It’s not my purpose to simply report earnings. That’s why you don’t see an article every time an industry public company reports. By waiting for the actual publicly filed document, I hope to glean a few pieces of information that might make you think-bring you up short even- and perhaps help you run your business better.

VF has had a string of glowingly good reports and the one for the quarter ended September 30 is no exception. I’ll get to summarizing the numbers, but first here are some other things for you to consider.

Back in September, VF held a Vans investor day where they announced they were planning to take Van’s revenues from $3 to $5 billion in five years. I wrote this article looking at why they might, or might not, pull it off. I said, “Vans is well into an experiment to see if a truly “omnichannel” approach to branding and customer engagement change some of the rules for growing a brand.” They are betting they can outperform by doing the things all brands/retailers need to do but doing them better than their competitors.

What ever happened to “features and benefits” as the preferred way to differentiate products?

A year ago, a friend recommended Retail’s Seismic Shift, by Michael Dart, to me. It finally got to the top of my reading stack. Should have gotten there sooner. In the last chapter is an interview with former VF CEO Eric Wiseman. Good read.

Brand Extension Versus Distribution Management

One of the things we do in the new retail environment, and that VF thinks it can do better than most, is to be insightful about where we get sales growth. Too much growth in the wrong places, as it always has, equals brand damage. I’ve been making that speech for at least a decade, but it’s become more important as the consumer has become more knowledgeable, perhaps less brand loyal, able to find information easily and buy in multiple places.

In talking about Vans in Europe, CFO Scott Roe says, “It’s really about making sure that we don’t get over torqued in any one particular part of our business. And what we’re seeing there is some rationing, frankly, of some of the product as we ensure that not one style or not one category gets too much out of balance.”

And then, addressing The North Face, CEO Steve Rendle makes the comment, “I think the brand is absolutely anchored in that core Mountain Sports… Where we’ve seen really nice growth…is more of that Mountain Lifestyle component, the more contemporary logo-ed sportswear pieces that are taking their influence from the Mountain Sports category, the influence that, that’s having on Urban Exploration component of the line.”

“And what we’ve seen in Europe is a brand that’s moved beyond just an outerwear and equipment resource, but truly a brand that can deliver lifestyle apparel while being very anchored in that outdoor Mountain Sports category. And that’s exactly what you see taking place in Asia. More importantly, what we just saw this quarter here in the United States marketplace, where we saw a strong sell-through of daypacks, really good lifestyle sportswear logo.”

Talking about the Williamson-Dickie acquisition he notes, “We knew that it was a strong consumer-focused brand…But what we’re finding is that it’s anchored so well in the Work category, specifically here in the U.S., but as we’ve worked with management and begun to understand the consumer response to this brand, we’re seeing a much stronger work lifestyle component anchored in Asia and Europe that we see being able to bring back across the globe.”

CFO Rendle suggests in the conference call that they feel Timberland has the same potential as Vans, The North Face and Williamson-Dickie to maintain its core business but expand outside it.

Controlled distribution in a brand’s existing franchise to protect the brand’s credibility but look for growth in tangential areas for growth where it’s already accepted but the opportunity hasn’t really been exploited. This, I’m pretty sure, is a key criterion for VF’s evaluation of brands- both those that they buy and those that they sell.

Speaking of Buy and Selling

It’s not exactly a sale, but VF is spinning off their jeans business as a separate public company. Here’s what I wrote about the August announcement.

On October 2, 2017 VF acquired Williamson-Dickie for $800.7 million. It generated $252.8 million of revenue and $18.5 million of new income in the September 30 quarter.

On April 3, 2018, VF acquired Icebreaker for $198.5 million. It contributed $53.7 million in revenue and $7.0 million in net income during the quarter.

June 1, 2018 brought the acquisition of athletic and performance-based lifestyle footwear brand Icon-Altra for $131.7 million. During the recent quarter its revenue and net income contributions were $17.0 and $1.9 million respectively.

On April 30, 2018, VF sold the Nautica brand for $289.1 million and recorded a loss of $38.6 million.

VF sold its License Sports Group and the JanSport brand collegiate businesses on April 28, 2017, receiving net proceeds of $213.5 million and reporting a loss of $4.1 million.

And in October 2018 VF sold Reef. Finally, after all my years bemoaning that we got no indication of how Reef was doing, we get a few numbers as a going away present. Subject to some adjustments, the proceeds from the sale were $139.4 million. The expected loss $9.9 million. Reef’s revenues, we’re told in the conference call were around $150 million annually.

They’ve also sold the Van Moer business they got with Williamson-Dickie, but the numbers are very small.

VF has always characterized itself as a portfolio manager. I hypothesize that VF has stood up, sniffed and wind, and taken notice of the massive changes happening in brand and retail management. No kidding, right? Haven’t we all. Many retailers and brands, however, seem flummoxed bordering on paralyzed by the change. Or it’s just too late for them.

VF, on the contrary has looked at it’s size, it’s diversified portfolio, management discipline and processes, manufacturing and supply chain flexibility, solid financial condition and strength as a portfolio manager and seen an opportunity rather than a problem.

Over the years, we’ve watched lots of brand try and fail at extending their brand franchise into other distribution and new customer groups. This has been especially prevalent in public companies because of the pressure to increase revenues.

VF is very specifically restructuring its portfolio of brands to take advantage of the new competitive conditions in ways it believes many of its competitors can’t or won’t. Brands they acquire (and keep) will have the virtues they describe in talking about Vans, The North Face and Williamson-Dickie in the quotes above and will be positioned to benefit from the resources VF brings to the table. The jeans business they are spinning off is an excellent example of a business that doesn’t fit VF’s criteria.

Think about that while we move on to the numbers for the quarter.

Financial Results

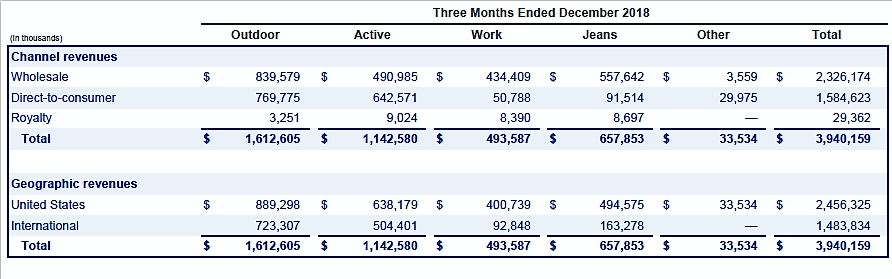

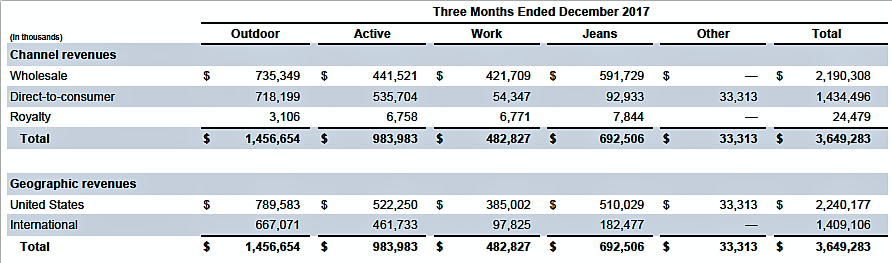

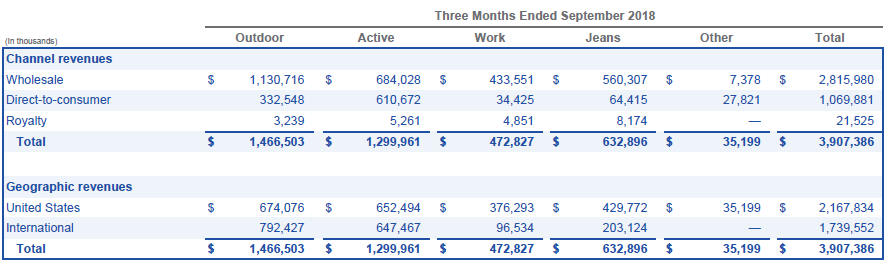

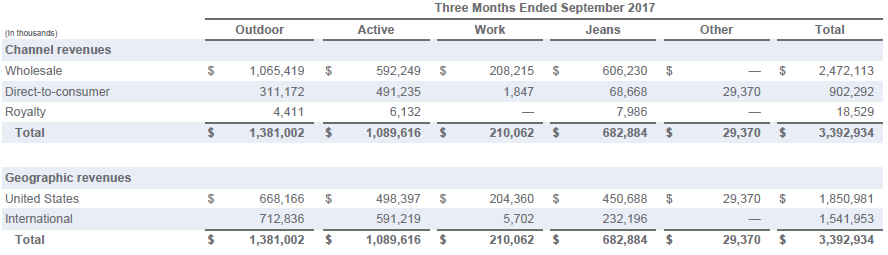

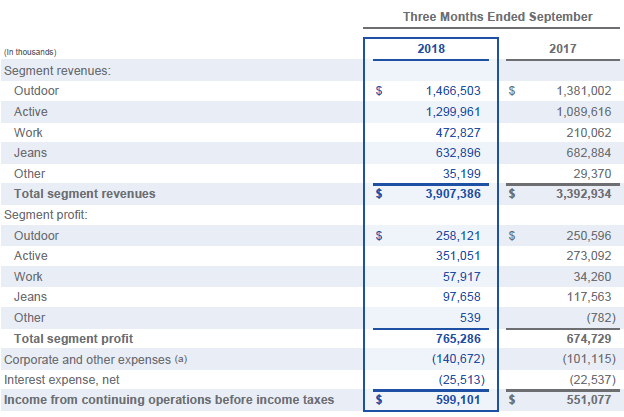

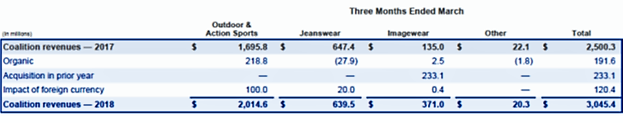

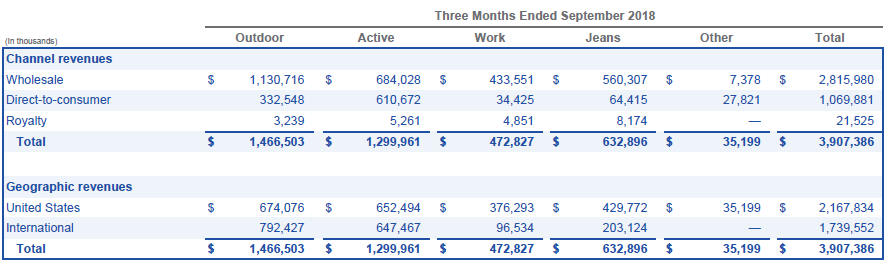

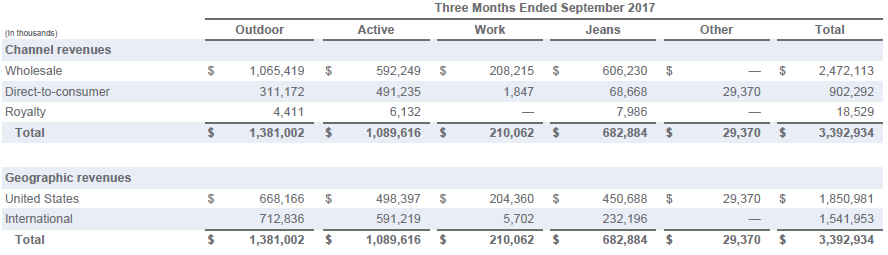

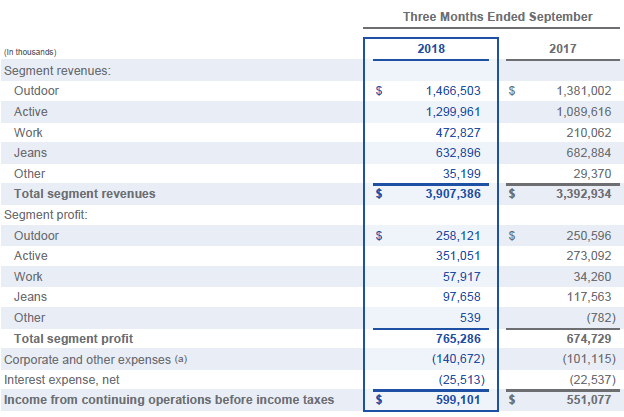

Revenues as reported rose 15.2% from $3.39 billion in last year’s quarter to $3.91 billion in this year’s. The breakdown by channel and segment is shows below for this year’s and last year’s quarter.

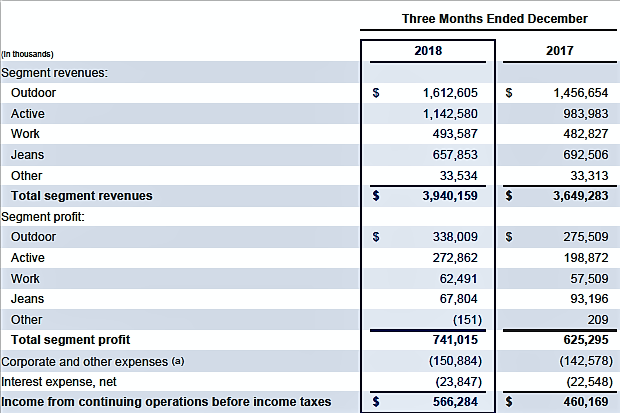

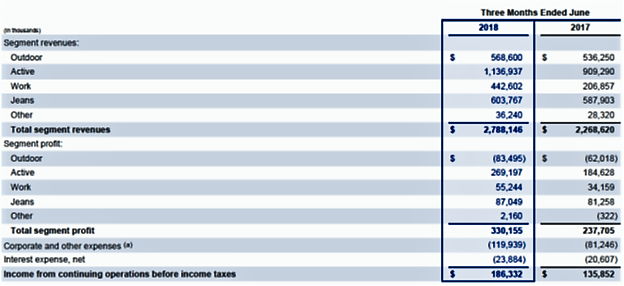

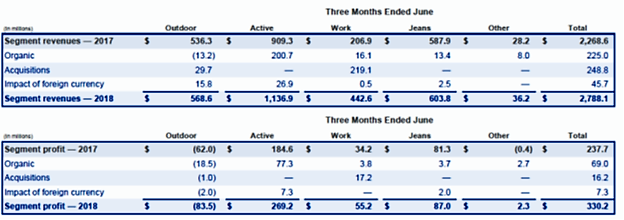

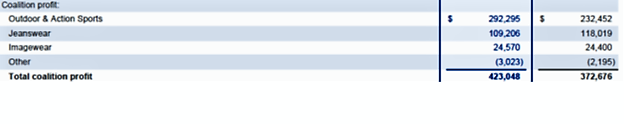

Outdoor includes The North Face, Timberland, Smartwool, Icebreaker and Altra. The big dog in the Active segment is Vans. It also includes six smaller brands. Of those six, JanSport and Reef are now sold. Remember that Jeans is being spun off. The next chart shows revenue and operating profit by revenue by segment for the two quarters. It’s a little easier to compare the change in revenues than in the chart above.

Of the revenue growth of $515 million quarter over quarter $230.9 million was from organic growth and $323.5 million from acquisitions. Vans revenues rose 26% and The North Face 5%. Timberland revenue fell by 2%. Wrangler and Lee were down 5% and 9% respectively, in case anybody was wondering why they are being spun off.

The gross margin declined very slightly from 50.2% to 50.1%. “Gross margin in the three months ended September 2018 was negatively impacted by lower margins attributable to acquired businesses, acquisition and integration costs and certain increases in product costs, partially offset by a mix-shift to higher margin businesses and increases in pricing.”

SG&A expense was up 15.1% from $1.13 to $1.30 billion. As a percent of total revenue they declined from 33.3% to 33.2%. “The decrease…was due to leverage of operating expenses on higher revenues and was partially offset by expenses related to the acquisition, integration and separation of businesses and continued investments in strategic priorities.”

Net interest expense rose $3.0 million in the quarter “…due to higher levels of short-term borrowings at higher interest rates and lower interest income as compared to 2017, which was partially offset by lower interest on long-term debt due to the payoff of the $250.0 million of 5.95% fixed-rate notes on November 1, 2017.”

Operating income grew 14.4% from $575.5 to 658.7 million. Net income rose 31.4% from $386.1 to $507.1 million.

The balance sheet remains strong with no significant changes not explained by acquisitions and divestitures. Cash provided by operating activities fell from $217 to $103 million.

We went through a phase years (decades?) ago where I pronounced, correctly I think, that operating well was a competitive advantage because so few were doing it. As industry management sophistication increased (more or less) I decided that operating well had become just a requirement of getting a chance to compete offering no competitive advantage- companies that had survived were mostly operating well. Now VF, as well as a few other companies, believes they can make operating well- keeping up with a relentless pace of change- a competitive advantage again.