Kathmandu Buys Rip Curl: Analysis and Questions

I admit it. Before this deal, I’d never head of Kathmandu, a public company headquartered in New Zealand. If you haven’t either, you can visit their consumer facing web site or their investors web site where you can pour over all the deal related documents I’ve looked at. Mostly, though, I think you’re happy to leave that chore to me.

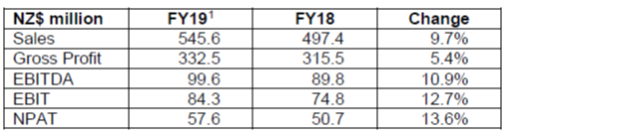

Kathmandu “…is a designer, marketer, retailer and wholesaler of clothing, footwear and equipment for travel and adventure. It operates in New Zealand, Australia, United Kingdom and United States of America,” as described in their public filing for the fiscal year ended July 31, 2019. Below are some summary numbers for its last two full years.

Translated from New Zealand dollars, the FY19 revenues were about U.S. $344.7 million at the current exchange rate.

Kathmandu bought the Montana based footwear company Oboz in April 2018. Here’s their web site. In the public filing, Kathmandu CEO Xavier Simonet noted that, “The key drivers of this [year over year] growth were a positive contribution from the Australian business, and rapid sales and profit growth from Oboz.”

During the most recently completed fiscal year, “…the Oboz business continued to grow strongly, with FY19 pro forma sales growth of 30.0% to US$44.6 million, and pro forma EBIT growth of 38.6% to US$7.9 million.” Now, $44 million U.S. is 70.5 million New Zealand dollars at the current exchange rate. So, looks like, without the Oboz revenue, Kathmandu’s total revenue would not have grown 9.7%. Might even have fallen, depending on what they mean by “proforma.” The same is true of EBIT.

Okay, we see that Kathmandu’s year over year revenue growth was dependent on the Oboz acquisition. I think that’s useful perspective as we finally get around to considering its acquisition of Rip Curl. One caveat- I’m working without a complete Rip Curl financial statement. Remarkably, even though Rip Curl is around the size of Kathmandu, there are only limited, summary Rip Curl financials. It’s difficult to evaluate the combination financially with only the data provided. Perhaps shareholders received more. I hope so.

Kathmandu is acquiring the equity of Rip Curl for $350 million Australian dollars (US$238 million). One Australian dollar, just so you know, will cost you 1.07 New Zealand dollars. The deal will be financed through raising equity of NZ$145 million, the founders and CEO of Rip Curl accepting NZ$32 million of Kathmandu shares (As part of the negotiation, they’ve agreed not to sell them for a year) and new senior secured debt of NZ$231 million. The deal is expected to close by the end of 2019. Kathmandu management expects the deal to deliver “…pro forma EPS accretion in excess of 10% (pre-synergies)” and before transaction costs in fiscal year 2020.

The Rip Curler founders are signing five-year noncompete agreements. Rip Curl, we learn, has 22 shareholders, “…3 of whom are associated with the founders and own approximately 85% of its issued shares…”

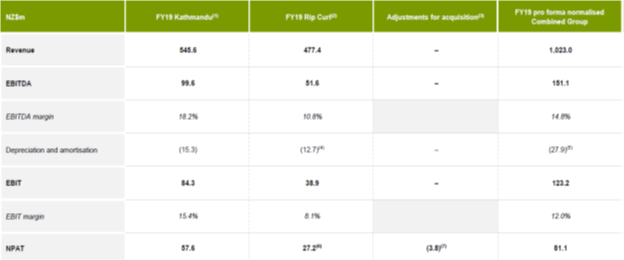

Seems to me that the first reason this deal is happening is because both Kathmandu and Rip Curl need to be bigger. Fortune seems to favor the large these days. Below is the proforma, summary, consolidating income statements for the deal. This is among the places where I’d like to have seen more detail.

At the bottom of this chart are some itsy bitsy, teeny weeny foot notes. The FY19 Kathmandu numbers are the as reported numbers. The FY19 Rip Curl numbers, well, aren’t. The footnotes tell us the numbers represent “…pro forma normalized financials of Rip Curl for the financial year ending 30 June 2019. Pro forma normalized financials reflect Rip Curl’s statutory revenue and EBITDA as disclosed in its audited financial statements adjusted for the impact of certain structural changes in the business and one-off items.”

Long term readers may remember my twice a year rants when Billabong filed their financials and elected to exclude so-called one-off items from the adjusted financials they offered. The list was sometimes lengthy and included items I could not, for the life of me, figure out why they weren’t ordinary course of business expenses. But at least Billabong listed what they were. Kathmandu doesn’t give us a clue. As for “certain structural changes,” I have not the slightest idea what that is. More importantly, I have no idea how much money we’re talking about.

If this chart was to have maximum utility, the third column would be Rip Curl’s as reported results and the fourth column (copiously footnoted) should have all the adjustments. And a lot more line items, breaking down the summary numbers further, would be nice.

The consolidated, proforma revenue of NZ$ 1.023 billion translates into US$ 648.5 million.

But why focus on a bunch of boring old numbers when we can share the almost mystical vision with Kathmandu CEO Xavier Simonet. “…our strategic view is that Kathmandu is on a transformational journey from a leading Australasian retailer to a global brand led omni channel business.”

Okay, so I just had a little fun with Mr. Simonet, but I can see what he’s talking about. I’m still annoyed by the lack of solid, detailed, interpretable numbers but let’s move on to the strategy.

Rip Curl, we’re told, is summer/beach focused. Kathmandu’s focus is winter/outdoor. The finance guy in me, who’s had the experience of trying to manage cash flow and balance sheets in the one season snowboard business, gets a warm, fuzzy feeling when I think of having year around cash flow.

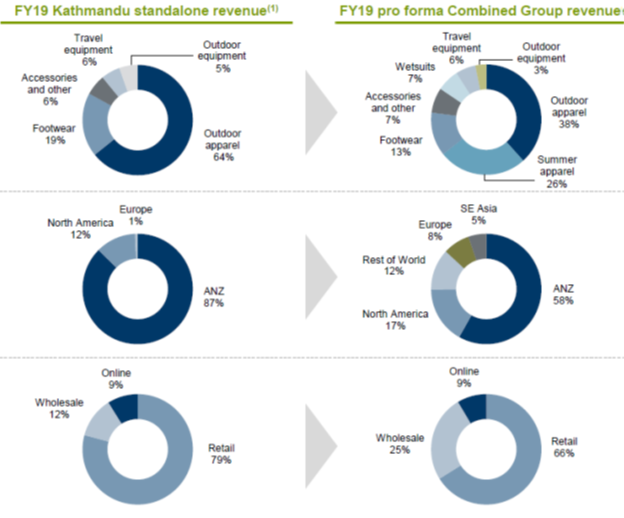

How exactly would that work? Below is a chart showing, from top to bottom on the left, Kathmandu’s revenue sources, the areas where it sells (ANZ is Australia/New Zealand) and distribution and then, on the right same information after the deal closes. Notice, on the left, Kathmandu’s concentration in ANZ and consider it was even higher before last year’s acquisition of Oboz.

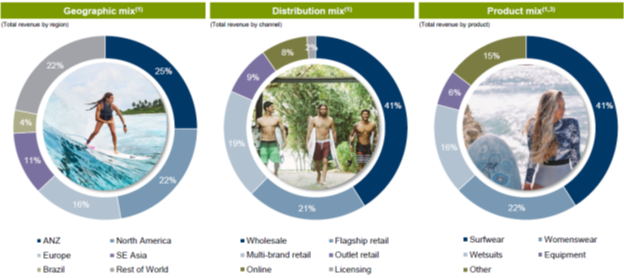

Here’s the same information for Rip Curl. Wish they’d put it in the same format.

Katmandu is maybe over concentrated geographically for growth (how big is the ANZ market in total after all?) and perhaps Rip Curl’s revenue is a bit too diversified given it’s size. That seems like an opportunity for both. Now look at their product categories- some areas of overlaps but no exact matches.

We see that Kathmandu is 79% retail excluding online (again, more before Oboz). Rip Curl is 49% retail excluding online and outlets.

Notice that Rip Curl is 8% online revenues and Kathmandu, 9% (about AUD$50 million). CEO Simonet makes the comment in the conference call on the deal that “…online is very new to Rip Curl…” but the two businesses look comparable in online volume.

Obviously, there are opportunities to share distribution in terms of both channels and geography, as well as product category. There is also the expectation that they can leverage each other’s technical expertise. A “Shared focus on technical and functional products” as the presentation puts it.

To sum it all up, the strategic rationale for the deal, right from one of the charts is:

- Global outdoor and action sports company

- Highly complementary product categories

- Geographic diversification

- Complementary expertise

- Brand affinity and cultural alignment

I think they’re on to something. But, as is true in any deal, there are some things that could go wrong. To be fair, Kathmandu has two pages listing what these might be. I don’t think they mention them all. Well, in fact, they note that they don’t, acknowledging that “…this Section [on risks] does not (and does not purport to) set out the key risks related to an investment in shares in Kathmandu or in relation to Kathmandu, its business or general market or industry risks.”

They do note that Kathmandu is taking on an additional NZ$240 million in debt to finance the deal. I’m wondering just how much they are going to have to invest operationally to accomplish what seems like a complex integration among 24 product categories, worldwide operations, and distribution channels that are both competing and complementary. Where do the brands compete with each other? How will they rationalize their inventory management and supply chain? What’s involved in integrating information systems so they can utilize the combined customer information they have? I could ask a dozen additional questions.

It’s always easy to buy a company. It’s the integration that’s hard. Even if I created a long list of challenges to the integration of Rip Curl and Kathmandu, that doesn’t mean the deal is a bad idea. It means I’d like to know more than they tell us about how they’ll do it.

I don’t get any comfort in that area from the conference call on the deal. One of the analysts asks, “Okay, so there is some complementary opportunities where you do manufacture in the same place with similar providers? Or not?”

CFO Reuben Casey gives the following answer:

“Yes, there are some Tim but we haven’t had the time really to quantify what those opportunities are. I mean this deal was not a deal that hinges on the synergies opportunities, not a synergy play. As Xavier said, there’s more value to be derived through leveraging each other’s expertise, versus combined sourcing opportunities for example. I mean there’s a small amount of product crossover, but not huge.”

I know when he tells us there’s just a little product crossover, he’s talking about in manufacturing, but we’ve been told in the slides for the presentation that there are “Highly complementary product categories.” Highly complementary how, I might have asked next.

I’ll come back to the synergy issue. Right now, I want to remind you that Kathmandu, and soon Kathmandu and Rip Curl, is a public company. I’ve noticed, I think, that the pressure for quarterly growth in revenue and profits is not quite as great in ANZ as in the U.S., but it certainly exists.

So I was interested when CEO Simonet said, as part a comment on Rip Curl’s position in the surf market, “Quiksilver and Billabong being much bigger, but they have had a very strong top line focus to the detriment of the bottom.”

They had a top line focus because they were public and had to. The public markets demand it. Once they became private, I’m heard and seen in various places, they cut low margin business in distribution they thought destructive to brand building and seem to have become very much bottom line focused.

I hope Mr. Simonet is saying they will be bottom line focused but I’m wondering, as a public company, if they will be allowed by stakeholders to do that.

That kind of brings us back to the synergy thing. Mr. Simonet noted in the conference call three core principals for operating the business post acquisition. “Kathmandu and Rip Curl and Oboz will retain their strong brand identities and cultural values, that’s the first principle. The second principle is that Rip Curl, Kathmandu and Oboz will retain operational ownership of their respective businesses. The last principle is that we will leverage the respective strength of our brands and build on each other’s competitive advantages over time.”

There certainly seem to be some implied synergies in those principals. Yet they make it very clear that they haven’t quantified the opportunities.

Here, in part, is how Mr. Simonet responded to a question on possible synergies:

“…we see lots of complementarityness between our businesses, particularly the acquisition of Rip Curl [which]will help us diversify the profile of Kathmandu, in terms of geography, channel, product and seasonality. Geography because they’re much more global than us and they’re going to give us the opportunity to expand more rapidly in new countries. In terms of channel, well we are retail specialists, historically they’re more focused on wholesale and we certainly can learn from each other. In terms of seasonality, we are more winter, outdoor focused business, while Rip Curl is more the beach and summer biased company. And last in products, well our products complement each other and for sure we can certainly help each other, in terms of synergies like sourcing. So complementary at the same time as similar.”

Earlier, CFO Casey had played down sourcing synergies.

I’ll also be interested to watch and see how management retaining “…operational ownership of their respective businesses” works out. Taking out Oboz, the two brands are very close to the same size. The Rip Curl owners will be significant shareholders in Kathmandu post costing. Wonder if they will get board seats.

Yet, there will be opportunities to combine administrative and certain sourcing functions. Certainly, as I mentioned, they will want to consolidate data processing and mining and will be looking hard at how they can sell across distribution.

You can argue that Quik had issues before the acquisition that we do not name. Certainly, they paid too much for it. From the inadequate numbers I can see, I don’t think Kathmandu is overpaying for Rip Curl. But Quik also got into trouble when the costs of integration went through the roof and the synergies did not emerge.

Operational independence doesn’t always go hand in hand with expected, and perhaps market required, synergies. I can imagine this deal working out, but I’d be a lot more comfortable if I had more details on just how the integration was going to be carried out and had some idea what it might cost.

I guess we’ll get to find out around next March.

Interested to see how this deal will play out. Will it be a brand killer or brand builder? I for one, am very loyal to the Rip Curl brand, as it always embodied a more core ethos within the surf segment and had a real estate stake in some of the finest surf spots in the world, like Trestles and Torquay. Unlike Quikabong, they were privately held, made great products and were true to the sport, while nurturing some of the best surfing athletes the planet has ever known.

For those not familiar, Kathmandu is the AU/NZ version of REI. Here’s hopes it goes well in the future. Thanks for the deeper dive, Jeff.

Hi Mark,

As I said in the article, I’m a bit concerned that the integration will be more difficult, time consuming, and expensive than expected. I also wonder if Rip Curl will be able to maintain the things you correctly point out as strengths as part of a public company. It will be fun to watch.

Thanks for the comment,

J.