GoPro’s Quarter. What Kind of Company is This Anyway?

Isn’t it interesting that I’m writing about GoPro at all? In 1995 I wrote my first column for Transworld Snowboarding Business and now, somehow, I’m writing about a consumer electronics company.

Relax GoPro people. I know you aren’t really a consumer electronics company. Or at least, you don’t want to be even though right now almost all your revenues come from your cameras. I’d go so far as to say that if you end up as a consumer electronics company, your competitive position will be uncertain bordering on unsustainable no matter how much you spend on R&D.

You aren’t for people who want to take snapshots either. That’s what we’ve got cell phones for. But if you can be the chosen way for the active outdoor market to create, edit, produce, and share content and if you can tie that community to you through not just your camera technology but your proprietary software, then you will be meeting a social need and requirement of the millennials, now a larger generation than the baby boomers.

Equally important, you will be serving this community- giving them what they require- not telling them what to buy. As I’ve written, that’s a requirement for success these days.

Here’s how GoPro described what they do.

“GoPro is transforming the way consumers capture, manage, share and enjoy meaningful life experiences. We do this by enabling people to capture compelling, immersive photo and video content of themselves participating in their favorite activities. The volume and quality of their shared GoPro content, coupled with their enthusiasm for our brand, are virally driving awareness and demand for our products. We sell capture devices and also mountable and wearable accessories that enable professional quality capture at affordable prices, and to date these products have generated substantially all of our revenue. In addition, we enhance our product offering by providing GoPro App and GoPro Studio, free software solutions to consumers that address the pain points of managing, editing and sharing content.”

And that, I guess is why I’m writing about GoPro. We were once the action sports market. Now, the focus of almost every company in the space is active outdoor- because that’s where the growth potential is and that’s what we’ve evolved to.

That sounded like the end of the article, not the beginning.

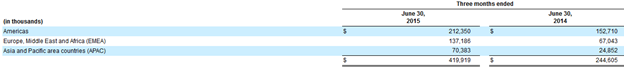

I won’t spend a lot of time on the financials. Revenue for the quarter ended June 30 was up 71.4% from $245 to $420 million. Below are revenues by region.

Revenue for the United States “…was $189.1 million, and $132.7 million for the three months ended June 30, 2015 and 2014, respectively…” GoPro has customers “…in more than 100 countries…” and sells “…in more than 40,000 retail outlets.” One customer accounted for 16% of revenue during the quarter, down from 17% in last year’s quarter.

The gross profit margin rose from 41.1% to 46.3%. “The increase…was primarily due to a favorable mix shift to the higher margin HERO$ Black and Silver capture devices.” I really like how they don’t call them cameras.

R&D expense rose from $34.7 to $58.5 million. As a percentage of revenues it was down from 14.2% to 13.9%. They’ve hired a lot of people in R&D.

Sales and marketing expense rose 45.3% from $43.7 to $63.5 million. Headcount in this area grew 69% from a year ago. As a percent of revenues, it was down from 17.9% to 15.1%. General and administrative expense fell from$41.2 to $26.3 million. Stock based compensation expense is part of G&A. It was down $19.5 million in the quarter compared to last year’s quarter “…primarily due to the timing of expense attributable to the issuance of 4.5 million RSUs to our CEO in June 2014 and the achievement of certain market conditions in January 2015.”

Total operating expense rose 24.4% from $119.5 to $148.2 million. As a percentage of revenues, it fell from 48.9% to 35.3%. Net income went from a loss of $18.2 million in last year’s quarter to a profit of $46.3 million in this year’s quarter.

I love seeing the expenses as a percentage of revenues dropping this way even as the actual expense rises. That’s what you’d like to see with growth.

The balance sheet is strong with no long term debt. For the six months ended June 30, operations provided $132 million in cash compared to $6.7 million in last year’s six months. I would note that three customers account, respectively, for 19%, 15%, and 11% of receivables as of the end of the quarter. That’s after GoPro sold $50 million of receivables without recourse during the quarter.

GoPro notes in its 10-Q that “During the six months ended June 30, 2015, the Company completed several acquisitions for an aggregate cash consideration of $59.3 million…” They don’t disclose who they acquired or what the product is. As they point out, they don’t have to disclose specifics because they were small deals. Still, I’d love to know because I suspect it would tell us a lot about how GoPro is pursuing its strategy. The one hint we do get is that they allocated $19.8 of the purchase price to “Developed technology” and $6 million to “process research and development.” $36.9 million was classified as good will.

Let’s move back to strategic issues.

In the 10-Q, they talk about four “factors affecting performance.” These are investing in research and development, investing in sales and marketing, leveraging software services and media content, and expanding into new vertical markets and growing internationally. It’s another blinding flash of the obvious from a 10-Q. I’ve learned to expect that.

Now if they’d just talk about the positioning issues I raised when I started this article, we’d have something to dig into. Happily, that’s what they do, to some extent, in the conference call.

In his opening comments, CEO Nick Woodman talks about GoPro being “…both an enabler and a beneficiary of four of the biggest trends in technology and entertainment.” The first trend is user generated content. The second “…is social media which represents a global audience for shared GoPro content.” The third is virtual reality, and he notes that they’ve had recent acquisition of virtual reality content. So I guess we do know a bit about what their acquisitions were.

The fourth trend benefitting GoPro is, Nick tells us, the quadcopter. They will launch their own, so to speak, in the first half of 2016.

I tend to think of the first two as trends. Maybe the third as well. But the fourth, the quadcopter, seems like a product with GoPro reacting to a market that already exists, rather than one they create. In other words, it could be defensive. How might it be more than that? It will depend on the features I suppose. I’ve wondered since GoPro went public if they’d be able to keep a lead in technology. We’ll see. It’s easy to buy a quadcopter right now that works with your GoPro.

Later on, CEO Woodman describes the GoPro environment this way:

“We are over 1,300 employees that are manically focused on our vision and we all come to work every day with that shared vision and this is all that we think about, all that we work on and you see it in the execution.”

There’s a certain amount of marketing in all conference calls, but that kind of shared vision is a powerful thing in any organization. However, it’s hard to create and maintain. It’s an ever evolving work in progress- not a static condition.

But I love that GoPro thinks of itself as an “enabler.” If that’s a chunk of the vision, and if GoPro can become as much a content creation/management as a device company (they’re working on ways to monetize content), and if they can build loyalty in their community based on the interaction of their software and capture devices (a way better term than camera) they can continue to be in the sweet spot of some major social and generational trends.

Leave a Reply

Want to join the discussion?Feel free to contribute!