The Beat Goes On- Skullcandy’s Results for the June 30 Quarter

Since right after he joined the company, Skull CEO Hoby Darling has been pushing the same five pillar strategic plan as the company works through its issues and out of turnaround mode. I’ve reviewed those five pillars every quarter since he presented them, and I think I’m done. You can go read one of my earlier articles or the conference call transcript if you need your memory refreshed.

Those five pillars are hardly unique to Skull- some of them are things that need to be done well by any company. But what I like is that they aren’t “things you have to do in a turnaround.” They are five targets, or areas of focus, that provided when he presented them, and continue to provide, a focus and consensus about how Skullcandy expects to succeed.

Financial Results

Revenue rose 7.7% from $53.9 million in last year’s quarter to $58 million for this year’s June 30 quarter. Two customers accounted, respectively, for 13% and 11.2% of total revenues. Best Buy had sales up double digit years over year, and Game Stop grew 30%. CFO Jason Hodell tells us that the quarter’s growth happened even though they lost $4.5 million in Radio Shack sales (following its bankruptcy) and in spite of last year’s quarter being the one in which they initially stocked Walmart.

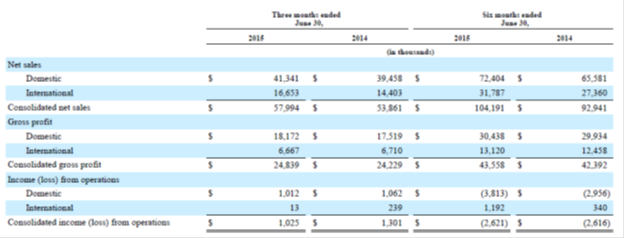

The gross profit margin took a hit, falling from 45% to 42.8%. Below is a table from the 10Q that shows sales, gross profit and operating income for the quarter and six months compared to last year’s periods.

If you crunch a couple of numbers from the quarter, you’ll see that domestic sales rose by 4.77% and international by 15.6% (24% on a constant currency basis). Interestingly, speakers and accessories were only 4% of revenue, compared to 6% a year ago. They tell us the decline is “…due to the launch in load-in of our wireless speaker products in Q2 of 2014.” Skullcandy needs to do well diversifying in that area.

The domestic gross profit margin was down a bit from 44.4% to 40.0%. The international margin got pounded, falling from 46.6% to 40%.

Referring to the decline in gross margin, they tell us, “Total gross margin decreased across both segments primarily due to increased warehousing expense and product mix shift to gaming products which have lower margins partially driven by higher third party licensing and royalty costs, and declines in foreign currencies in our International segment.”

It shouldn’t surprise anybody that U.S. Dollar strength didn’t do the international gross margin any good. Half of the international gross margin decline was due to exchange rates. That’s a common theme across companies these days. But I’d sure like to know more about “…product mix shift to gaming products. The rest of the international gross margin decline was “…generally due to some inventory cleanup in our EMEA region that is inevitable with new businesses still learning distributor and retailer order patterns…”

Now, nowhere do we get, or have we ever gotten, any kind of breakdown of revenues from the three different brands. But I want to go back to their comment I noted in the discussion of gross margin where they talked about “…product mix shift to gaming products…” as a reason gross margin fell.

What does that mean exactly? Is it a good thing? Astro is apparently doing really well in the high end gamer headphone market. If the shift means that Skull is selling more expensive products even at a lower gross margin, I’m fine with that. I love a high gross profit margin, but I’d always rather sell a $100 product with a 40% margin than a $20 dollar product with a 50% margin. And yes, it depends on how many of each you can sell over what period of time.

Or does the shift somehow imply that Astro is doing great but the Skullcandy and 2XL brands not as well? They said “shift” to gaming products. They didn’t say all three are growing. Sorry if I’m trying too hard to read the tea leaves. I just find what they didn’t say as interesting as what they did say.

In the conference call, however, CEO Darling tells us that NPD reported that “…Skullcandy was again the consumers’ number one headphone choice for quarter and year-to-date in terms of units sold.” That certainly seems to imply growth. He also says that “…domestic, non-gaming gross margins were up in Q2 year-over-year.”

It is also interesting to learn that the spread of their gross margin across their products varies by 30% from highest to lowest. Okay, now I really want more information on the three brands.

SG&A expense was up about a million bucks to $23.8 million. As a percentage of revenue, they fell 42.6% to 41.1%. The 10Q states that, “The increase in SG&A expenses is primarily due to increases in demand creation and research and innovation expenses, depreciation, and intellectual property related expenses, partially offset by decreases in bad debt and personnel expenses.”

Well, they seem to spending the money in the right places. They note in another 10Q section, that “The primary components of our marketing and demand creation expenses include in-store advertising, point of sale fixtures, sponsorship of trade shows and events, promotional products and relationships with athletes, DJs, musicians and artists.”

Anybody besides me note that print advertising doesn’t appear to be a major part of demand creation spending? Good for them.

Net income for the quarter was $1.15 million, down from $1.58 million in last year’s quarter. For the first six months of the year, the net loss rose from $1.81 to $2.68 million.

The balance shows a rise in equity from $142.8 million a year ago to $150.9 million at June 30, 2015. There’s no long term debt and wasn’t a year ago. Cash is down from $44 to $19 million but accounts payable and accrued liabilities are also down. Inventories rose 20.4% to $61.2 million. As they explain it, this is related to getting reading for back to school and to the launch of some higher priced products.

Receivables were also up significantly, from $43.8 to $54.6 million, or by 25%. That’s quite a jump given the sales increase and I wish there was more information on it.

The current ratio improved from 3.7 to 4.7 times.

We also learn that the decline in cash and various payables was influenced by Skullcandy deciding to take some discounts for early payment from suppliers. That reduces both cash and some liabilities. I would also point out that it improves the gross margin, as Skull is effectively paying a lower price.

Finally, on the balance sheet, Skullcandy notes: “The Company sells products to customers through consignment arrangements and had approximately $397,000 and $634,000 of inventory consigned to others included in inventories, net at June 30, 2015 and December 31, 2014, respectively.”

We all know consignment is common. This is a pretty small number and I’d be really curious to know how they are using it and with whom.

Strategy

Skullcandy describes itself as “…the original lifestyle and performance audio brand inspired by the creativity and irreverence of youth culture. The Company designs, markets and distributes audio and gaming headphones, earbuds, speakers and other accessories under the Skullcandy, Astro Gaming and 2XL brands.”

Now, here’s how they talk about their Skullcandy and 2XL brands:

“We pioneered the distribution of headphones and audio products in specialty retailers focused on action sports and youth culture with hundreds of independent snow, skate and surf retailers. Through this channel we reach consumer influencers, individuals who help establish and maintain the credibility and authenticity of our brand. Building on this foundation, we have successfully expanded our distribution to leading consumer electronics, sporting goods, mobile phone and big box retailers such as Best Buy, Dick’s Sporting Goods, AT&T Wireless, Target and Wal-Mart.”

When they talk about Astro, they describe the distribution this way:

“Astro Gaming…develops and markets high-performance, feature rich products to dedicated gamers, through both the direct-to-consumer channel and through an expected growing global network of retailers and distributors. “

So it appears that distribution is different as I would expect it to be.

Here’s another quote from Hoby Darling:

“…I feel like we can shift some of our focus from awareness, especially in the U.S., back to emotionally connecting with influencers and core consumers, something we know how to do very well as the foundation of the Skullcandy and Astro brands. We need to make sure we shore up our foundations, ensure brands are strong for the long-term.”

“You will see us spending more time and resources on grassroots marketing that drives emotional connections with our consumer, especially for the Skullcandy brand. To this end, we are going to invest more in grassroots influencer marking in back half of the year and invest several hundred thousand dollars above our initial budget.”

As I’ve said before, I’m wondering if merchandising is becoming more important than distribution. Hoby Darling tells us they’ve got 1,500 of their new display racks in Walmart and he believes “…we can take our brand anywhere when we look good at retail and when we see that lift [improvement in sales following the installation of the new racks].” In a similar vein, he talks about “…upgrading our own digital in-store presences as well with digital partners like Amazon.com.”

Like many brands, then, Skullcandy is prepared to place product wherever their customers want to shop. They believe that if they can reach the right influencers and the core community, however that’s defined, it matters less where the product is sold as long as it’s merchandised well.

So are the days when you have to be cautious about what retail channels you are in because you, as a smaller niche company, can’t compete with much larger, better financed brands over? Does it no longer matter that the larger your distribution is the more likely it is that the target customer may know your brand, but not your story which has been the basis of your competitive advantage?

Skullcandy is a solid brand that could do really well as a private company. As I’ve said before about various companies, I don’t think being public works in their interest due to the growth pressures it creates. Skullcandy has been given some slack by Wall Street because it was a turnaround, but I’m thinking that time is running out.

If I owned Skullcandy stock (I don’t) I’d be asking myself three questions:

- Can they keep up technically and even if they do is there a reason this consumer electronics product won’t become a commodity? They are certainly working hard to keep up or even stay ahead from what I can tell (full disclosure- I do not have an engineering degree).

- To the extent the product becomes a commodity, will the community they are working to create and hold on to remain loyal?

- Is number two possible in the broad distribution they are in? They believe it is (well, what else are they going to say?) based on their marketing and merchandising programs. They may be right.

It would be easier to figure some of this out if their 10Q and conference call included some different information. Quiksilver and VF, just to name two, tell us what’s selling where with much more clarity and I’d like to see that from Skullcandy. Their decision just to provide the breakdown between domestic and international may keep them from disclosing information that, understandably, they don’t want competitors to have, but it makes it hard to figure out what’s going on.

Leave a Reply

Want to join the discussion?Feel free to contribute!