PacSun’s Results for the Year; The Good and the Bad

It’s always the same conversation around PacSun. They are doing a lot of things right, and you see progress in the income statement (though there’s still a net loss). But you worry about the turnaround advancing far enough and fast enough before liquidity becomes an issue.

As usual, we’ll dive into the financials, but I also wanted to point out a couple of interesting things they say that seem to me to be indicative of where the whole retail environment is going.

Retail Evolution

Let’s begin with a comment they make in their 10K for the year ended January 31 (which you can review here). Following a list of some of the brands they carry they say, “We sometimes enter into license agreements with some of these brands as a complement to our more typical wholesale relationship.”

I thought, “Oh- special makeups- nothing new there.” But when I thought about it a bit more, I focused on the word “license” which I take to mean that PacSun has the right to make the product themselves subject to whatever the conditions of the licensing agreement are. They did not say that a year ago in their 10K- I checked- so it’s new.

What exactly is a brand, and for that matter what is a retailer, if the retailer is designing, producing, merchandising and selling the product? We aren’t told exactly how many such relationships PacSun has with brands, how often they do it or exactly how it works. The distinction between retailers and brands just keeps shrinking.

Continuing that train of thought, they further tell us (page 3 of the 10K), “Our proprietary brand merchandise accounted for approximately 49% of total net sales in fiscal 2014, 49% of net sales in fiscal 2013, and 47% of total net sales in fiscal 2012.” They go on in the next paragraph, “To encourage the design and development of new merchandise, we frequently share ideas regarding fashion trends and merchandise sell-through with our vendors. We also suggest merchandise design and fabrication to certain vendors.”

Then, under competition, they list 25 retailers they compete with (including Amazon and J.C. Penney). But they don’t list any brands they compete with, and if half of their revenue (or any other retailers’ for that matter) is coming from proprietary brands, how can PacSun claim to not be competing with the non-owned brands it carries?

I hope that somewhere, some lawyer who drafts and reviews 10Ks has just gone, “Oh shit!” and that we might see that clarification in future filings for one company or another.

Meanwhile, in the conference call, PacSun CEO Gary Schoenfeld tells us, “…the line between outlets and core stores are blurring more and more.” I think most of us knew that.

So PacSun, along with most of the retailers in our space, whatever “our space” means, competes in an extremely broad retail space, but also competes with the non-owned brands it carries, and acts precisely as a brand itself. And there’s less difference between an outlet and a core store!? How the hell did this happen and how exactly do you compete in this diffuse, apparently less differentiated by channel, market? PacSun is trying to do it with its Golden State of Mind brand positioning.

I’ve got some ideas on this issue, but I think that’s for another article. Sorry to leave you hanging. Let’s move on to the financials.

Numbers

PacSun ended the year with 605 stores. As a reminder, they tell us that, “During fiscal 2008, 2009 and 2010 we closed 38 stores, 40 stores, and 49 stores respectively.” The number of closures in fiscal 2011 was 119 and in fiscal 2012, 92. They’ve closed 30 and 18 stores in the last two fiscal years, and expect to close somewhere 10 to 20 in the current year.

In spite of those closing, sales have increased every year since fiscal 2010, though not a lot, and their operating loss has declined each year since fiscal 2011.

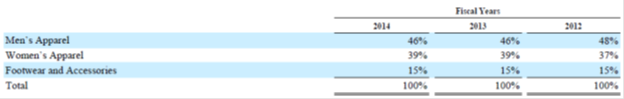

In fiscal 2014, sales increased 3.6% from $798 to $827 million. Below is a sales breakdown by category.

They make the following comment. “While denim historically represented a significant percentage of net sales in our long bottoms business, we have seen a shift in long bottoms trends to other products, such as joggers and casual pants.” That’s not really new, but ever since I noticed that jeans are almost all I wear, I figured the denim trend had to weaken as I’m not exactly fashion forward.

Internet sales were approximately 7% of total sales in each of the last three years. Comparable store sales rose 3% during the year, and include ecommerce revenues.

The gross margin rose from 25% to 27%. 1.7% of the 2% increase was the result of the merchandise margin rising from 49.1% to 50.8% as a result of improved markups and lower promotions and markdowns. I’d point out that PacSun has improved their gross margin 5% over the last three years. That’s quite an improvement.

SG&A as a percent of revenue rose from 27.7% to 28.8%. There was a 0.9% increase for “…consulting costs supporting long-term strategies,” and I would love to know just what that meant.

PacSun reported a net loss of $29.3 million, an improvement over last year’s loss of $48.7 million.

Losses, especially when they continue, inevitably draw us to the balance sheet, because losses can’t continue forever. The first thing we see on PacSun’s is negative equity of $9.4 million. We see a small decline in inventory from $83.1 to $81.7 million even with the sales growth, and that’s good. The current ratio is a barely positive 1.07, down from 1.14 at the end of the previous year.

Long term debt rose again from $86.1 to $94.4 million. Mostly that’s because some of their interest is

“payment in kind,” where it’s just added to a loan balance instead of being paid in cash. In the year that began January 15th, PacSun has required payments of $4 million under its term loan. But in the two years after that, it has to pay down a total of $91 million of that loan. Under current circumstances, I can’t see that coming from operating cash flow. I wonder if that isn’t at least part of what the “consulting costs supporting long-term strategies” is focused on.

At the risk of sounding like a corrupted music file on my phone (broken record dates me), we’re kind of finding ourselves at the same old place. PacSun’s income statement and cash flow isn’t presently improving quickly enough to overcome the balance sheet problems.

To add some clarity to the non-competing brands section, one of the in-house brands Pac Sun is involved in and if my source was correct outright owns, is Modern Amusement. When joggers and urban wear hit the markets last year Modern Amusement was one of Pac’s best sellers. I’ve been told they own outright a few more of the brands they carry but not sure which ones exactly.

If you ask me though, I think it’s really smart of them to own or license brands. Pac’s buyers typically have first looks at all the newest styles by competing brands which they can use to their own advantage when producing their in-house lines. Yes they are essentially competing with outside brands in their stores and undoubtedly taking legal risk, however, on the upside their product design cost is minimal and they have full access to what’s hot and trendy. If you were in their shoes wouldn’t you do the same thing?

Hi Nate,

PacSun is getting half of it’s revenues from its own brands. Those are, I think, mostly brands they created themselves, but I guess there’s no reason they couldn’t buy brands as well. I seem to remember them making a deal with Modern Amusement, but I am not sure they are the owner of the brand. The difficulty might be in buying those brands and then making them exclusive to PacSun after they’ve been sold in other retailers. But, as I think about it, maybe they don’t need to make them exclusive to PacSun. Boy, the retail market is getting messier and messier.

Thanks for the comment,

J.