glenn,

I thought my discussion of R&D spending and consumer electronics typically turning into a commodity product covered the competitive issues. Maybe I thought it so obvious that I kind of took it for granted. Sounds like you have some specific information I don’t have about who’s doing what. Want to share? I didn’t discuss it because I don’t have those specifics, but I certainly agree with you that there’s a lot out there. Can GoPro spend enough and be smart enough to make a meaningfully better product at a competitive price than the 800 pound gorillas? History suggests that will be tough. If they can’t, they are a niche company unless they manage to become a media company.

Thanks,

J.

Thanks,

J.

Yes, your R&D / commodity product comment did cross paths with competition but as you say, some of us are denser than others…..so I didn’t really connect the dots.

Running events in China, I’ve been watching and approached by brands that are in some ways copies and others improvements. One in particular to watch might be EZ Viz, owned HIK Vision. Huge surveillance camera company (not phone, I was mistaken). They are cranking in their home market and expanding in the US and Europe.

I might add though that we believe in relationships and are sticking with GoPro rather than jumping ship for the next latest greatest. Call me dumb?

HI Glenn,

No, I like that decision. But I hope you are making it based on the market you are focused on. You should share a commonality with GoPro’s target customers. If/when those target customers start to show up with other brands at least partly because they are half the price and do most of what GoPro products do, you will have to revisit it. I am completely and irrevocably in favor of working with companies you trust and have a long term relationship with. But that commitment can’t be based only on momentum. Not that would ever happen in the action sports arena.

Thanks,

J.