“More of the Same” is Not the Way to Prosper When Change in Retail is Rampant: Big 5 Sporting Goods.

I don’t cover Big 5 every quarter. However, their 10K for the year ended December 30, 2018 requires some discussion. They seem to be flailing in the emerging retail environment and seem reluctant to respond to all the changes. They are betting that their old strategy will continue to work.

It appears I’m not the only one who thinks that’s not the right approach. Go take a look at a chart of their stock (symbol BGFV) since the start of 2017. Let’s take a look at the numbers before discussing the strategy.

In the year ended last December 30, sales fell 2.2% from $1.009 to $0.988 billion. Same store sales fell 2.7%. They ended the year with 436 stores, not much changed since 2014 ended with 439.

Cost of sales stayed the same so, obviously, gross margin fell; from 32.0% to 30.5%. Merchandise margins were only 0.12% lower. Most of the decline came from the same expense level being spread over lower sales.

SG&A expense, though it fell in total from $307 to $302 million, rose as a percentage of sales from 30.4% to 30.6%. Advertising expense fell from $37.9 to $32.8 million. Interest expense increased from $1.64 to $3.37 million. Pretax income declined from a profit of $14.7 million to a loss of $4.6 million.

On the balance sheet, we see cash at $6.7 million down from last year’s $7.2 million. Inventory declined from $314 to $295 million, or 5.75%. Good to see with the sales decline. In 2017 they had bought some additional inventory in anticipation of higher demand due to some competitors closing. Wouldn’t be surprised if they mean Sports Authority. That was a 2016 event. I guess they expected all the excess inventory to have disappeared by 2017.

They reduced their accounts payable by $33 million down to $80.6 million. Long term debt rose by $20 million to $65 million. The decline in total liabilities from $258 to $245 million is basically the decline in payables less the increase in long term debt. Equity fell 6.5% to $174.9 million.

Big 5 spent $10.7 million in 2018 paying dividends of $0.50 per share. They acknowledge part of the reason they increased debt was to pay the dividend. That’s $0.15 per share during the first three quarters, reduced to $0.05 in the last quarter of 2018 and the first quarter of 2019. They also spent $400,000 buying back shares in 2018 after spending $7.7 million on repurchases in 2017. Doesn’t seem to have helped the stock much.

Against this financial background that is at least of concern, let’s move to the issue of strategy.

The thing that hits you is the extent to which they don’t seem to be dealing with the internet driven consumer revolution in retail. Their discussion of “digital” seems like an afterthought and we are told their ecommerce sales are “insignificant.” Their ecommerce web site was launched in 2014. Take a look at it and see what you think.

They note, “We have advertised predominantly through weekly print advertisements since 1955.” Then they continue.

“We typically utilize four-page color advertisements to highlight promotions across our merchandise categories. We believe our print advertising… consistently reaches more households in our established markets than that of our full-line sporting goods competitors. For non-subscribers of newspapers, we provide our print advertisements through carrier delivery and direct mail. The consistency and reach of our print advertising programs drive sales and create high customer awareness of the name “Big 5 Sporting Goods.””

They include a risk factor that says, “Increased costs or declines in the effectiveness of print advertising, or a reduction in publishers of print advertising, could cause our operating results to suffer.”

“Our business relies heavily on print advertising…Newspaper circulation and readership has been declining, which could limit the number of people who receive or read our advertisements. Additionally, declining newspaper demand is adversely impacting newspaper publishers and could jeopardize their ability to operate, which could restrict our ability to advertise in the manner we have in the past.”

Well, what do you think? Any chance print advertising will decline and become less effective?

In that risk factor they go on to say, “In an effort to continue to deliver our message to consumers, we have been shifting some of our advertising from print to digital.” Basically, they are acknowledging their dependence on an advertising strategy which they know is not going to work as well.

Here’s how they describe their business on page four of the 10K. You can read it here, and it might be worth a few minutes to review pages 4-8 where they describe their business and how they compete.

Big 5 provides “…full-line product offering in a traditional sporting goods store format that averages approximately 11,000 square feet. Our product mix includes athletic shoes, apparel and accessories, as well as a broad selection of outdoor and athletic equipment for team sports, fitness, camping, hunting, fishing, tennis, golf, winter and summer recreation and roller sports.”

That’s pretty broad. They note in the financial statements that they have “…over 700 suppliers…” but that the largest 20 “…accounted for 41.7% of total purchases…” I hypothesize that there might be some opportunity to rationalize their supply chain.

The 10K goes on; “We believe that over our 64-year history we have developed a reputation with the competitive and recreational sporting goods customer as a convenient neighborhood sporting goods retailer that consistently delivers value on quality merchandise…We reinforce our value reputation through weekly print advertising in major and local newspapers, direct mailers and digital marketing programs designed to generate customer traffic, drive net sales and build brand awareness. We also maintain social media sites to enhance distribution capabilities for our promotional offers and to enable communication with our customers.”

There’s that thing about print advertising again and note that they use it to “reinforce our value reputation.” If you want to compete by having a value reputation across a very broad product line but the brands you carry are the same as everybody else has aren’t you competing very directly with online low-price leaders? In discussing their merchandising, they say they are offering “…a distinctive merchandise mix…” They don’t explain what they mean and I can’t tell you.

They mention their online efforts, but as part of a traditional advertising approach- not as a flexible customer centric, experience offering integration between online and brick and mortar.

And then, “Our accumulated management experience and expertise in sporting goods merchandising, advertising, operations, store development and overall cost management have enabled us to historically generate profitable results. We believe our historical success can be attributed to a value-based and execution-driven operating philosophy, a controlled growth strategy and a proven business model.”

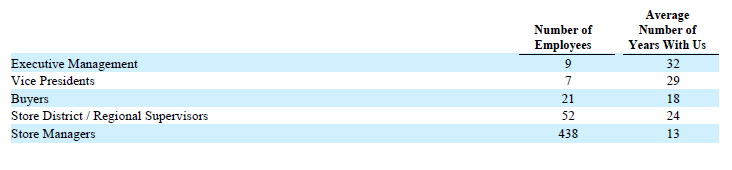

Accumulated experience and expertise are a good thing. If you look at the table below, you’ll see they have lot of it.

That kind of experience, and the relationships and organizational knowledge it brings with it is invaluable, BUT…..

Some of you may recall that I suggested some retailers should hire 16-year olds for theirs comfort with and knowledge of how their peers were interacting with retailers in the internet age. I suppose it would be awkward to put 16-year olds on a board of directors. Averages an be deceiving, but I’d be interested in how their team is evolving to get more omnichannel focused input.

They have a risk factor that says, “If we lose key management or are unable to attract and retain the talent required for our business, our operating results could suffer.”

Maybe, but not to worry. Another risk factor states, “Our anti-takeover provisions could prevent or delay a change in control of our Company, even if such change of control would be beneficial to our stockholders.”

In discussing their real estate strategy they state, “Our 11,000 average square foot store format differentiates us from superstores that typically average over 35,000 square feet, require larger target markets, are more expensive to operate and require higher net sales per store for profitability.”

Well, yes it differentiates them, but obviously bigger stores always and everywhere have higher operating costs, need higher net sales to be profitable and need larger target markets. Aren’t those just truisms? How are they an advantage to Big 5?

Big 5 acknowledges that they’ve basically had the same business model for 64 years, though of course they’ve refined it. As they describe it, “We have not made wholesale changes to our model, but rather have adjusted the model in an effort to broaden both our product offering and customer base.”

The retailers that are surviving and succeeding are having to do more than adjust their business models. They have made and are making ongoing, uncomfortable changes and trying new things that don’t always work.

Pretty clearly Big 5 management has deep and broad experience in sporting goods retail. But they seem to have some catching up to do in how they conceptualize the competitive environment.

Leave a Reply

Want to join the discussion?Feel free to contribute!