For the year and quarter ended March 31, Deckers improved its results as discussed below. Related to that improvement is the progress of its restructuring and operating profit improvement plans. As we review these results, we’ll see that Deckers is confronting the same issues other brands/retailers are confronting as the internet changes the role of stores and the way people shop.

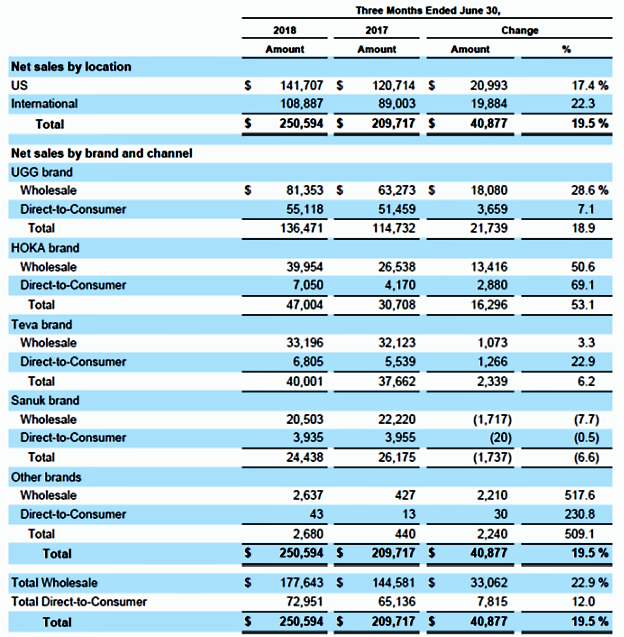

In the year ended March 31, Deckers reported a revenue increase of 6.3% from $1.79 to $1.903 billion. The UGG brand, at $1.507 billion for the year, represented 79.2% of Decker’ total revenues. Sanuk’s revenues fell slightly from $91.8 to $90.9 million. The brand’s wholesale revenue rose from $77.6 to $78.3 million. Direct to consumer fell from $14.2 to $12.6 million. Just to put that into perspective, Sanuk’s wholesale revenues by themselves, for the year ended December 31, 2013 were $94.4 million.

CEO Dave Powers, explaining Sanuk’s result, said it “…was driven by mid-single digit growth in US wholesale, offset by the planned decline internationally as the brand is in the process of resetting its distribution.”

“We also significantly reduced the amount of closeouts in an effort to clean up the marketplace and drive margin improvements.”

I’ve got no problem at all with revenue stalling if it means a higher gross margin and cleaner, more appropriate, distribution. That’s how you build, or I guess I mean rebuild, the brand. What took them so long?

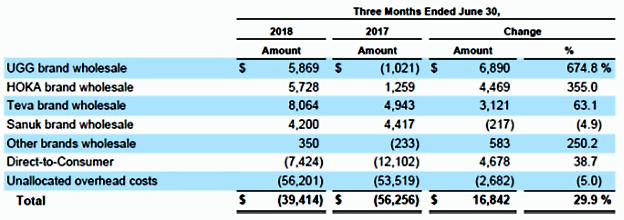

Sanuk’s operating profit on its wholesale business only was $14.5 million, up from a loss of $110.6 million the previous year. As explained in the 10K, “The increase in income from operations of Sanuk brand wholesale was primarily due to impairment charges for goodwill and long-lived assets incurred in the prior period, as well as higher sales at higher gross margins in the current period.” For none of their brands do they give an operating profit that includes direct to consumer. At best, it would be very difficult to calculate- probably meaningless.

Deckers’ overall gross margin rose from 46.7% to 48.9% “…primarily driven by lower input costs as we execute our supply chain initiatives through our operating profit improvement plan, a higher proportion of full-priced selling partly due to favorable weather conditions, as well as favorable foreign currency fluctuations compared to the prior period.”

Weather and currency fluctuations, of course, are outside of Deckers’ control. We don’t find out how much of the increase was from company controlled “lower input costs.”

SG&A expenses declined 15.3% from $837 to $709 million and, as a percent of revenue, from 46.8% to 37.3%. BUT that includes $118 million of Sanuk related impairment charges from the previous year. Total impairment and depreciation charges last year were $138 million.

Pretax income improved from a loss of $7 million to a profit of $221 million. Big improvement even taking in to account last year’s big charge offs. Net income rose from $5.7 to $114 million. This year’s net income would have been higher, but the tax provision rose from a benefit last year of $12.7 million to an expense this year of $106.3 million. As a result of the so-called Tax Reform Act, Deckers “…recorded provisional US federal and state tax estimates for the one-time mandatory deemed repatriation of foreign earnings of $59,114 [$59.1 million] …”

For the March 31 quarter, revenue rose 8.7% from $369 million in last year’s quarter to $401 million. The gross profit margin rose from 43% to 48%. CFO Thomas George tells us in the conference call that the increase “…was largely due to fewer closeout sales and an improved promotional environment in the quarter, which contributed 160 basis points, continued realization of significant progress on our supply chain improvements worth approximately 170 basis points and 120 basis points from FX, with the balance being driven by favorable channel mix.” Again, it’s important to recognize how much of the improvement was the result of factors out of Deckers’ control.

Last year’s quarter had a loss of %15.7 million. In this year’s, net income was a positive $20.6 million. Last year’s quarter included restructuring charges of $29 million. Comparable charges this year were $1.7 million.

Starting in February 2016, Deckers implemented, and continues to implement, a restructuring and, a year later, an operating profit improvement plan. The goal of the restructuring plan is to “…streamline brand operations, reduce overhead costs, create operating efficiencies and improve collaboration.” The operating profit improvement is to come from “…reducing product development cycle times, optimizing material yields, consolidating our factory base, and continuing to move product manufacturing outside of China.” As they describe it, the plans are working with the savings and improvements already significant.

As part of the plans, Deckers is reevaluating its retail stores. They ended the year with 165 of them worldwide, having already closed 32 as part of their plans. Their long-term plan is to further reduce that number to 125. Talking about the stores, the 10K says the following. “While we are seeing initial signs of improvement, our decision to open or close store locations will be evaluated based on the operating results of each store and our retail store and fleet optimization strategies, which may ultimately impact our global retail store count.”

Then, talking about their direct to consumer strategy, they state, “…we believe that our retail stores and websites are largely intertwined and interdependent. We believe that many consumers interact with both our brick and mortar stores and our websites before making purchasing decisions. For example, consumers may feel or try on products in our retail stores and then place an order online later. Conversely, they may initially research products online, and then view inventory availability by store location and make a purchase in store.”

No kidding.

One of their risk factors is about opening retail stores. It says, “It may be difficult to identify new retail store locations that meet our requirements, and any new retail stores may not realize returns on our investments.” Risk Factors have tended to become blinding glimpses of the obvious, so that’s fine. However, the discussion of this factor takes a business as usual approach to store opening decisions; no mention of ecommerce.

Maybe some retailers need a new risk factor: “If we don’t figure out how to think about and manage our stores and ecommerce as if they are one and the same, we’re screwed!” Probably some lawyer will stop them from putting it quite that way.

Let me go on and quote for you some of their Trends Impacting Our Overall Business.

“• We believe there has been a meaningful shift in the way consumers shop for products and make purchasing decisions. In particular, brick and mortar retail stores are experiencing significant and prolonged decreases in consumer traffic as customers continue to migrate to shopping online.”

“• In light of the shift in consumer shopping behavior, we are seeking to optimize our brick and mortar retail footprint. In pursuing store closures, we have been impacted by costs to exit lease agreements, employee termination costs, retail store fixed asset impairments, and other closure costs. However, we do not expect to continue incurring significant incremental store closure costs, primarily because the majority of our remaining store closures are expected to occur as store leases expire to avoid incurring additional lease termination costs.”

“• We expect our E-Commerce business will continue to be a driver of long-term growth…”

All I know, of course, is what I read in the SEC filings and conference call transcripts. Perhaps their ongoing reduction in stores is their thought-out response to the integration of ecommerce with brick and mortar, but I can’t tell that from the information I have available.

What I want you to take away from the above discussion about their brick and mortar strategy and risk factors is that while they give lip service to the integration of brick and mortar and ecommerce, they don’t give us much information on just how their “fleet optimization strategy” relates to their ecommerce strategy.

Deckers has a solid balance sheet, great cash flow, and is making money. Their restructuring and profit improvement plans seem to be working. I (mostly) like what they are doing with Sanuk. It seems like they’ve figured out what the brand can, and cannot, be. They grew their revenue last year and did it in the right ways. CEO Powers says in the conference call, “…we are making strategic decisions that will generate some topline pressure in the current year but are in the best interests of the brand’s long-term success.”

You know I love that approach.

But from Deckers, and from any retailer by the way, I need to know what exactly the “optimization” of their brick and mortar footprint means. When a retailer finally starts to talk in some detail about how brick and mortar and ecommerce are one revenue stream, I know they’re making progress.