Debt, Inflation, Capitalism, and the Denarius.

I’ve spent copious amounts of time on financial history and trying to understand how money and debt work at a granular level. Still learning. You may not care about these kinds of details but as you’ve probably noticed they care about you and there’s no escape. History offers perspective and suggests that this time is no different.

This is my attempt to explain it as succinctly and simply in a series of articles. This one is about the impact of currency debasement, which is inflation.

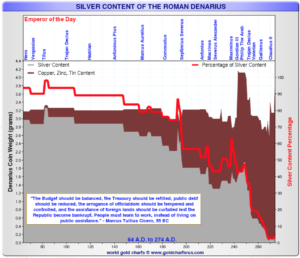

Let’s start with the chart below showing the change in the silver content of the Roman Denarius over time.

Wow. That’s a sentence sure to get people to stop reading.

Declining silver content in the Denarius is, to be clear, devaluation of the currency also known as inflation. Note that the fall of silver content coincided with the fall of the Roman Empire and that as things got bad emperors didn’t last very long- a sign of political instability. Read Cicero’s quote in the box. Sound at all familiar?

Does that seem too long ago to be relevant? Let’s move up the timeline a little and I’ll introduce you to “Old Copper nose.”

From Wikipedia:

“The Great Debasement (1544–1551) was a currency debasement policy introduced in 1544 England under the order of Henry VIII which saw the amount of precious metal in gold and silver coins reduced and, in some cases, replaced entirely with cheaper base metals such as copper. Overspending by Henry VIII to pay for his lavish lifestyle and to fund foreign wars with France and Scotland are cited as reasons for the policy’s introduction. The main aim of the policy was to increase revenue for the Crown at the cost of taxpayers through savings in currency production with less bullion being required to mint new coins. During debasement gold standards dropped from the previous standard of twenty-three karats to as low as twenty karats while silver was reduced from 92.5% sterling silver to just 25%. Revoked in 1551 by Edward VI, the policy’s economic effects continued for many years until 1560 when all debased currency was removed from circulation.”

Henry VIII got the name “old copper nose” because the thin layer of precious metals wore off his apparently bulbous nose on the coins and his nose showed through.

If that’s still too long ago for you, let’s jump to the 20th century. I’m quoting from The Lords of Finance, Liaquat Ahamed’s fabulous book about Germany after the first world war.

“Von Havenstein [President of Germany’s central bank] faced a real dilemma. Were he to refuse to print the money necessary to finance the deficit, he risked causing a sharp rise in interest rates as the government scrambled to borrow from every source. The mass unemployment that would ensue, he believed, would bring on a domestic economic & political crisis, which in Germany’s current fragile state might precipitate a real political convulsion. As the prominent Hamburg banker Max Warburg, a member of the Reichsbank’s board of directors, put it, the dilemma was ‘whether one wished to stop the inflation & trigger the revolution,’ or continue to print money. Loyal servant of the state that he was, Von Havenstein had no wish to destroy the last vestiges of the old order… Faced with these confusing & competing considerations, Von Havenstein decided to play for time, supplying the government with whatever money it needed. Contrary to popular myth, he was perfectly aware that printing money to finance the deficit would bring on inflation. But he hoped it would be modest, & that in the meantime, something would turn up to induce the Allies to lower their demands…”

I’ve read the book and it’s on my shelf. But I was reminded of this quote at Forest for the Trees, whose weekly publication I love and subscribe to (spoiler alert- it ain’t cheap and I subscribed when it was cheaper).

Anybody sensing a pattern here?

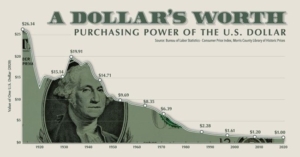

As close to home as we can get, here’s a chart of the purchasing power of the U. S. dollar since the first years of the 20th century.

It’s fallen a little. I know that correlation doesn’t equal causation, but I can’t help but point out that the Federal Reserve was created towards the end of 1913. Not suggesting we should get rid of the Federal Reserve. But I’d get rid of the press conferences, dot plots and all the speeches by the members and put businesspeople on the open market committee instead of economists. Use to be that way.

The United States is not Rome. There are not, literally anyway, barbarians at the gates. And we aren’t post World War I Germany. We didn’t have to sign a peace treaty requiring completely unpayable reparations.

But you can’t help but see the similarities among these examples and you might be wondering why the hell smart people keep letting this happen.

It starts out with good intentions or maybe with a war or disaster. Perhaps it’s necessary and the intention is to pay it back. That actually used to happen. Debt can be a constructive thing, but that’s a subject for the next article.

The government borrows the money and nothing bad happens- maybe even good things happen. For how long and how good depends on how borrowed money is invested.

But politicians don’t like to say no- makes it hard to get reelected. Voters don’t want to hear bad news about their benefits. Raising taxes is not too popular. And the severe negative impacts are way down the road. Even now we don’t want to deal with it when the end of the road is in sight.

If you’re interested in these ubiquitous debt cycles (no country and no time in recorded history has been immune) Check out part of Ray Dalio’s book here. This is just the 60-page summary, and you can find the way longer book as a free download if you want it.

What have we learned? Currency debasement (inflation) has been around as long as money. There is a predictable debt cycle that doesn’t end well. The debt cycle happens in most countries and cultures. It’s just the way people are. Some combination of fear and greed coupled with a tendency to not deal with a problem until we can’t avoid it. Nobody is immune.

What to do? First, know that it’s happening but that’s it’s a process rather than a moment in time. Second, the national solutions I know of are austerity (cutting spending, raising taxes) inflation that reduces the value of the debt (we’ve had inflation- not sure it’s over), or an amazing innovation that sends productivity and economic growth through the roof (Fusion? AI?). History says it will be one or both of the first two. Politicians prefer inflation because, compared to austerity, it’s insidious. How will your business, not to mention your family, prepare? Avoid debt? Hold hard assets and emphasize cash flow? Those aren’t recommendations. I’m trying to figure it out too.

Next time we’ll focus on debt and its impact on the economy, business, and individuals.