This Can’t Be Happening- An Online Shopping Experience

It was not supposed to be 14 degrees in Seattle. But it was and we needed an extra space heater to try and keep the pipes from freezing. Diane (my wife- 37 years. Starting to look like it might work out) ordered one from Target and had a coupon for same day delivery (the Target store is two plus miles away). It was dropped off at three that afternoon and was just what we needed.

Impressed, Diane went online to buy something else from Target. She was met with a screen that asked her to review the home delivery.

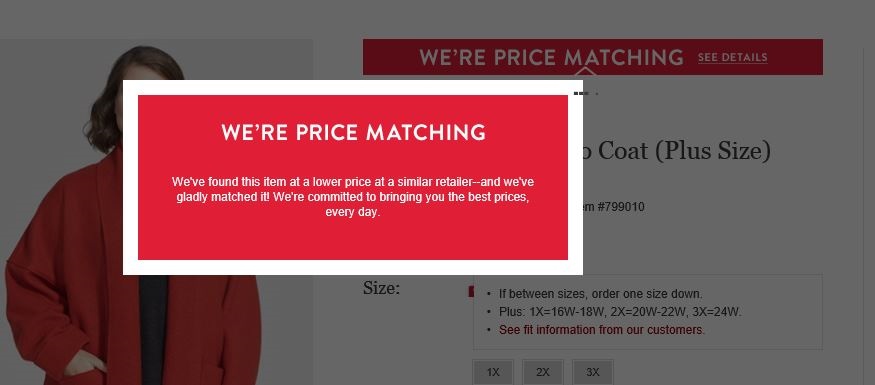

There was no way to bypass that screen to just shop. And, she later learned, she would also have been required to tip or not tip the driver. But the cherry on the turd, as you will see from the chat summarized below, was that she was informed she would face that impenetrable screen for thirteen days.

It turned out the chat was wrong, and it was only three days or something. But still, I am sure that denying a customer the ability to shop for any amount of time is a poor approach to customer retention (Spoiler alter- Diane got what she needed from a different retailer that’s pretty good at delivering- especially if you live in Seattle-that doesn’t require rating or a tip choice).

Below, in summarized form, is the chat. I have left things out but everything from the chat is a direct quote. You may or may not want to read the whole thing. First, let’s talk about why and how this happens.

I refuse to believe Target wants it to happen. It could be that Shipt, the local fulfillment company Target uses, requires it. They hire the delivery people and certainly hiring is easier if their hires have the opportunity for tips. The review is for the person who did the delivery, not the Target people Diane interfaced with. Did Target just miss this in the contract?

We all know that companies use rating their customer service reps to manage and evaluate them. I think it’s why those reps stick to their long, inane, time-wasting scripts no matter what and remind us to give them a five.

As a customer, I recognize the problem I’m contacting them about is not the fault of the person I’m talking with. I really want to give them fives. But when I’ve been on hold for however long, been transferred to three different people, can hardly understand the person due to background noise, been hung up on (not on purpose I hope) or given inaccurate or incomplete information, I find myself gunning for the “1” button. But often there’s no way to describe the overall poor experience over much time and multiple calls and rather than hit five or one, I hang up in frustration and move on.

Blocking somebody’s path to giving feedback is guaranteed to get you negative feedback- if you get any at all.

There are two conflicting purposes to these “customer satisfaction” surveys. First, they want to keep the person you interact with on the straight and narrow. Okay, makes sense. Most times it feels like it drags the support process out but perhaps overall it’s more cost effective and efficient when tightly scripted. But second, they want to get information from the customer on the overall interaction with the company. In a chat/phone conversation with a survey, you can do one but not the other.

I’d do two things. Maybe companies already are. First, my message after the call would be something like, “Press one to rate the person you spoke with. Press two to provide a comment on the overall interaction with the company.” I’d separate the two goals. Second, I wouldn’t ask everybody to complete the survey (my experience makes me think most companies ask everybody). Given the response rate, how many do you need to accomplish your goals? Okay, sometimes I get the “you have been selected” message, but I never quite believe they think I’m special.

It can’t be that hard to change the recorded message. I wonder why I’m never asked about a specific issue or area of interest the company has.

Wow, retail is tough these days. Everybody is just trying to figure it out as demographics, economics, attitudes, and expectations change around them.

Diane’s chat is below.

Diane: Hey Target, I had an item delivered to my home. Now my browser experience and app are both frozen unless I review the home delivery, which I choose not to do. There is no way to exit the review screen. Which means I can’t place another other. This is a bad experience. Please tell me there is an easy fix for this. Otherwise, I am off to Amazon or Walmart.

Target: We apologize for the technical issue you are having with your browser and app. We would recommend clearing your cache/cookies or uninstall/reinstall the app for a better experience. If you are still having technical issues, please reach out to Shipt [independent company for local delivery] for further assistance.

So, Diane started a chat with Shipt:

Shipt: We apologize for the inconvenience this has caused! Unfortunately, we are not able to assist with Target.com or Target app issues. However, we do highly recommend rating your Shopper according to your experience, as it helps us with recognizing our Shopper’s performance.

Then, inevitably, Shipt asks Diane to complete “…a short, three-question survey…” about her interaction with Shipt.

Not sure Diane’s response is printable in a family publication like this.

Okay, now back to our story. Diane reengages in her chat with Target.

Diane: I uninstalled/reinstalled the app, which seemed to fix the issue [turns out it didn’t]. I have deleted my cache, but the browser issue persists. Shipt said it’s not their problem and referred me back to you. Ideas? Or do I shop elsewhere?

Target: Our apologies for the experience, this certainly shouldn’t be happening. We’ll be happy to document the experience. Please provide your full name and email. Also is this happening from the browser and the app?

Diane: Please see the thread above for the answers to your questions.

The time of Diane’s response is 7:15 AM. Diane gets no response, goes about her day and at 4:04 PM, goes back to the chat.

Diane: Hey any response? The app is not fixed as it turns out- I am still stuck with the requirement to rate the delivery. I do not want to do so I will permanently delete the app if you folks don’t have a solve.

Target responds at 4:19 PM.

Target: We understand you would rather not review or tip for your order. It’s part of the order process to complete the rating/tipping the shopper before moving on to the Target.com experience. Tips are greatly appreciated but not required. However, you have 13 days to rate and tip the shopper or it will be removed. We hope this information is helpful.

Diane: Thank you for the straight information. I get that companies want performance data but if I am blocked from using Target.com for 13 days so you can get it—well, that just seems counterintuitive for a for-profit enterprise. As for tipping- sorry, that didn’t even occur to me as part of this experience. Should I expect to tip the cashiers at Target too? I’ll stick with Amazon. Thank you.

The End.

It is a microcosm of the challenges of the whole retail environment. So much has changed that managers aren’t quite sure what to do. But that’s a topic for another article. I hope you enjoyed this story and I hope Target cleans this up.